Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

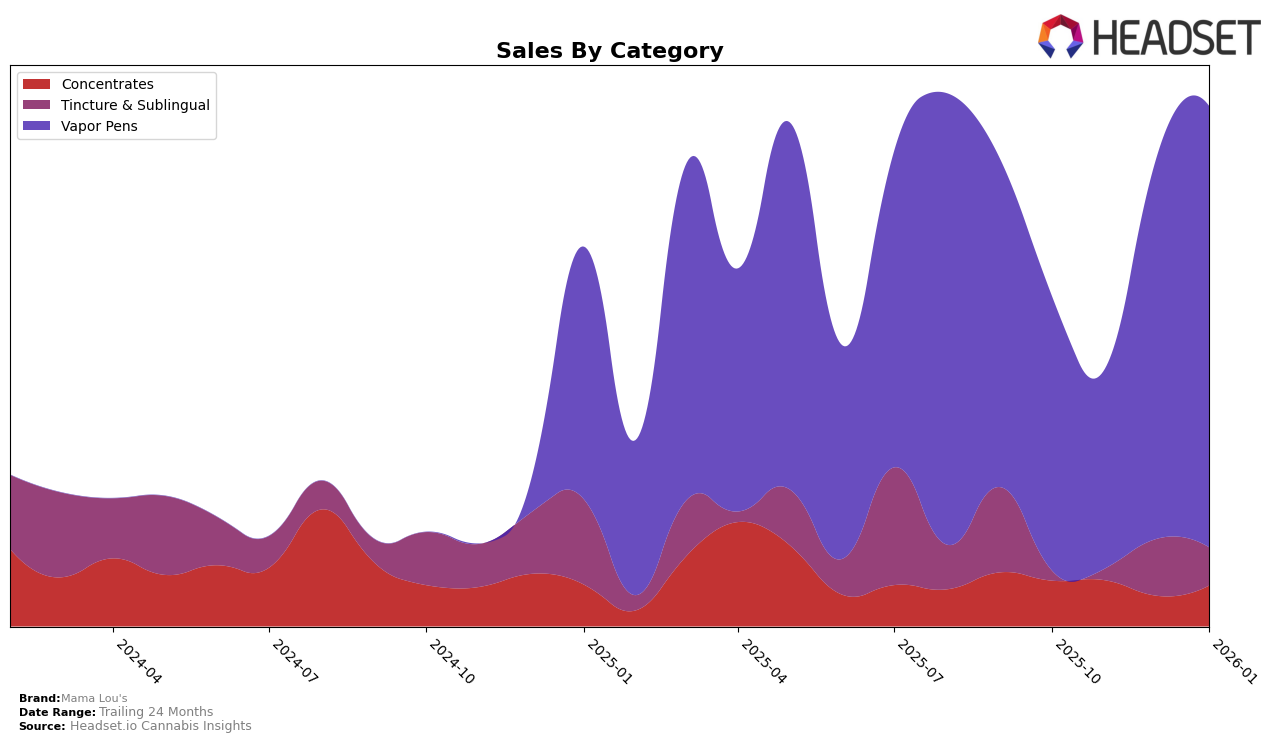

In the Oregon market, Mama Lou's has shown a promising upward trend in the Vapor Pens category. Despite not being in the top 30 brands initially, the brand has consistently improved its ranking from 67th in October 2025 to 58th by January 2026. This upward trajectory suggests a growing consumer interest and possibly effective strategic adjustments by the brand. The significant jump in sales from November to December 2025 indicates a strong holiday season performance, which could be attributed to either seasonal demand or successful marketing campaigns.

While Mama Lou's is making strides in Oregon, the absence of top 30 rankings in other states or provinces might indicate challenges in expanding their market presence beyond this region. This could be due to various factors, such as regional competition, distribution limitations, or brand recognition hurdles. However, the positive momentum in Oregon could serve as a blueprint for potential growth strategies in other markets, provided the brand can replicate its success and adapt to different regional dynamics.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Mama Lou's has shown a dynamic shift in its market position from October 2025 to January 2026. Despite a dip in rank from 67th in October to 71st in November, Mama Lou's rebounded to 58th by January, indicating a strong recovery and adaptability in the market. This fluctuation in rank contrasts with competitors like Dr. Jolly's, which consistently improved its position from 70th to 60th, and Happy Cabbage Farms, which saw a peak in December at 55th before slipping to 61st. Meanwhile, High Tech maintained a relatively stable rank, hovering around the 50th position. Notably, PRUF Cultivar emerged in January at 53rd, after not being in the top 20 in the preceding months, suggesting a potential new contender in the market. These shifts highlight the competitive pressures and opportunities for Mama Lou's to capitalize on its recent upward trend in sales and rank, positioning itself strategically against both established and emerging brands.

Notable Products

In January 2026, the top-performing product from Mama Lou's was the Grandaddy Purp Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking from the previous month with sales reaching 1622 units. The Cherry Pie Distillate Cartridge (1g) improved its position to second place, showing significant growth from December. Blue Dream Distillate Cartridge (1g) rose to the third spot from fifth in December, indicating a positive trend in sales. Meanwhile, Chocolate Diesel Distillate Cartridge (1g) dropped to fourth place, despite being second in December. Lastly, CBG RSO (1g) in the Concentrates category re-entered the rankings at fifth place, showcasing a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.