Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

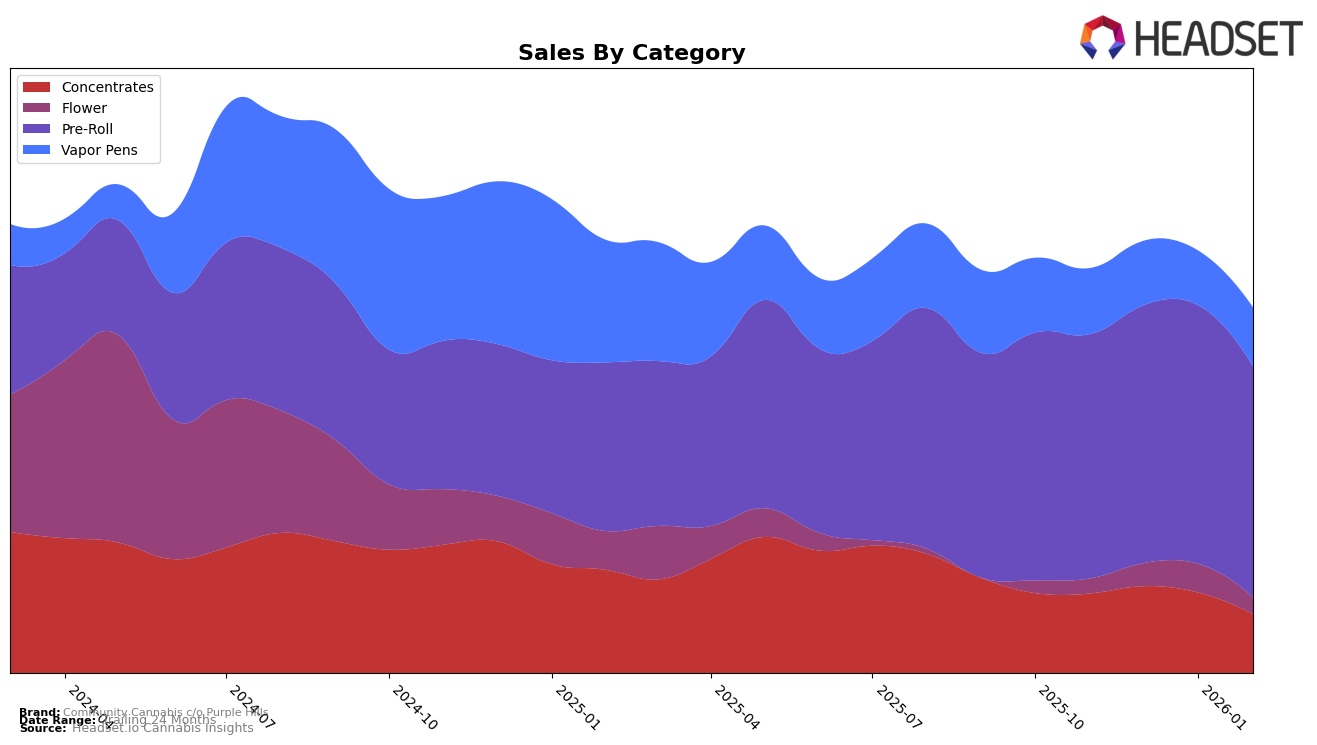

In the province of Ontario, Community Cannabis c/o Purple Hills has shown a mixed performance across different product categories. In the Concentrates category, the brand has demonstrated some volatility with its ranking moving from 24th in November 2025 to 28th by February 2026. This downward trend suggests a need for strategic adjustments to regain a stronger foothold. On the other hand, the Pre-Roll category has seen a steady improvement, moving from a rank of 57 in November 2025 to 52 by January 2026, where it then stabilized through February. This indicates a growing acceptance or popularity of their Pre-Roll offerings, despite not breaking into the top 30 brands in this category. Notably, sales in Pre-Rolls have experienced a dip in February, which could be a point of concern if the trend continues.

The Vapor Pens category has seen a slight fluctuation in rankings, starting at 55 in November 2025 and ending at 58 in February 2026, after a brief dip in December. This indicates a relatively stable position, yet still outside the top 30 brands, which highlights an opportunity for growth. The sales figures for Vapor Pens show a slight recovery in February after a decrease in January, suggesting potential for upward movement if the brand can capitalize on this momentum. Overall, while Community Cannabis c/o Purple Hills is making strides in certain areas, particularly in Pre-Rolls, there remains room for improvement in both Concentrates and Vapor Pens to enhance their market presence in Ontario.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Community Cannabis c/o Purple Hills has shown a steady performance, maintaining its rank at 52nd in February 2026, after a slight improvement from 57th in November 2025. This consistency places it ahead of Big Bag O' Buds, which saw a significant jump from 70th to 51st, and BC Doobies, which improved from 60th to 54th. However, Community Cannabis c/o Purple Hills faces stiff competition from Shatterizer, which, despite a declining trend, remains ahead in rank, moving from 42nd to 50th. Additionally, Bold consistently outperformed Community Cannabis c/o Purple Hills in terms of sales, although its rank fluctuated slightly, ending at 53rd. These dynamics suggest that while Community Cannabis c/o Purple Hills is holding its ground, strategic initiatives may be necessary to climb higher in the ranks and close the sales gap with leading competitors.

Notable Products

In February 2026, the top-performing product from Community Cannabis c/o Purple Hills was the TwoFer Pre-Roll 2-Pack (2g) in the Pre-Roll category, maintaining its consistent first-place ranking since November 2025 with sales of 14,006 units. The Bakery Preroll 14-Pack (7g) also held steady in second place in the Pre-Roll category, closely following the leader. The Hybrid Hash (3g) from the Concentrates category maintained its third position, although its sales saw a slight decrease compared to the previous month. The Sour Grapes XL CO2 Cartridge (1.2g) in the Vapor Pens category remained in fourth place, while the Indica XL Distillate Cartridge (1.2g) continued in fifth, showing a downward trend in sales over the months. Overall, the rankings for these top products have remained stable, indicating consistent consumer preferences within the brand's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.