Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

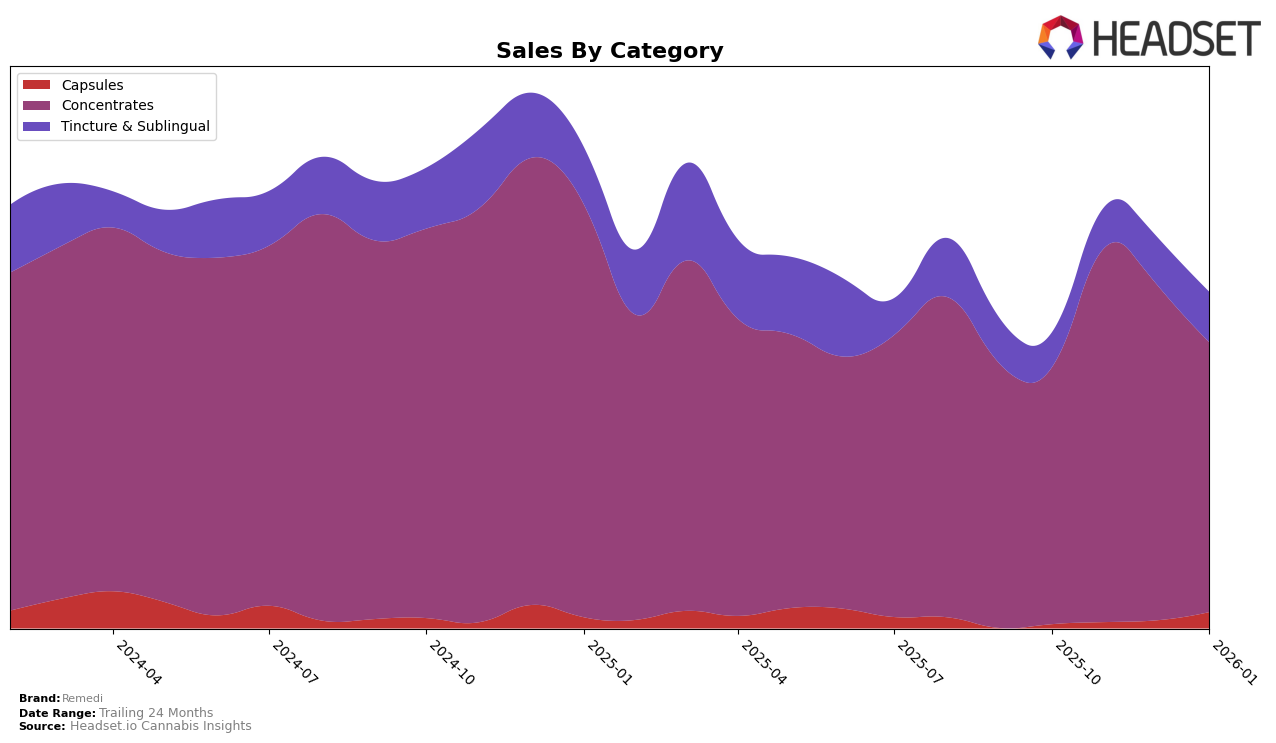

In the state of Illinois, Remedi has shown a consistent presence in the Tincture & Sublingual category, maintaining a strong position at rank 3 from November 2025 through January 2026. This stability suggests a solid consumer base and effective market strategies in this category. Conversely, in the Concentrates category, Remedi's performance has been more volatile, with rankings fluctuating between 18 and 24 over the same period. Notably, while they managed to climb up to rank 18 in November, they have not been able to sustain this improvement, indicating potential challenges in maintaining a competitive edge in this segment.

Meanwhile, in Massachusetts, Remedi's performance in the Concentrates category has not been as strong, as they did not make it into the top 30 rankings in October 2025. Despite this, they have shown some progress, reaching rank 33 in the subsequent months, which may indicate a gradual improvement or increased market penetration. However, the absence from the top 30 in October highlights a significant gap in their market presence compared to their performance in Illinois. This disparity between states suggests that Remedi's strategies might be more effective or better received in certain markets, hinting at regional preferences or competitive dynamics that could be further explored.

