Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

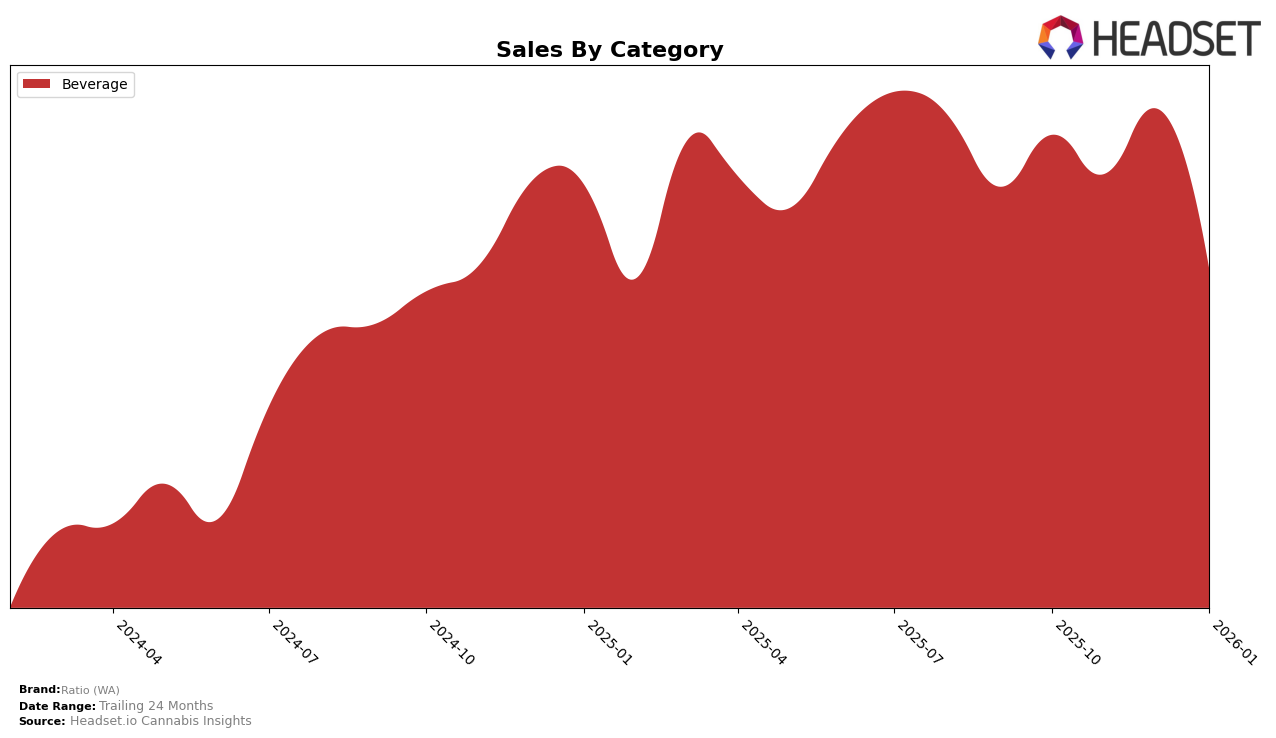

In the Washington market, Ratio (WA) has demonstrated a consistent presence within the beverage category, although its performance has experienced some fluctuations. The brand maintained a steady position in the top 10 from October to December 2025, with rankings of 7th in October and 8th in both November and December. However, in January 2026, Ratio (WA) dropped to 11th place, falling out of the top 10. This decline in ranking coincided with a notable decrease in sales, from December's sales figures to January's, which could suggest increased competition or seasonal factors impacting consumer demand.

Despite the dip in January, Ratio (WA) has shown resilience by consistently appearing in the top 30 rankings, which is not the case for many brands. The brand's ability to remain competitive in the Washington beverage category highlights its strong market presence, even as it faces challenges. Missing from the top 30 in any given month would be a cause for concern, but Ratio (WA) has managed to avoid this, maintaining visibility and relevance in a crowded market. This consistent ranking suggests that Ratio (WA) has a loyal customer base and a product offering that resonates with consumers, even as it navigates the dynamic cannabis market landscape.

Competitive Landscape

In the Washington beverage category, Ratio (WA) has experienced notable fluctuations in its ranking and sales performance over the recent months. Starting from a strong position at rank 7 in October 2025, Ratio (WA) saw a gradual decline, slipping to rank 11 by January 2026. This downward trend in rank coincides with a decrease in sales from October to January, suggesting a potential loss in market share. In contrast, competitors like Constellation Cannabis improved their rank from 11 to 8 over the same period, indicating a strengthening position in the market. Meanwhile, Hot Shotz maintained a consistent presence in the top 10, highlighting its stable performance. The fluctuating ranks and sales figures suggest that Ratio (WA) may need to reassess its market strategies to regain its competitive edge in the Washington beverage market.

Notable Products

In January 2026, the Island Coconut Shot (100mg THC, 2.5oz) emerged as the top-performing product for Ratio (WA), climbing from fourth place in December 2025 to secure the number one rank, with sales reaching 3926. The Orange Breeze Shot (100mg THC, 2.5oz) maintained its strong performance, holding steady at the second position despite a decline in sales compared to previous months. The Strawberry Burst Shot (100mg THC, 2.5oz), which was the leading product in December, dropped to third place in January. The Island Punch Shot (100mg THC, 2.5oz) remained consistent, securing the fourth position as it did in December. Lastly, the CBN/CBD/THC 1:1:2 Grape Dream Shot (25mg CBN, 25mg CBD, 50mg THC, 2.5oz) maintained its fifth-place ranking, showing a slight increase in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.