Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

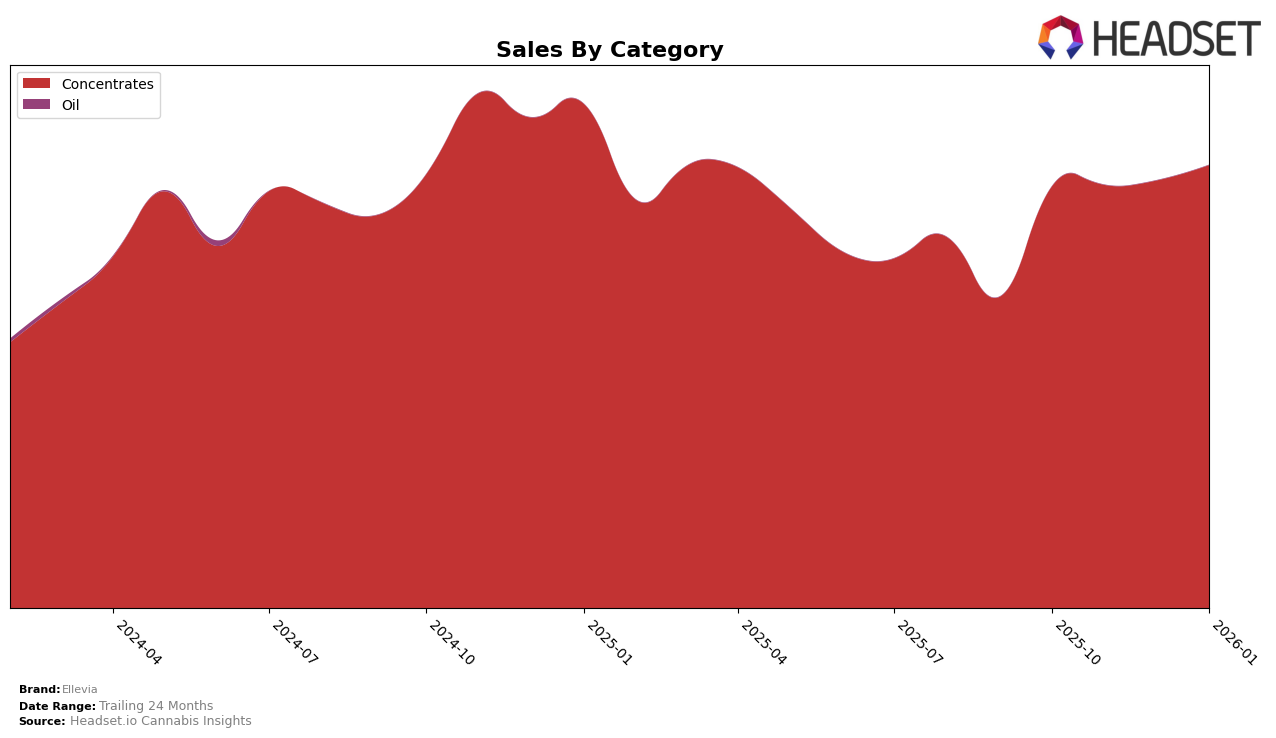

Ellevia has shown notable performance in the Concentrates category within the Ontario market. Over the last four months, the brand's ranking has fluctuated, starting at 25th in October 2025, dipping slightly in November and December to 26th and 28th, respectively, before climbing back up to 22nd in January 2026. This upward movement in January suggests a positive trend and possible increased consumer interest or effective marketing strategies that resonated well with the Ontario audience. Notably, the brand's sales figures have consistently grown month-over-month, indicating a strong market presence despite the mid-period dip in rankings.

The absence of Ellevia in the top 30 rankings for other states or provinces in the Concentrates category could be seen as a potential area for growth. The brand's ability to maintain and improve its position in Ontario might serve as a blueprint for expansion strategies in other regions. However, the lack of presence in these areas also highlights a challenge that Ellevia faces in diversifying its market reach. By focusing on enhancing product offerings or tailoring marketing efforts to specific regional preferences, Ellevia could potentially replicate its Ontario success in other markets.

Competitive Landscape

In the competitive landscape of concentrates in Ontario, Ellevia has demonstrated a fluctuating yet promising trajectory in terms of rank and sales. As of January 2026, Ellevia improved its rank to 22nd from 28th in December 2025, showcasing a positive trend in market presence. This upward movement is significant when compared to competitors like The Loud Plug, which remained outside the top 20, and Community Cannabis c/o Purple Hills, which only slightly dropped to 23rd. Despite Versus maintaining a higher rank, it experienced a notable decline in sales, contrasting with Ellevia's steady sales growth. Meanwhile, Chillum saw a decrease in rank to 21st, indicating potential volatility. Ellevia's strategic improvements in rank and consistent sales increase position it as a resilient player in the Ontario concentrates market, suggesting a promising outlook for further growth and market penetration.

Notable Products

In January 2026, RSO Full Spectrum (4g) maintained its position as the top-selling product for Ellevia, despite a slight decline in sales to 1131 units. RSO Full Spectrum (1g) also held steady in second place, showing a notable increase in sales from the previous month, reaching 1108 units. RSO Resin (1g) consistently ranked third, with a gradual increase in sales over the past months, culminating in 543 units sold in January. Hybrid RSO Dispenser (1g) remained in fourth place, with a modest rise in sales compared to December. The CBD/THC 1:1 - Balanced RSO Applicator (1g) did not appear in the January rankings, indicating a discontinuation or a lack of sales data for that month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.