Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

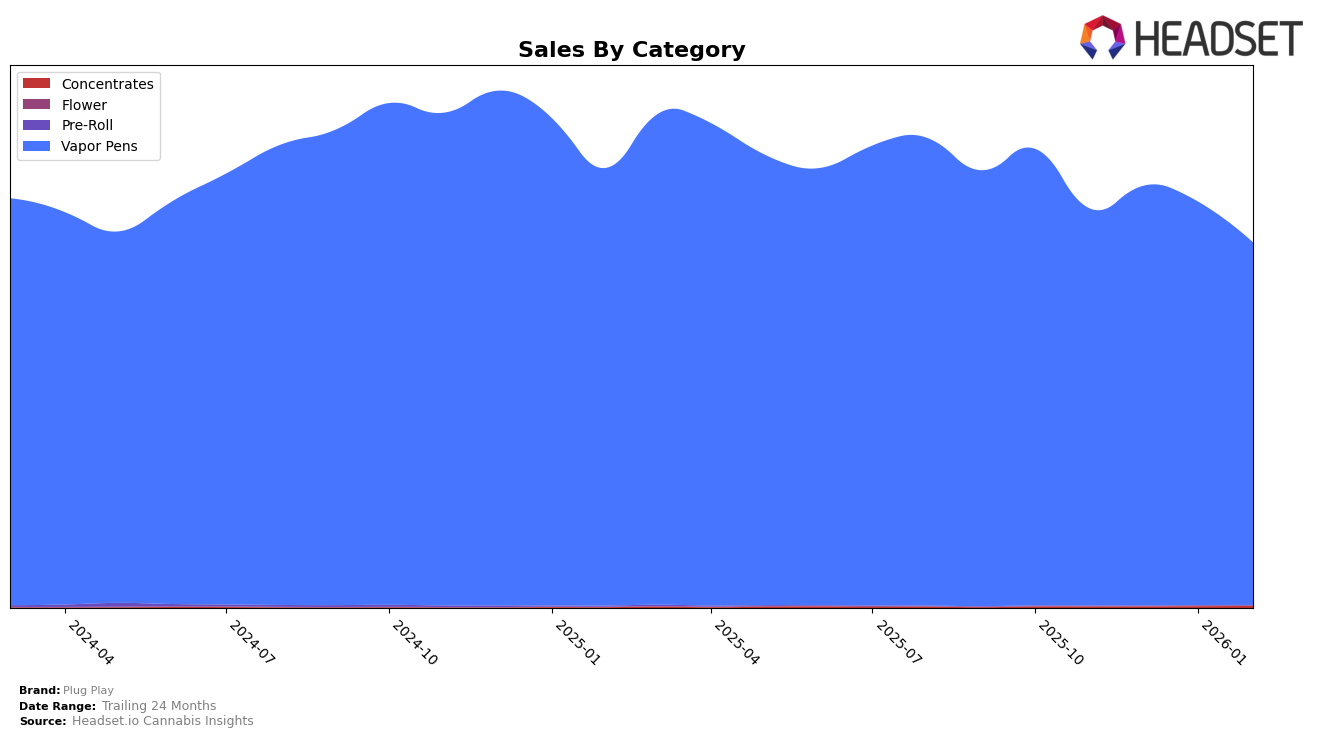

Plug Play has demonstrated a consistent performance in the California market, particularly within the Vapor Pens category, maintaining a steady rank of 4th place from November 2025 through February 2026. This stability in ranking suggests a strong foothold and loyal customer base in the region, despite a slight decline in sales from December 2025 to February 2026. Such consistency in a competitive market like California highlights Plug Play's effective market strategies and product appeal. However, the sales figures indicate a need for strategies to boost revenue, as evidenced by the decrease in sales from January to February 2026.

In contrast, Plug Play's presence in New York is less prominent, as the brand did not rank within the top 30 in the Vapor Pens category during the observed months. This absence from the top rankings could be indicative of either a nascent entry into the market or competitive challenges unique to New York. The brand's rank at 55th in December 2025 suggests there was some market activity, although not enough to secure a stronger position. This could represent an opportunity for Plug Play to strategize on increasing its market share and visibility in New York, potentially through targeted marketing efforts or product differentiation.

Competitive Landscape

In the competitive California vapor pen market, Plug Play consistently held the 4th rank from November 2025 through February 2026, indicating a stable position amidst fierce competition. Notably, Raw Garden maintained the top spot, showcasing a significant lead in sales, while Jetty Extracts followed closely in 3rd place. Despite Plug Play's steady rank, its sales figures saw a slight decline in February 2026, which could be a concern if the trend continues. Meanwhile, CAKE she hits different and Heavy Hitters remained consistent in the 5th and 6th positions, respectively, with sales figures trailing behind Plug Play. This data suggests that while Plug Play is currently stable, it must strategize to counteract the downward sales trend and potentially climb the ranks in this competitive landscape.

Notable Products

In February 2026, the top-performing product for Plug Play was Exotics - Melon Dew Distillate Plug Pod (1g) in the Vapor Pens category, climbing to the number one rank despite a slight decrease in sales to 7810 units. DNA - Blue Dream Distillate Plug (1g) maintained its second-place position from the previous month. Exotics - Watermelon Sorbet Distillate Plug (1g) dropped to third place after leading the sales in January. Notably, Exotics - Apple Slushie Distillate Plug (1g) entered the rankings for the first time at fourth place. DNA - Northern Lights Distillate Plug (1g) also made its debut in the rankings, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.