Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

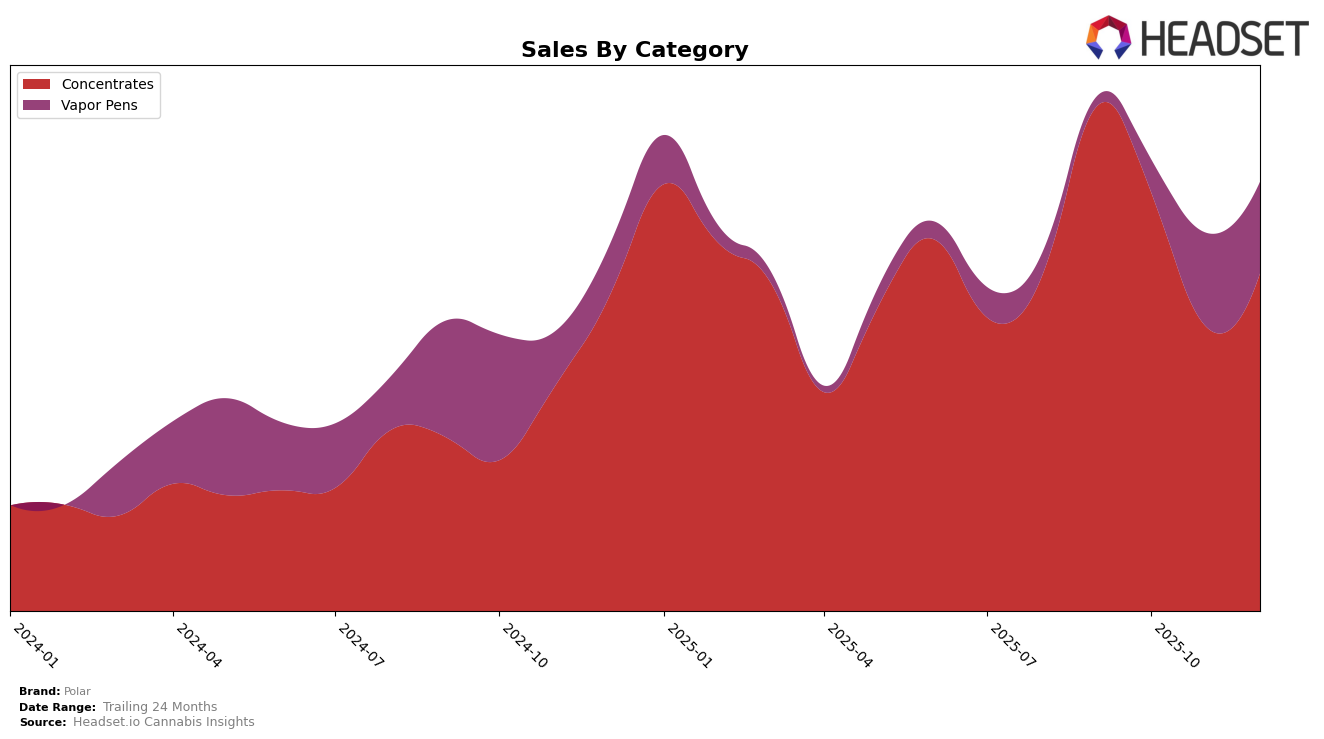

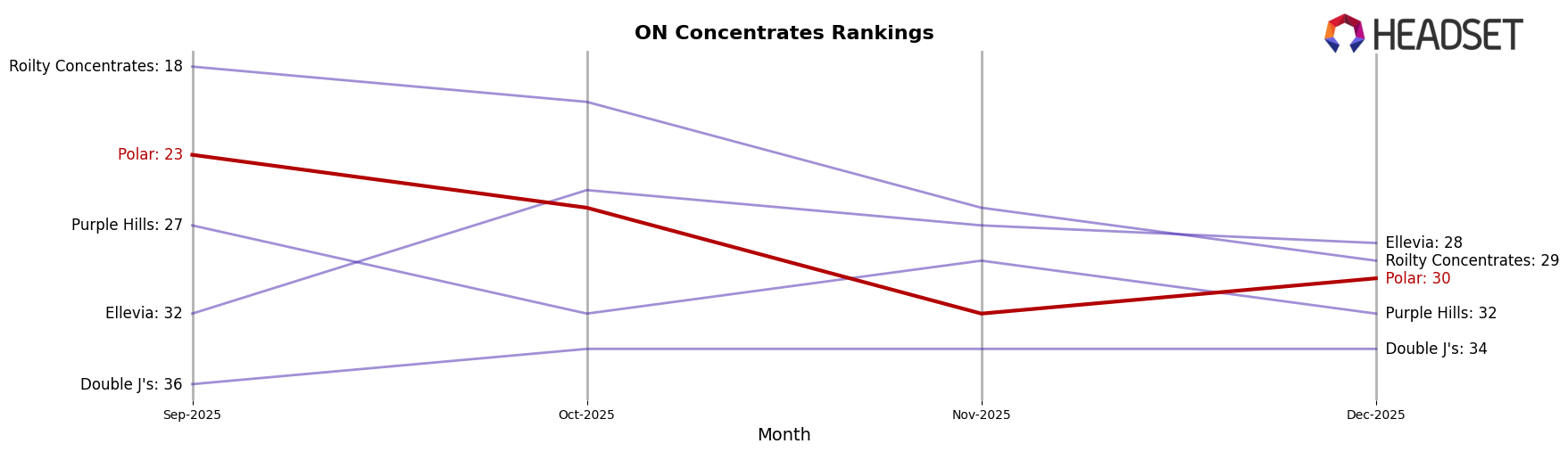

Polar has shown varying performance across different categories and regions, with notable activity in Ontario. In the Concentrates category, Polar's ranking fluctuated over the last few months of 2025, starting at 23rd in September, dropping to 26th in October, and then slipping out of the top 30 in November before bouncing back to 30th in December. This movement indicates a struggle to maintain a consistent position among top competitors. Despite the ups and downs in rankings, sales figures reveal a more concerning trend, with a significant drop from September to November, followed by a slight recovery in December. This suggests that Polar might be facing challenges in sustaining consumer interest or competition from other brands in the Concentrates category.

In contrast, Polar's presence in the Vapor Pens category has been less prominent. The brand did not secure a spot in the top 30 rankings in September, October, or November, only appearing in the 99th position in December, which highlights a significant gap in market penetration or consumer preference. This absence from the top rankings could indicate either a lack of focus on this category or strong competition within Ontario. The Vapor Pens segment might represent an area for potential growth or strategic realignment for Polar, as the brand seeks to strengthen its market position across different product categories.

Competitive Landscape

