Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

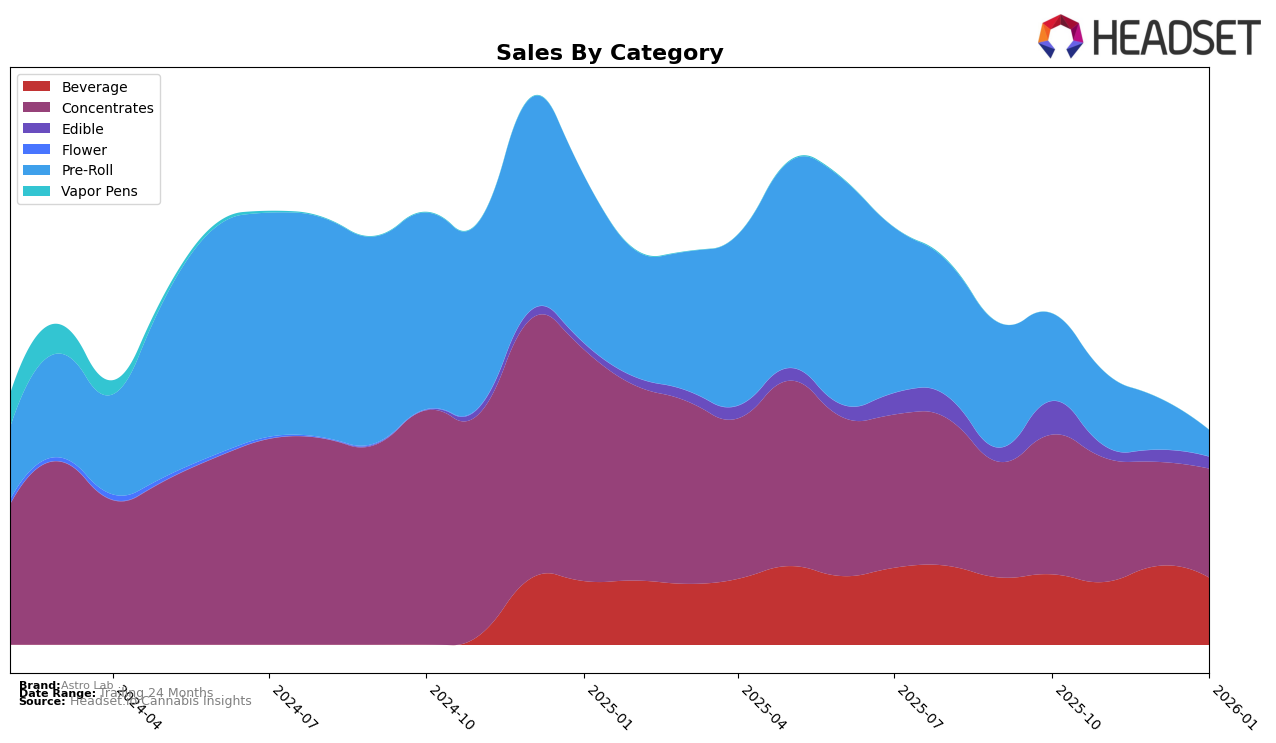

Astro Lab's performance across categories in Alberta shows a stable presence in the Beverage category, maintaining a consistent 9th rank from October 2025 through January 2026. However, the Pre-Roll category presents a downward trajectory from a rank of 54 in October to 92 by January, indicating a potential area of concern. In the Concentrates category, Astro Lab experienced a notable recovery, moving from 20th in December to 8th in January, despite a dip in November. This rebound suggests a positive reception to their products within the category. Conversely, the Edible category saw Astro Lab falling out of the top 30 in December, only to reappear at 22nd in January, highlighting a fluctuating performance that may need strategic adjustments.

In British Columbia, Astro Lab faced challenges in the Concentrates category, dropping from 8th in October to 36th in December, before slightly recovering to 31st in January. This indicates a volatile market presence that may require attention. The Edible category also saw Astro Lab drop out of the top 30 in November and January, suggesting inconsistent demand or competitive pressures. Meanwhile, in Ontario, Astro Lab maintained a steady ranking in the Beverage category, moving slightly from 13th to 12th by January, with sales reflecting a stable consumer base. However, the Concentrates category showed a decline from 23rd to 31st over the same period, indicating potential challenges in maintaining market share. These patterns across provinces suggest areas where Astro Lab could focus efforts to stabilize and enhance its market position.

Competitive Landscape

In the competitive landscape of the concentrates category in Alberta, Astro Lab has experienced notable fluctuations in its market position over the past few months. While Astro Lab began in October 2025 ranked 9th, it saw a decline to 12th in November and further down to 20th in December, before rebounding to 8th in January 2026. This volatility contrasts with competitors like Nugz (Canada), which maintained a steady 6th place from November to January, and The Goo!, which consistently ranked within the top 10. Meanwhile, Stigma Grow showed a positive upward trend, improving from 15th in October to 7th by January. Astro Lab's sales mirrored its ranking changes, with a dip in December followed by a recovery in January, suggesting potential challenges in maintaining consistent market traction amidst strong competition. For a deeper dive into these dynamics and to uncover potential strategic opportunities, accessing more advanced data could provide valuable insights.

Notable Products

In January 2026, Astro Lab's top-performing product was the Interstellar Live Rosin Cream Soda (10mg THC, 355ml) in the Beverage category, maintaining its number one rank with sales reaching 8,175 units. Following closely in the second position was the Interstellar Rocket Lime Live Rosin Soda (10mg THC, 355ml), which held steady from the previous month. The Galactic Sour Live Rosin Gummy (10mg) consistently remained in third place across the observed months. Gummy Old School Hash (2g) also retained its fourth position, although its sales figures have been declining. A notable new entry in January was the PBB Cold Cured Live Rosin (1g), debuting at rank five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.