Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

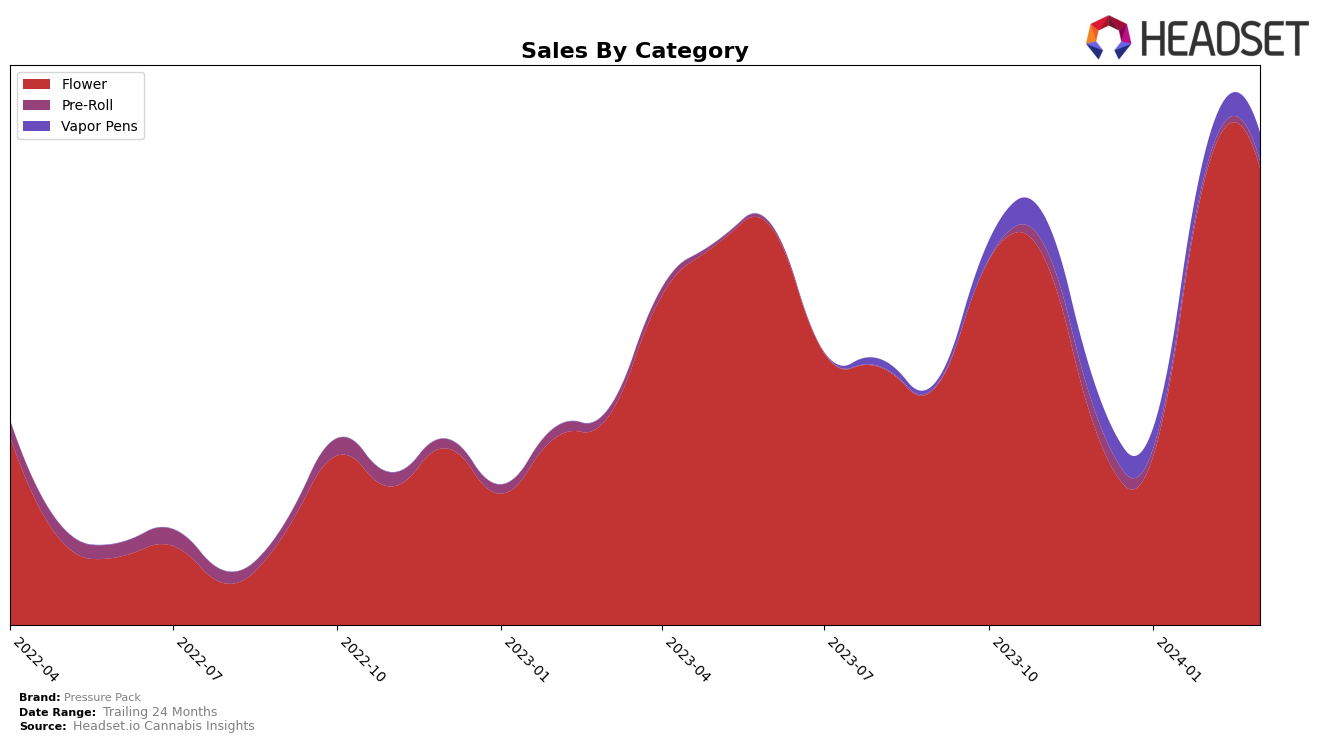

In Michigan, Pressure Pack has shown a notable performance across different cannabis categories, with its most significant movements observed in the Flower and Vapor Pens categories. For Flower, the brand's ranking improvement from 68th in January to 20th in February, and maintaining a close position at 22nd in March, indicates a strong upward trajectory. This movement is particularly impressive, considering the brand was not within the top 30 in December, suggesting a remarkable increase in market share and consumer preference. In contrast, the Vapor Pens category tells a different story. Despite a slight increase in sales from February to March, Pressure Pack struggled to climb the rankings, moving from 92nd in February to 90th in March. This stagnation near the bottom of the top 100 highlights challenges in this category, possibly indicating stronger competition or a mismatch between product offerings and consumer preferences in Michigan.

The sales figures provide a deeper insight into Pressure Pack's performance dynamics. In the Flower category, a significant sales jump in February, with over a million in sales, suggests a successful marketing or distribution strategy that notably increased its market footprint. However, the consistent rankings in the lower tiers for Vapor Pens, despite a sales increase in March, suggest that while the brand may be growing its customer base or improving its sales tactics, it's not enough to significantly shift its market position within this category. This analysis underscores the importance of category-specific strategies for cannabis brands looking to expand their market presence. While Pressure Pack is making impressive strides in Flowers, there's a clear indication that a reevaluation or enhanced focus on the Vapor Pens category could be beneficial for overall brand growth and market penetration in Michigan.

Competitive Landscape

In the competitive landscape of the cannabis flower category in Michigan, Pressure Pack has shown a notable fluctuation in its market position, moving from a rank of 61st in December 2023 to 68th in January 2024, then making a significant leap to 20th in February and maintaining a close position at 22nd in March 2024. This trajectory suggests a volatile start to the year but indicates a strong recovery and stabilization in the market. Its competitors, such as Galactic (fka Galactic Meds), J's Terp House Cannabis, and Distro 10, have also experienced shifts in their rankings, with Distro 10 consistently maintaining a higher rank and showing a downward trend from 9th in December to 21st in March. On the other hand, Galactic made a significant jump from 66th to 16th from December to January, then experienced fluctuations, settling at 23rd in March. J's Terp House Cannabis displayed more stability but still saw a slight decline from 22nd in February to 24th in March. Notably, The Limit made an impressive entry at 20th in March, indicating a competitive market with dynamic shifts in brand rankings and sales, highlighting the importance of strategic positioning and marketing efforts for brands like Pressure Pack to maintain and improve their market share.

Notable Products

In March 2024, Pressure Pack saw Super Pure Runtz (3.5g) leading its sales with 5,775 units sold, maintaining its top position from February. Following closely, Champions Edition (3.5g) and Kashlato (3.5g) took the second and third spots, respectively, showing a notable rise in their rankings; Champions Edition climbed from third in February, while Kashlato moved up from second. Rotation Pressure (3.5g) entered the rankings directly at the fourth position, indicating a significant interest in this product despite it not being ranked in the previous months. Kashlato Smalls (3.5g) held steady, maintaining its fifth position from February. This month's rankings highlight a dynamic shift in consumer preferences within Pressure Pack's offerings, with both new and established products showing strong performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.