Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

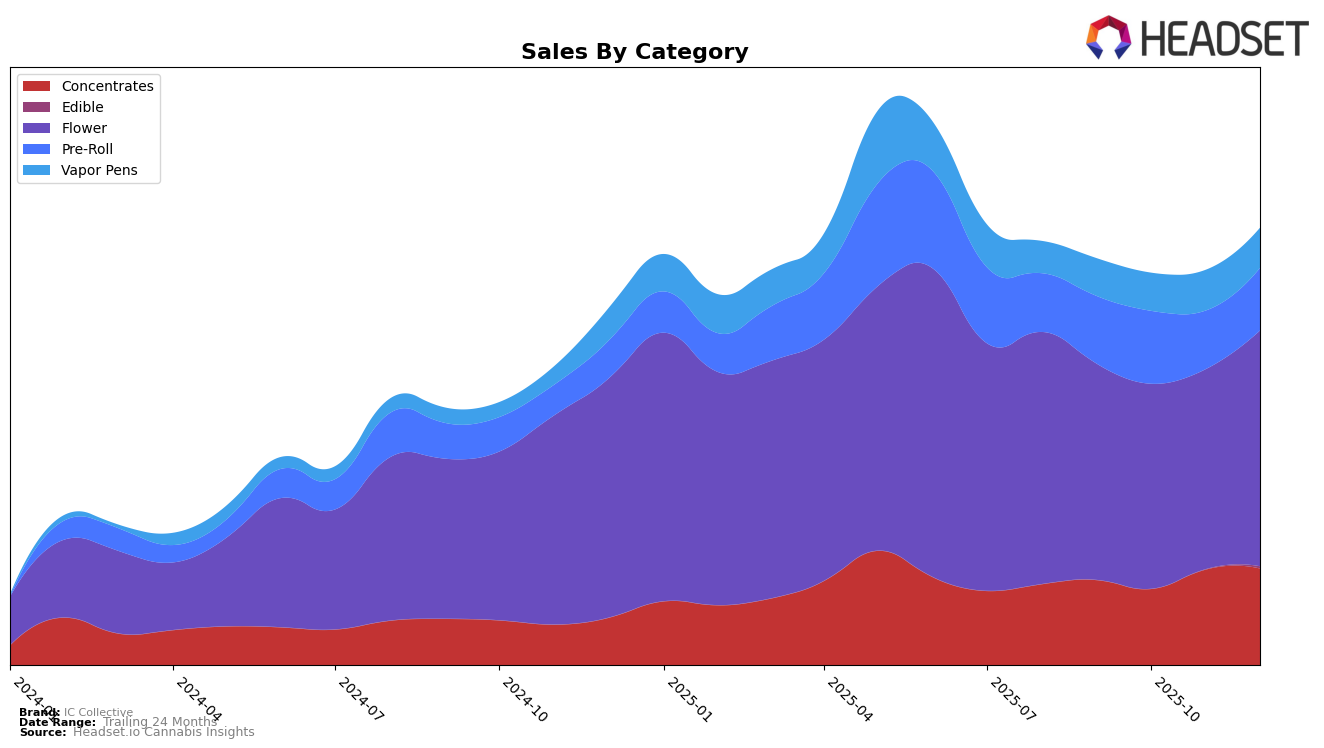

In the state of Illinois, IC Collective has shown varied performance across different product categories. Notably, in the Concentrates category, IC Collective has demonstrated a strong upward movement, climbing from a rank of 9 in October 2025 to a rank of 4 by November and maintaining this position in December. This indicates a growing consumer preference or successful marketing strategies in this segment. Conversely, in the Flower category, IC Collective's ranking fluctuated slightly, peaking at rank 22 in December, which suggests a competitive landscape in Illinois. Despite these fluctuations, the brand managed to increase its sales, indicating resilience and potential for growth.

In other categories, IC Collective's performance has been mixed. For Pre-Rolls, the brand saw a decline in ranking from 17 in October to 22 in November and December, which could suggest challenges in maintaining consumer interest or increased competition. The Vapor Pens category presents a more concerning picture, with IC Collective consistently ranking outside the top 30, indicating a potential area for improvement. Despite this, the overall sales figures, particularly in the Concentrates category, reveal a positive trajectory, suggesting that IC Collective's strategic focus might be paying off in certain segments within Illinois.

Competitive Landscape

In the competitive landscape of the Illinois flower category, IC Collective has experienced fluctuating rankings over the last few months of 2025, indicating a dynamic market presence. Starting at 21st place in September, IC Collective's rank slipped to 24th in October and 26th in November, before recovering slightly to 22nd in December. This volatility contrasts with competitors like Island, which maintained a more stable position, albeit outside the top 20 by November and December. Meanwhile, Kaviar showed a more consistent performance, ranking within the top 20 for most of the period, which could suggest a stronger market hold. The sales figures reflect these trends, with IC Collective's sales dipping in October and November but showing a rebound in December. This recovery, however, still leaves them trailing behind brands like Kaviar, which consistently outperformed IC Collective in sales. As IC Collective navigates this competitive environment, understanding these shifts can be crucial for strategic adjustments and market positioning.

Notable Products

In December 2025, IC Collective's top-performing product was the T.I.T.S. Pre-Roll (1g) in the Pre-Roll category, maintaining its position as the number one ranked product for four consecutive months, with sales reaching 1942 units. The T.I.T.S. (3.5g) Flower followed closely, holding the second rank, showing a consistent climb from third in September to second since November. OMFG (3.5g) Flower secured the third spot, improving from its fourth position in September, with steady sales growth each month. The OMFG THCA Infused Banger Pre-Roll (1.5g) debuted in December at fourth place, while Pheno Hunt #711 Pre-Roll (1g) entered the rankings at fifth. These rankings highlight a competitive pre-roll market and a strong performance in the Flower category for IC Collective.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.