Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

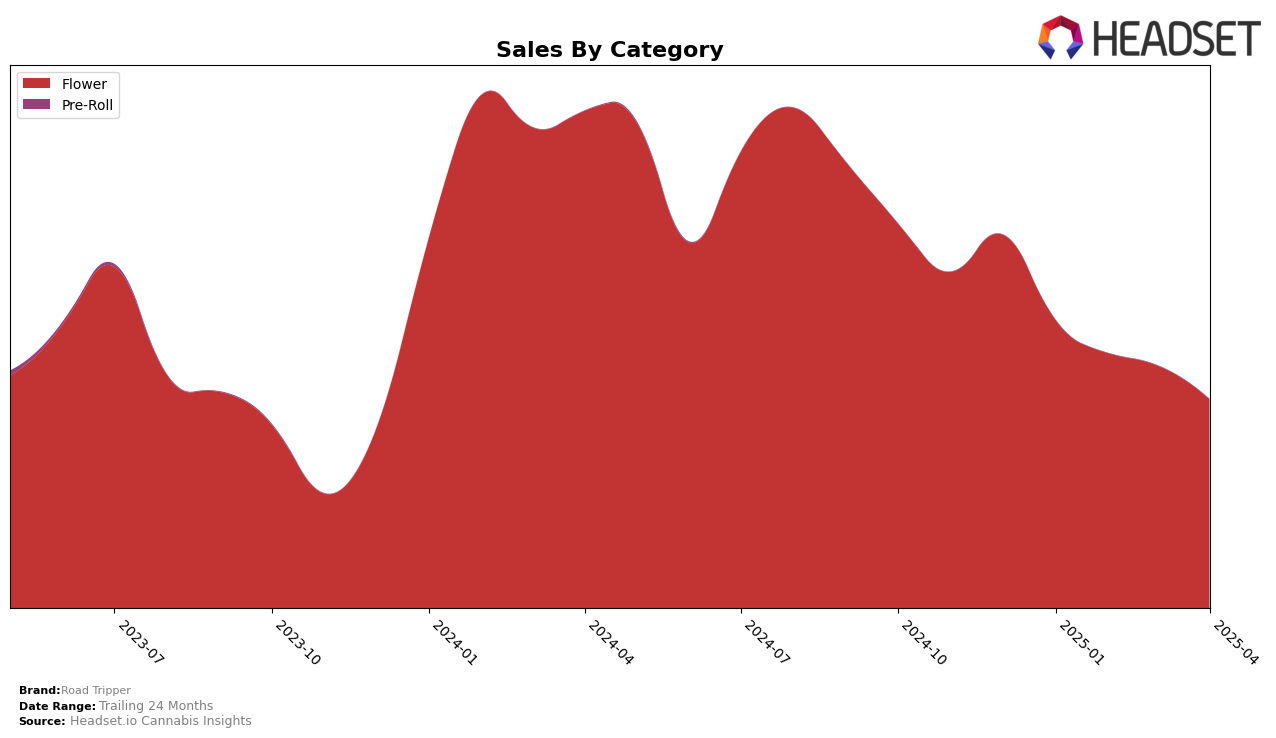

Road Tripper's performance in the Massachusetts cannabis market shows a gradual decline in its flower category rankings from January to April 2025. Starting at the 5th position in January, the brand slipped to 8th by April, indicating a need to address competitive pressures or shifts in consumer preferences. Despite the drop in rankings, the brand maintained a substantial presence in the top 10, suggesting a solid foundation in this state. Sales figures also reflect this downward trend, with a notable decrease from approximately $1.4 million in January to around $1.1 million by April. This decline in sales, coupled with the ranking drop, could imply challenges in maintaining market share or evolving consumer demands that Road Tripper might need to address.

In contrast, the New Jersey market presents a more challenging scenario for Road Tripper. The brand did not make it into the top 30 rankings for the flower category by April 2025, highlighting a significant struggle to capture market attention in this state. Starting outside the top 40 in January and experiencing further declines in subsequent months, it suggests that Road Tripper faces stiff competition or market entry barriers in New Jersey. The sales figures corroborate this, with a sharp decline from over $100,000 in January to less than half that amount by March. The absence from the top 30 by April is a clear indicator of the uphill battle the brand faces in establishing a foothold in New Jersey's competitive cannabis market.

Competitive Landscape

In the Massachusetts flower category, Road Tripper has experienced a notable decline in its competitive positioning from January to April 2025. Starting at rank 5 in January, Road Tripper slipped to rank 8 by April, indicating a downward trend in its market presence. This decline is contrasted by the ascent of Cresco Labs, which improved its rank from 32 in January to 10 in April, showcasing a significant upward trajectory. Additionally, Kynd Cannabis Company also showed positive momentum, moving from rank 10 to 6 during the same period. Meanwhile, Good Chemistry Nurseries maintained a relatively stable position, fluctuating slightly between ranks 5 and 7. Despite Road Tripper's initial strong position, the competitive landscape suggests increasing pressure from rising brands like Cresco Labs and Kynd Cannabis Company, which could be impacting Road Tripper's sales and market share.

Notable Products

In April 2025, Purple Haze (3.5g) emerged as the top-performing product for Road Tripper, maintaining its number one rank from February, with sales reaching 7171. Lemon Cherry Gelato #1 (3.5g) followed closely in second place, having dropped from its top position in March, with sales figures of 5295. Afgoo (3.5g) climbed to the third spot, showing a strong performance compared to previous months where it was not ranked consistently. Velvet Pie (3.5g) held steady at fourth place, although its sales decreased from March. Banana OG (3.5g) made its debut in the rankings at fifth place, indicating a new entry among the top sellers for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.