Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

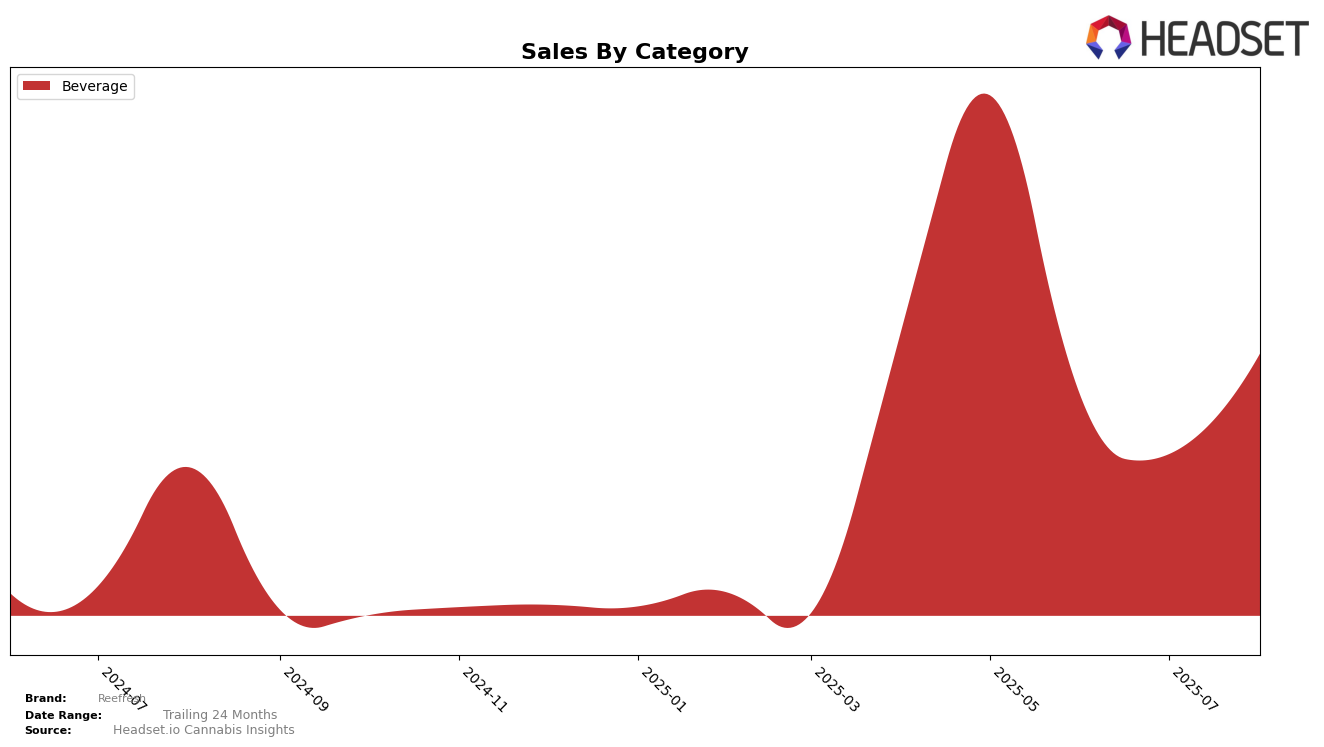

Reefresh's performance in the cannabis beverage category in California has shown some notable trends. In May 2025, the brand secured the 22nd position in the state's beverage category rankings, suggesting a moderate presence in a competitive market. However, the absence of rankings in the subsequent months of June, July, and August indicates that Reefresh did not maintain a spot in the top 30 brands, which could be a point of concern for the brand's market penetration and visibility. This drop-off might reflect increased competition or a need for strategic adjustments to regain traction in the market.

While the sales figures for May 2025 were recorded at $13,085, the lack of ranking data for the following months implies that Reefresh might have experienced a decline in sales or failed to keep pace with competitors in the beverage category. The absence of Reefresh from the top 30 in June, July, and August could indicate challenges in maintaining consumer interest or market share. This scenario underscores the importance of staying competitive and innovative in the rapidly evolving cannabis industry, particularly in a state as significant as California.

Competitive Landscape

In the competitive California beverage category, Reefresh has shown potential but faces significant challenges from established brands. Notably, Reefresh was ranked 22nd in May 2025 but did not maintain a top 20 position in subsequent months, indicating a need for strategic improvements to boost visibility and sales. In contrast, Kikoko consistently held the 20th position in May and June before dropping out of the top 20, suggesting a similar struggle to maintain market presence. Meanwhile, Mary Jones achieved a 15th place ranking in May, highlighting a stronger foothold in the market. This competitive landscape suggests that while Reefresh has room for growth, it must innovate and adapt to climb the ranks and compete effectively against brands like Mary Jones, which have demonstrated higher sales and market stability.

Notable Products

In August 2025, the top-performing product from Reefresh was the Strawberry Lemonade Sugar Free Shot (100mg THC, 2oz) in the Beverage category, maintaining its number one rank from July with sales of 242 units. The Watermelon Sugar Free Blast Shot (100mg THC, 2oz, 60ml) held the second position, consistent with its rank in July, but saw a slight decrease in sales compared to previous months. The Strawberry Lemonade (10mg) made a significant leap to third place after not being ranked in July, indicating a strong surge in popularity. The Fruit Punch Shot (100mg THC, 2oz) ranked fourth, down from its third-place standing in July, while the Sour Apple Blast Shot (100mg THC, 2oz) remained steady in fifth place. Overall, the rankings indicate a stable performance for the top products, with minor shifts in consumer preferences within the Beverage category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.