Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

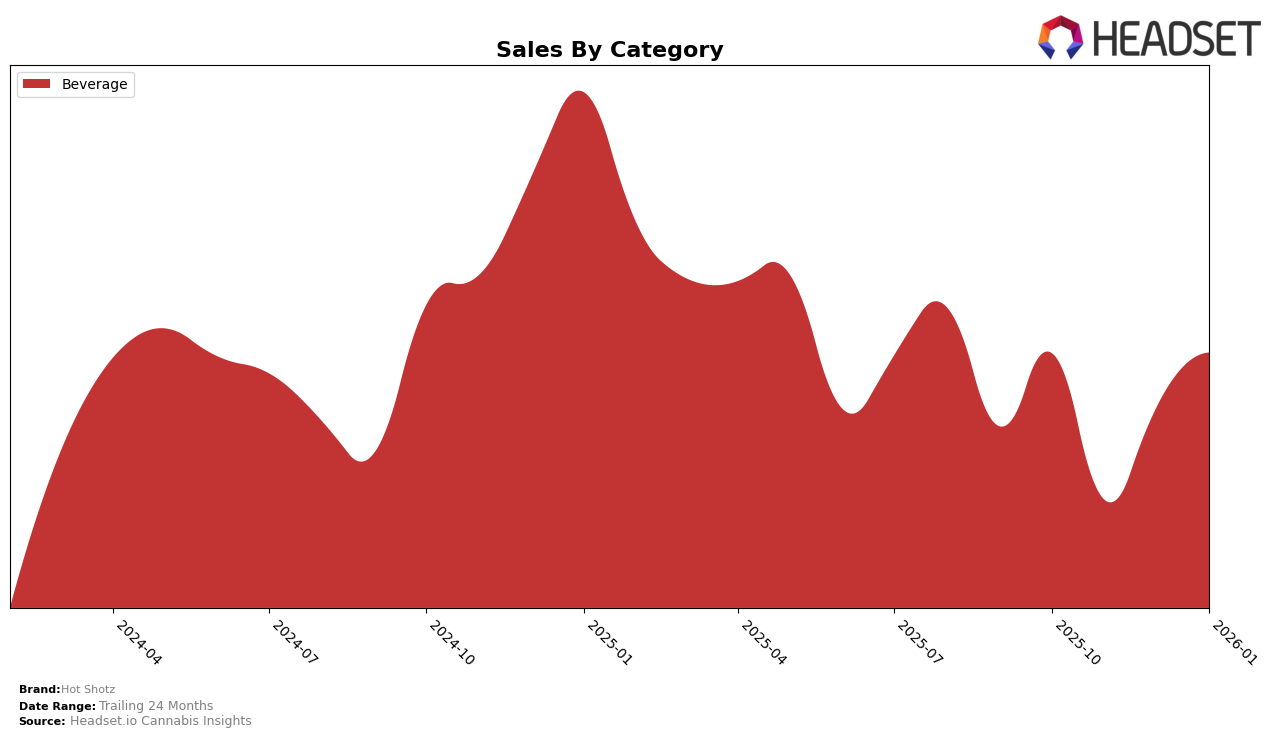

Hot Shotz has shown consistent performance in the Beverage category within the state of Washington. Over the four-month period from October 2025 to January 2026, the brand maintained a steady presence, oscillating between the 9th and 10th positions. This stability suggests a strong foothold in the Washington market, particularly in the Beverage segment, which can be challenging due to high competition. Notably, their sales figures reflect a significant rebound in January 2026, returning to the October levels, which indicates a successful recovery strategy after a dip in November.

However, the absence of Hot Shotz from the top 30 rankings in other states and categories could be cause for concern or indicate areas for potential growth. This absence might suggest that the brand's influence is currently concentrated in Washington, and expanding their presence in other markets could be a strategic focus moving forward. The consistency in their Washington rankings could serve as a blueprint for entering new markets, but the challenge remains in replicating this success elsewhere. Understanding the dynamics and consumer preferences in different states could be key to Hot Shotz's future expansion strategies.

Competitive Landscape

In the competitive landscape of the beverage category in Washington, Hot Shotz has shown a consistent presence, maintaining a rank of 9th in both October 2025 and January 2026, despite a brief dip to 10th in November and December 2025. This stability in ranking indicates a resilient market position amidst fluctuating sales figures. Notably, Blaze Soda consistently held the 7th position throughout the same period, suggesting a stronger foothold in the market. Meanwhile, Ratio (WA) experienced a decline from 7th to 11th place by January 2026, which may present an opportunity for Hot Shotz to capture some of their market share. Additionally, Constellation Cannabis improved its rank from 11th in October 2025 to 8th by January 2026, indicating a competitive push that Hot Shotz should keep an eye on. These dynamics highlight the importance of strategic positioning and marketing efforts for Hot Shotz to enhance its market presence and potentially climb higher in the rankings.

Notable Products

In January 2026, Hot Shotz's top-performing product was the Blue Raspberry Energy Drink, consistently maintaining its number one rank since October 2025 with sales of 3787 units. The Dragon Fruit Energy Shot also held steady in second place throughout the months leading up to January, with sales reaching 2242 units. The CBD/THC 1:1 Watermelon Energy Drink remained in third place, showing stable sales figures. The Green Apple Energy Drink, which climbed from fifth to fourth place between October and November 2025, retained its fourth position in January 2026. Notably, the Fruit Punch Energy Drink entered the top five rankings for the first time in January 2026, taking the fifth spot with 1192 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.