Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

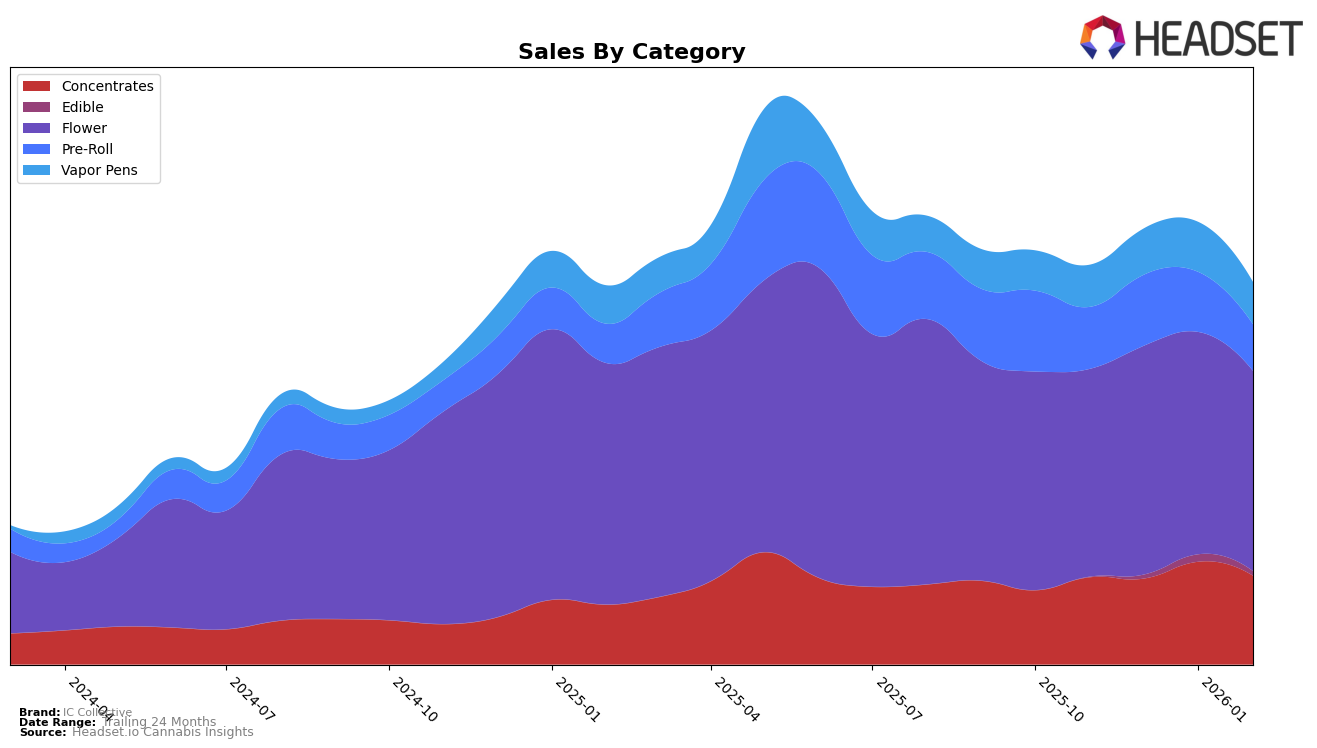

IC Collective has shown a dynamic performance across various categories in Illinois. In the Concentrates category, the brand has demonstrated a commendable upward trend, moving from 6th place in November 2025 to 4th place by January 2026, before slightly dipping back to 6th in February 2026. This indicates a strong competitive presence in this category. Meanwhile, in the Flower category, IC Collective has maintained a relatively stable position, fluctuating between the 22nd and 26th ranks. This stability suggests a consistent demand for their flower products, although there is potential for growth if they aim to break into higher ranks.

In contrast, the Pre-Roll category has seen more volatility, with IC Collective's rank dropping from 20th in January 2026 to 26th by February 2026, indicating potential challenges or increased competition. This decline might warrant a closer look at market dynamics or consumer preferences that could be affecting their performance. Additionally, while they are not within the top 30 in the Vapor Pens category, maintaining positions in the 40s range, the slight improvements in sales figures could be an encouraging sign. The brand's ability to hold its ground in a competitive market like Illinois across multiple product categories is noteworthy, but there is room for strategic growth and improvement.

Competitive Landscape

In the competitive landscape of the Illinois flower category, IC Collective has experienced fluctuating rankings, moving from 26th in November 2025 to 23rd by February 2026. Despite this modest improvement, IC Collective faces stiff competition from brands like Revolution Cannabis, which maintained a higher rank until a significant drop to 25th in February 2026, and Tales & Travels, which consistently hovered around the 20th rank. Notably, Graffiti by NGW surged from 50th to 22nd, indicating a strong upward trend that could pose a future threat. Meanwhile, Sol Canna showed a decline from 12th to 21st, yet still outperformed IC Collective in terms of sales. These dynamics suggest that while IC Collective is making strides, it must strategize to outpace competitors who are either maintaining higher sales or showing rapid improvements in rank.

Notable Products

In February 2026, the top-performing product for IC Collective was T.I.T.S.(3.5g) in the Flower category, climbing to the number one position with sales of 1378 units, maintaining a consistent top-two ranking since November 2025. The One Way Pre-Roll (1g) emerged as a strong contender, debuting at the second spot with significant sales. Headband (3.5g) ranked third, marking its first appearance in the top ranks. One Way (3.5g) saw a decline, dropping from third position in January to fourth in February, despite its consistent presence in the top five. Lemon Diablo Pre-Roll (1g) maintained its fifth position from January, indicating stable performance in its category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.