Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

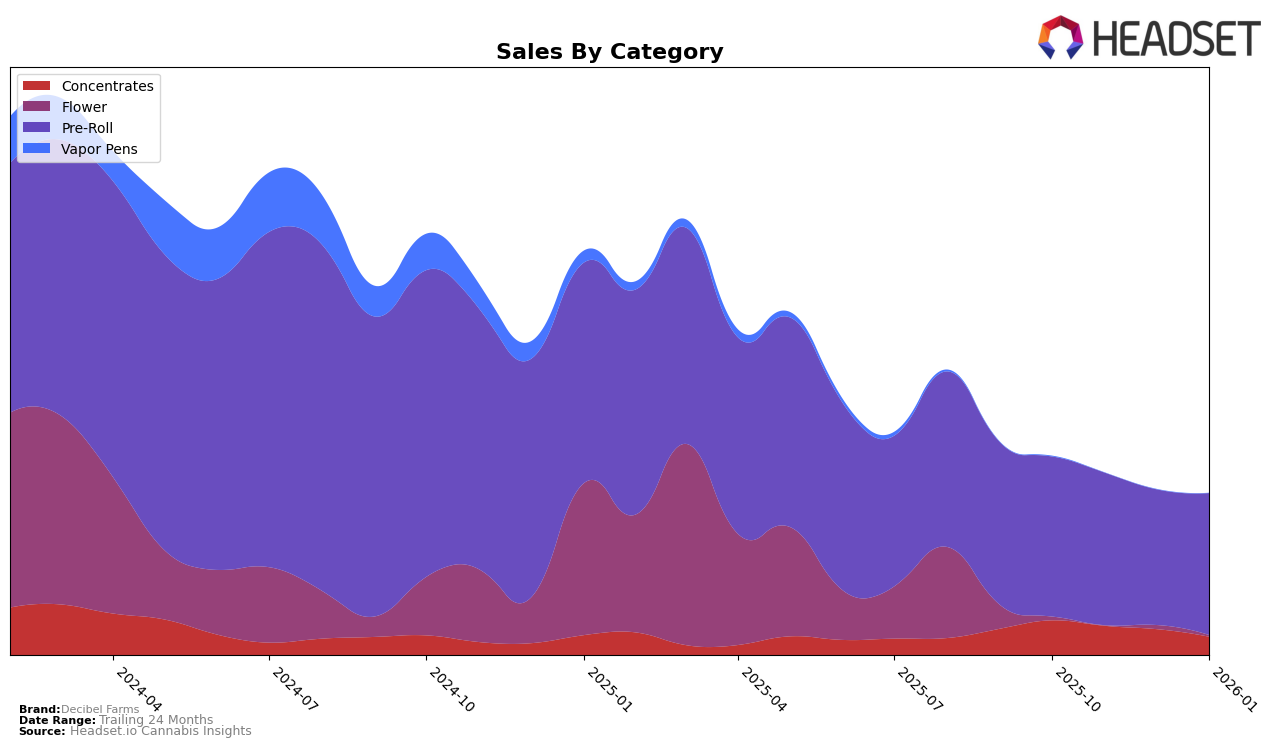

In the state of Oregon, Decibel Farms has shown varying performance across different product categories. In the Concentrates category, the brand did not make it into the top 30 rankings from October 2025 to January 2026, indicating a decline in market presence over these months. The downward trend is further evidenced by a consistent drop in sales, from $28,519 in October 2025 to $15,020 in January 2026. This suggests that the brand may be facing challenges in maintaining its competitive edge in this category, potentially due to increased competition or shifting consumer preferences.

Conversely, Decibel Farms has maintained a relatively stable presence in the Pre-Roll category within Oregon. The brand's ranking fluctuated slightly but remained within the top 30, with positions ranging from 24th to 29th over the same period. Interestingly, despite a slight decline in sales from October to December 2025, there was a recovery in January 2026, with sales increasing to $116,525. This suggests that while the brand faces competitive pressures, it has managed to sustain consumer interest and demand in the Pre-Roll category, which could be an area of strategic focus for further growth.

Competitive Landscape

In the competitive landscape of Oregon's pre-roll category, Decibel Farms has experienced fluctuating rankings, reflecting a dynamic market presence. From October 2025 to January 2026, Decibel Farms' rank varied from 28th to 24th, before settling at 26th, indicating a competitive but stable position. Notably, Gud Gardens consistently outperformed Decibel Farms, maintaining a higher rank and showcasing stronger sales figures, particularly in December 2025. Meanwhile, Mule Extracts demonstrated a slight edge over Decibel Farms by consistently ranking higher, except in November 2025. On the other hand, PRUF Cultivar / PRŪF Cultivar and Altered Alchemy showed a notable upward trend, with PRUF Cultivar making a significant leap in January 2026, surpassing Decibel Farms. These shifts highlight the competitive pressures Decibel Farms faces, emphasizing the need for strategic marketing and product differentiation to enhance its market position.

Notable Products

In January 2026, the top-performing product from Decibel Farms was Basslines Duets - Sativa Infused Pre-Roll 6-Pack (3g), which ascended to the first rank with sales totaling 1710 units. This product maintained its upward trajectory from its second-place position in the previous two months. Basslines Duets - Indica Infused Pre-Roll 6-Pack (3g) secured the second spot, recovering from a dip in December 2025. Duets - Mr. Clean x MAC's Dream Infused Pre-Roll 6-Pack (3g) showed notable improvement, climbing to third place from fifth in December. Trebles - Sativa Blend Bubble Hash Infused Pre-Roll 2-Pack (1g), previously a top contender, dropped to fifth place, reflecting a significant decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.