Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

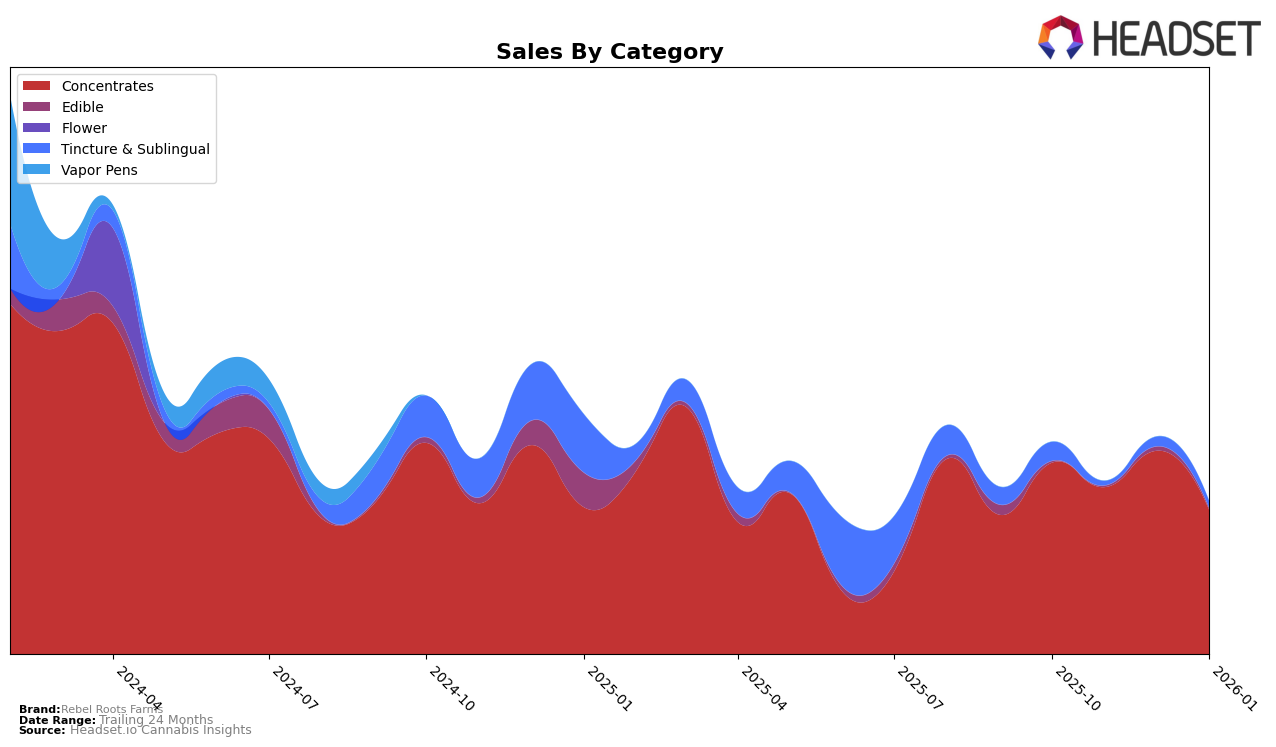

Rebel Roots Farms has shown a varied performance across different categories and states, with notable fluctuations in their rankings and sales figures. In the state of Oregon, the brand's presence in the Concentrates category has been inconsistent. Despite not making it into the top 30 rankings from October 2025 through January 2026, there is a positive trend in sales figures, with a notable increase from November to December 2025. This upward movement in sales suggests that while they may not be leading the market in terms of rankings, their product appeal is gaining traction among consumers, which could potentially lead to improved rankings in the future.

The absence of Rebel Roots Farms from the top 30 in the Concentrates category in Oregon for several months indicates a competitive market environment. However, the increase in sales during this period points to a potential for growth and an opportunity for the brand to strategize on capturing a larger market share. This scenario underscores the importance of market dynamics and consumer preferences in shaping the performance of cannabis brands like Rebel Roots Farms. Keeping an eye on their future movements and strategies could provide valuable insights into how they plan to enhance their market position.

Competitive Landscape

In the Oregon concentrates category, Rebel Roots Farms has experienced fluctuating rankings over the past few months, reflecting a dynamic competitive landscape. While Rebel Roots Farms was ranked 73rd in October 2025, it slipped to 75th in November before climbing to 67th in December, indicating a positive trend in sales performance. However, the brand was not in the top 20 in January 2026, suggesting increased competition or market challenges. Notably, Decibel Farms consistently outperformed Rebel Roots Farms, maintaining a higher rank despite a downward trend from 45th in October to 67th in January. Meanwhile, Oregon Roots showed a similar pattern to Rebel Roots Farms, with rankings just slightly above Rebel Roots Farms in October and November. Additionally, Rogue Gold emerged in December with a rank of 72, adding to the competitive pressure. These insights suggest that while Rebel Roots Farms has shown resilience and potential for growth, it faces significant competition from established brands in the Oregon concentrates market.

Notable Products

In January 2026, the top-performing product for Rebel Roots Farms was Indica RSO 1g in the Concentrates category, reclaiming its number one rank from October 2025 with sales of 271 units. Berry Pie RSO 1g rose significantly to the second position from its previous fifth rank in December, showing a notable increase in sales. Indica Multi-Strain RSO 1g maintained a steady presence in the top three, dropping slightly from its December rank of fourth to third in January. Northern Lights RSO 1g, which peaked at first position in December, fell to third place in January. Cherry Chem RSO 1g experienced a slight decline, moving from third in December to fourth in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.