Competitive Landscape

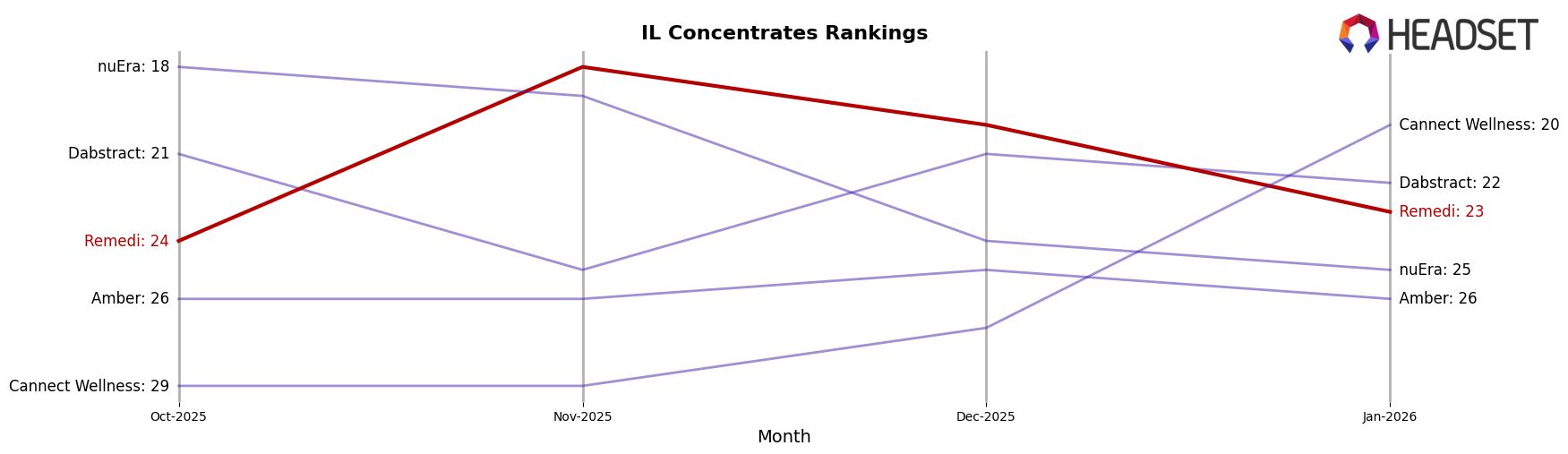

In the competitive landscape of the concentrates category in Illinois, Remedi has shown a dynamic performance over the past few months. Starting from October 2025, Remedi was ranked 24th, but it climbed to 18th in November, marking a significant improvement. However, this upward trend was not sustained as it slipped to 20th in December and further down to 23rd by January 2026. This fluctuation in rank is reflective of the volatile sales environment in the concentrates market. Notably, Dabstract, which was not in the top 20, maintained a relatively stable position around the low 20s, while nuEra experienced a decline from 18th to 25th, indicating a potential opportunity for Remedi to capitalize on its competitors' instability. Meanwhile, Cannect Wellness showed a promising rise from 29th to 20th, suggesting an emerging competitor to watch. These shifts highlight the importance for Remedi to leverage strategic marketing and product differentiation to regain and maintain a stronger position in the Illinois concentrates market.

Notable Products

In January 2026, Remedi's top-performing product was the Indica Relief RSO Syringe (0.5g) in the Concentrates category, maintaining its first-place ranking consistently from October 2025. This product achieved sales of $1,070. The Indica Rest RSO Dropper (0.5g) also held steady in second place across the same period. The Indica Rest RSO Syringe (0.5g) continued its streak in third position, showing a slight increase in sales from December to January. The CBD/THC 1:5 Rest Tincture (20mg CBD, 100mg THC, 30ml) maintained its fourth position since November 2025, while the CBD/THC 1:1 Relief Tincture (50mg CBD, 50mg THC, 30ml) re-entered the rankings at fifth place, having been unranked in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.