Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

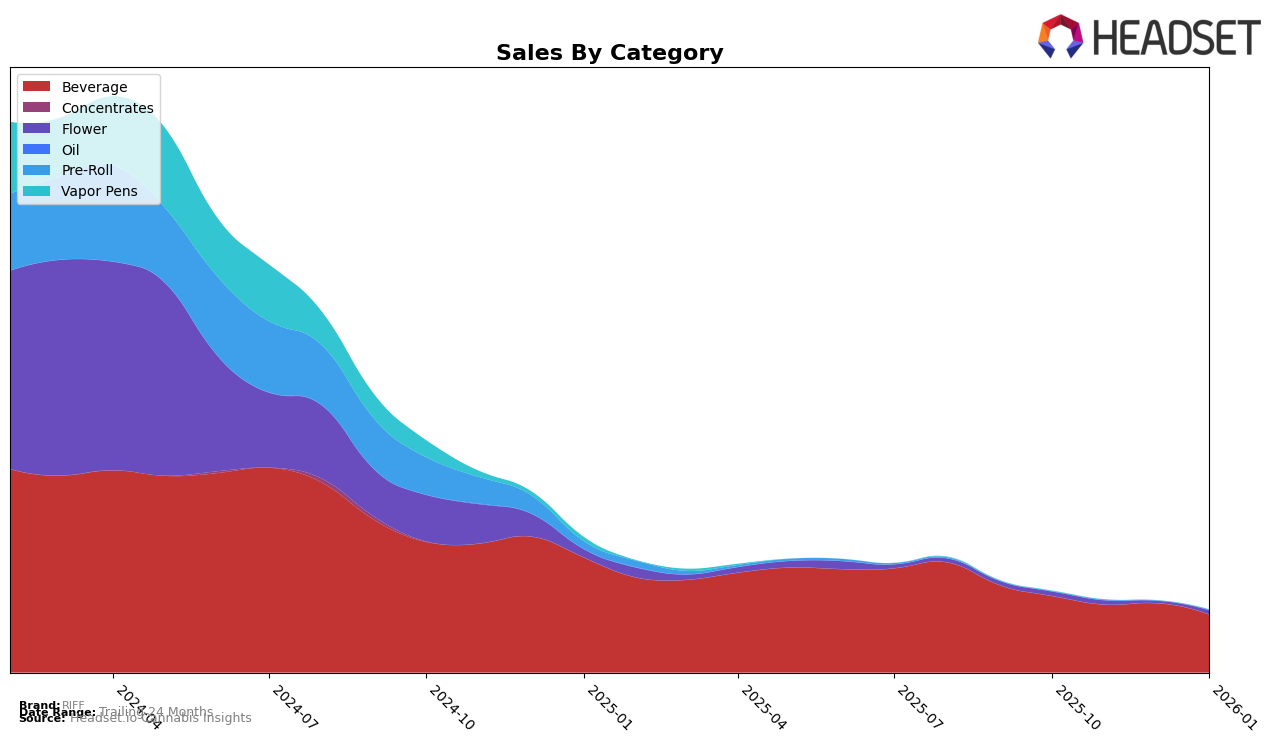

RIFF's performance in the beverage category within the Canadian provinces of Alberta and Ontario shows a steady presence, albeit with some fluctuations. In Alberta, RIFF maintained a consistent ranking within the top 15, peaking at 12th in October 2025 but experiencing slight declines to 15th and 14th in the subsequent months, indicating a need for strategies to regain its earlier momentum. The sales figures reflect this trend, with a notable drop from October to November, followed by a minor rebound in December before falling again in January 2026. This suggests that while RIFF has a foothold in the market, there is room for improvement in maintaining consumer interest and sales consistency.

In Ontario, RIFF's beverage category ranking remained stable at 16th through the last quarter of 2025, before slipping to 17th in January 2026. This consistent ranking within the top 20 indicates a solid presence, yet the slight decline in January could be a signal for the brand to reassess its market strategies to prevent further slippage. The sales trend mirrors this stability, with a significant decrease in November followed by a recovery in December, only to decline again in January. This pattern suggests that while RIFF has been able to capture a consistent consumer base, there is potential to enhance its market position through targeted campaigns or product innovations to boost sales and improve rankings further.

Competitive Landscape

In the competitive landscape of the Ontario cannabis beverage market, RIFF has maintained a relatively stable position, ranking 16th from October to December 2025 before slipping to 17th in January 2026. This slight decline in rank coincides with a decrease in sales from 38,716 in October to 31,772 in January. Meanwhile, Señorita consistently outperformed RIFF, holding the 15th position until January 2026, when it dropped to 16th, yet still maintaining higher sales figures. Sense & Purpose Beverages showed a notable upward trend, moving from 19th to 15th place by January, with sales increasing significantly, potentially posing a threat to RIFF's market share. Palmetto and Dulces remained outside the top 20 for most months, indicating less immediate competition. These dynamics suggest that while RIFF has maintained a steady presence, it faces increasing competition from brands like Señorita and Sense & Purpose Beverages, necessitating strategic adjustments to bolster its market position.

Notable Products

In January 2026, RIFF's top-performing product was the Wild Raspberry Lemonade (10mg THC, 355ml), maintaining its first-place ranking for four consecutive months with sales of 4752 units. The Blue Raspberry Ice Lemonade (10mg THC, 355ml) consistently held the second position, although its sales have decreased since October 2025. The Boost- THC/CBG 1:1 Tropical Burst Carbonated Drink (10mg THC, 10mg CBG 355ml) stayed steady at third place, showing a slight decline in sales. Pink Certz (7g) improved its ranking from fifth to fourth place, indicating a resurgence in popularity. Meanwhile, the Boost- THC/CBG 1:1 Vanilla Frost Carbonated Drink slipped from fourth to fifth place, reflecting a downturn in consumer demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.