Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

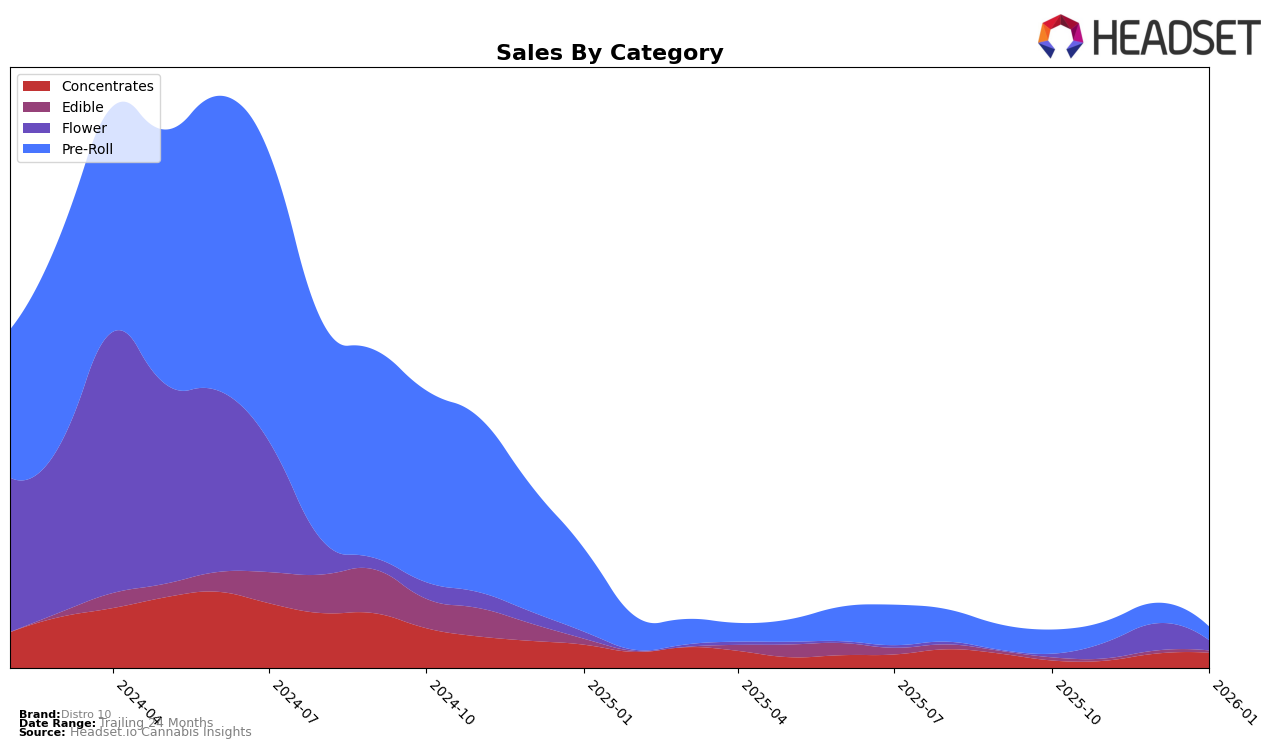

Distro 10's performance in the Michigan market reveals notable trends across different cannabis categories. In the Concentrates category, Distro 10 showed a positive trajectory, moving from a rank of 42 in October 2025 to 27 by January 2026, indicating a strong upward momentum in this segment. This rise in ranking is supported by a significant increase in sales during this period. However, the brand's presence in the Edible category seems less robust, as it remained outside the top 30, with rankings fluctuating between 69 and 77. This suggests that while Distro 10 is gaining traction in Concentrates, it faces challenges in breaking into the leading ranks of Edibles.

Examining the Pre-Roll category, Distro 10 experienced a downward trend in Michigan, dropping from rank 50 in October 2025 to 63 by January 2026. This decline might reflect increased competition or shifting consumer preferences in the Pre-Roll market. Despite this, the brand maintained a relatively stable position within the top 70 across all categories, which indicates a consistent presence but also highlights areas for potential improvement. The data suggests that while Distro 10 is making headway in Concentrates, it may need to strategize differently to enhance its performance in other categories like Edibles and Pre-Rolls.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Distro 10 has shown a notable upward trajectory in its rankings from October 2025 to January 2026. Starting at rank 42 in October, Distro 10 improved to rank 27 by January, indicating a positive trend in market presence. This rise is significant when compared to competitors like Fresh Coast, which experienced a decline from rank 9 to 28 in the same period, and Light Sky Farms, which also saw a drop from rank 18 to 29. Meanwhile, Redemption maintained a relatively stable position, fluctuating slightly but ending at rank 26. Interestingly, LOCO made a significant leap from rank 57 to 25, suggesting a competitive push in January. Despite these movements, Distro 10's consistent sales growth, particularly from December to January, positions it as a brand on the rise, potentially capturing market share from declining competitors.

Notable Products

In January 2026, the top-performing product for Distro 10 was the Crumb Cake Infused Pre-Roll (1.2g) in the Pre-Roll category, reclaiming its first-place rank from October and November 2025 after briefly dropping to fifth in December. The Strawberry Float Infused Pre-Roll (1.2g) held the second position, a slight drop from its top rank in December, with notable sales of 8,644 units. Purple Plum Infused Pre-Roll (1.2g) maintained a strong presence, ranking third, consistent with its October and December standings. Bubba Burst Infused Pre-Roll (1.2g) remained stable in fourth place throughout the months, showing consistent performance. Lastly, Cherry Swirl Infused Pre-Roll (1.2g) rounded out the top five, maintaining its December position after fluctuating in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.