In the competitive landscape of the concentrates category in Ontario, Polar has experienced notable fluctuations in its ranking and sales over the last few months of 2025. Starting from a rank of 23 in September, Polar slipped to 26 in October, further dropping to 32 in November, before slightly recovering to 30 in December. This downward trend in rank is mirrored by a decrease in sales, with a significant dip in November. In comparison, Roilty Concentrates also experienced a decline, moving from 18th to 29th place, indicating a competitive pressure in the market. Meanwhile, Ellevia showed a more stable performance, improving its rank from 32 in September to 28 in December, with a consistent increase in sales, suggesting a potential shift in consumer preference. These dynamics highlight the competitive challenges Polar faces, emphasizing the need for strategic adjustments to regain market share and improve sales performance in this evolving market.

Notable Products

In December 2025, Polar's top-performing product was Black Mountain Side Live Hash Rosin (1g) in the Concentrates category, maintaining its number one rank from November with sales of 660 units. Bananium Live Hash Rosin (1g) held the second position consistently from October, despite a slight decline in sales. Arctic Drop Live Rosin (1g) remained steady in third place across the last four months, showing a gradual decrease in sales figures. Notably, Sativa Reserve Live Rosin Disposable (1g) entered the rankings in December, securing the fourth position in the Vapor Pens category. Reserve Sativa Rosin Disposable (1g) dropped to fifth place after peaking at fourth in October and November, reflecting a decrease in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.