Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

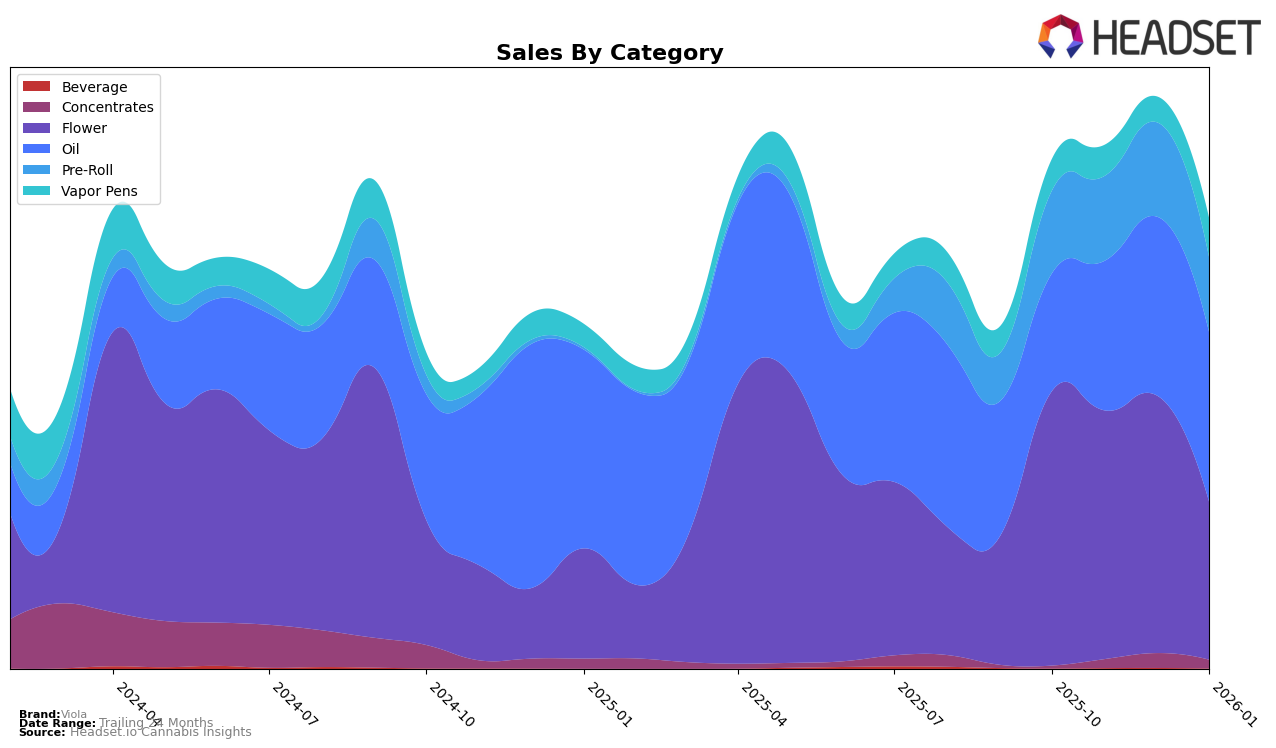

In the Canadian market, Viola has demonstrated notable stability and growth, particularly in the Oil category. In Alberta, Viola has maintained a strong position, consistently holding the second rank from November 2025 to January 2026. This indicates a solid consumer base and effective market strategies in the province. Meanwhile, in Ontario, Viola has exhibited stability by consistently ranking seventh in the Oil category over the same period. This consistent performance in Ontario suggests a steady demand, though there is room for growth to break into the top five. The brand's ability to maintain these ranks in competitive markets highlights its resilience and potential for further expansion.

In the United States, Viola's performance has been more varied. In Colorado, the brand faced challenges in the Flower category, where it was not ranked in the top 30 as of January 2026, indicating a decline from its previous positions. This suggests increased competition or shifting consumer preferences in the state. Similarly, Viola's Pre-Roll category in Colorado saw fluctuating rankings, with an improvement to 52nd in January 2026 from the 64th position in December 2025, though still outside the top 30. In Saskatchewan, Viola's Flower category appeared in the rankings briefly at the 50th position, indicating a nascent presence in the market. These movements highlight both challenges and opportunities for Viola to reassess and potentially strengthen its strategies in the U.S. market.

Competitive Landscape

In the competitive landscape of the Colorado Flower category, Viola has experienced fluctuating ranks from October 2025 to January 2026, with a notable decline from 37th to 52nd position. This downward trend in rank is mirrored by a decrease in sales, suggesting challenges in maintaining its market position. In contrast, Bloom County showed resilience, improving its rank from 45th to 46th while experiencing a sales increase in November 2025, indicating effective competitive strategies. Meanwhile, Seed and Smith (LBW Consulting) and Meraki Gardens faced similar rank volatility, with Meraki Gardens notably climbing to 41st in November before dropping again. Rocky Mountain High maintained a relatively stable position, suggesting a consistent customer base. Viola's challenge lies in reversing its sales decline and rank drop, potentially by analyzing competitors' strategies and market trends to regain its competitive edge.

Notable Products

In January 2026, Viola's top-performing product was Daily Grapes Smalls (Bulk) in the Flower category, rising to the first position with sales of 5766. The Drop THC Extract Oil (20ml) in the Oil category secured the second rank, having previously been first in November 2025. Z41 Smalls (Bulk) entered the rankings at third, indicating a strong debut. Face On Fire Smalls (Bulk) moved up to fourth from fifth in December 2025, showing consistent performance. P85 Smalls (Bulk) maintained its position at fifth, rounding out the top five products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.