Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

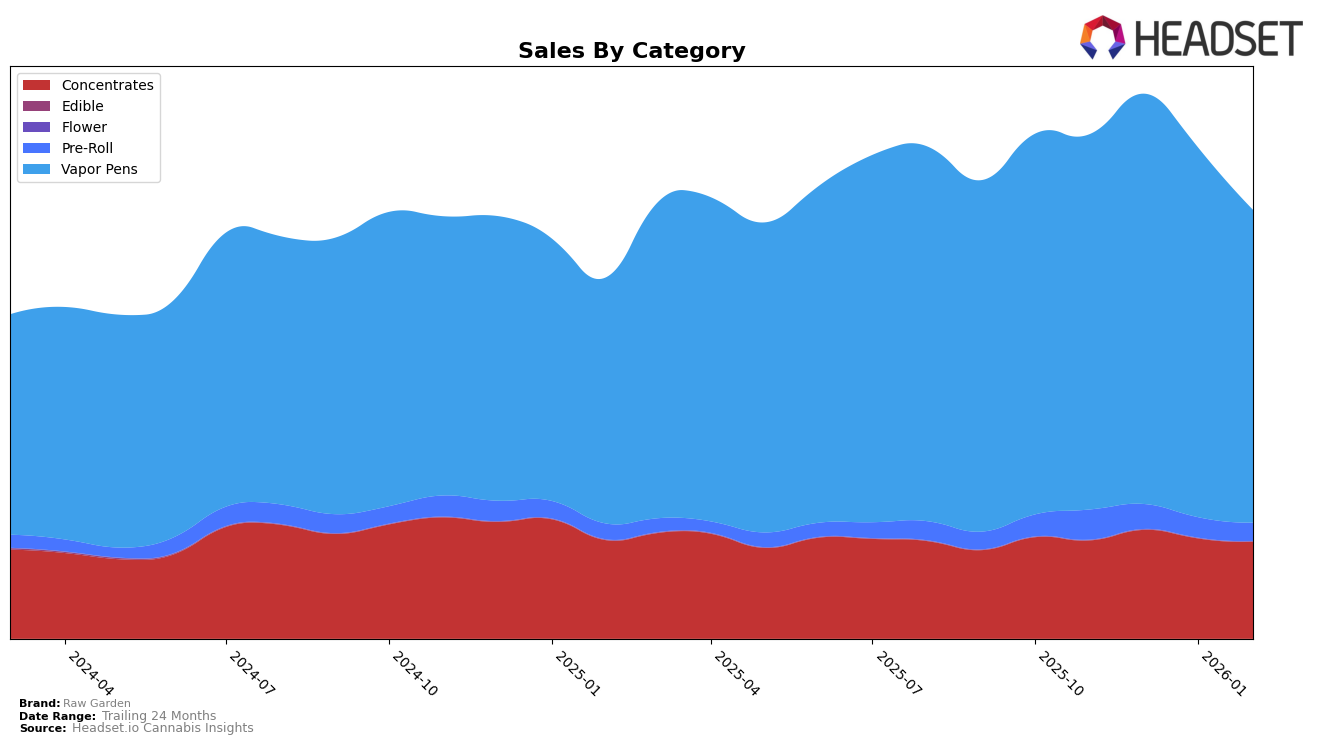

Raw Garden continues to dominate the California market, particularly in the Concentrates category where it consistently holds the top rank from November 2025 through February 2026. This unwavering performance underscores the brand's strong foothold and appeal in this category, despite a slight dip in sales from December to February. In the Vapor Pens category, Raw Garden maintains a solid second place across the same period, indicating strong consumer loyalty and market presence. However, the Pre-Roll category presents a different story, as Raw Garden's ranking slips from 20th in November to 31st by February, suggesting potential challenges in this segment or increased competition.

In New Jersey, Raw Garden's presence in the Vapor Pens category shows a fluctuating pattern. The brand appears in the rankings in December 2025 at 21st place, disappears in January, and reemerges in February at 23rd. This inconsistent performance could either be a sign of strategic market adjustments or volatility in consumer demand. Notably, Raw Garden does not feature in the top 30 in any other category in New Jersey, which might highlight either a focused strategy on Vapor Pens or potential growth opportunities in other categories. The data suggests that while Raw Garden has a stronghold in California, its presence in New Jersey is still developing and could benefit from more consistent performance.

Competitive Landscape

In the competitive landscape of vapor pens in California, Raw Garden consistently holds the second rank from November 2025 to February 2026, indicating a stable position in the market. Despite a slight decline in sales from December 2025 to February 2026, Raw Garden maintains its rank, suggesting strong brand loyalty and market presence. The top competitor, STIIIZY, holds the first position with significantly higher sales, indicating a substantial lead in the market. Meanwhile, Jetty Extracts and Plug Play remain consistently in third and fourth place, respectively, with sales figures notably lower than Raw Garden's. This stable ranking amidst fluctuating sales highlights Raw Garden's resilience and suggests potential opportunities for strategic marketing to close the gap with the market leader.

Notable Products

In February 2026, Raw Garden's top-performing product was the Carbon Fiber Diesel Sauce Cartridge (1g) in the Vapor Pens category, which ascended to the first rank with sales of 5,015 units. The Yuzu Blossom Refined Live Resin Cartridge (1g) debuted impressively at the second position. The Blue Dream Refined Live Resin Cartridge (1g), previously holding the top rank in November and December 2025, dropped to third place. Fresh Water Taffy Live Resin Cartridge (1g) and Gelato Slushy Refined Live Resin Cartridge (1g) secured the fourth and fifth ranks, respectively, making their first appearance in the rankings. The shift in rankings highlights a dynamic change in consumer preferences towards new product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.