Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

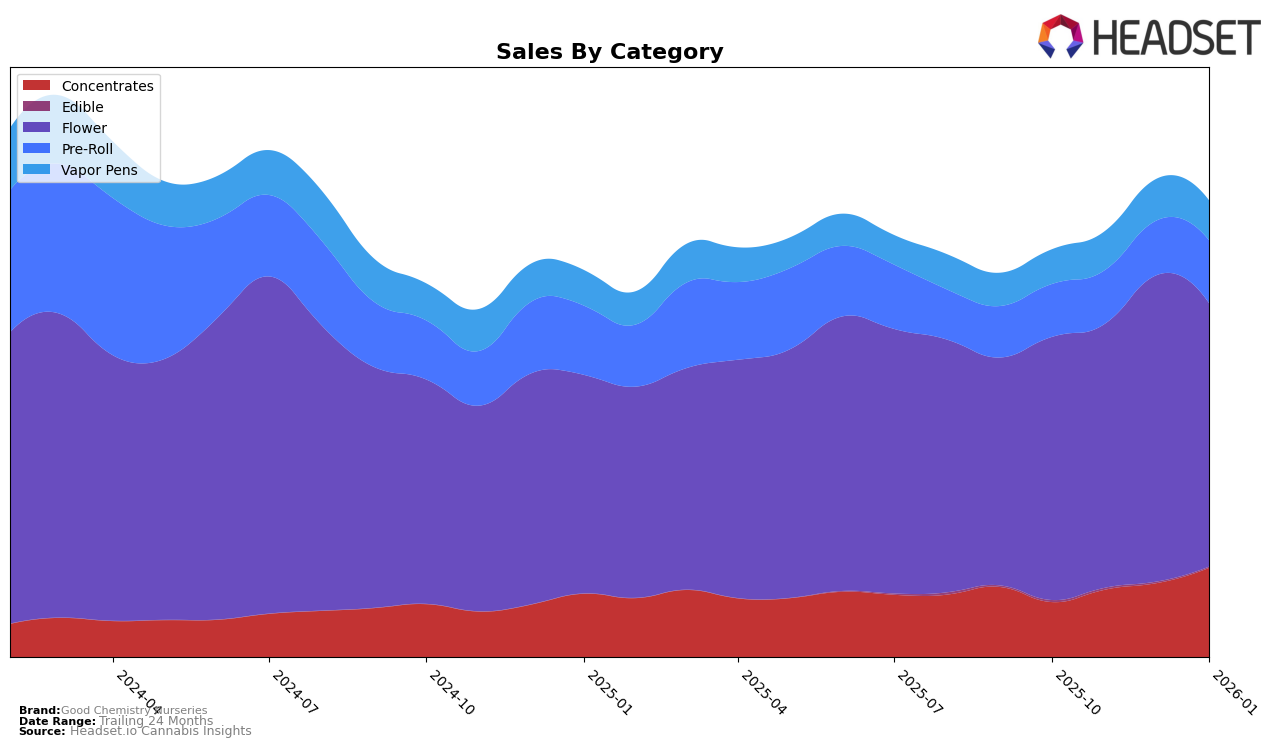

Good Chemistry Nurseries has demonstrated a strong performance in the Colorado market, particularly in the Flower category where it consistently held the second position from October 2025 through January 2026. This stability indicates a robust presence and consumer loyalty in the Flower segment. In the Concentrates category, the brand showed a noteworthy upward trend, moving from 19th place in October 2025 to 11th by January 2026, suggesting a growing preference for their products in this category. However, their performance in Vapor Pens was less impressive, as they did not break into the top 30, highlighting a potential area for improvement or strategic focus to enhance their market presence.

In Massachusetts, Good Chemistry Nurseries excelled in the Concentrates category, maintaining the top spot from November 2025 onwards, which underscores their dominance and the high demand for their concentrate products in this state. The brand also made a significant leap in the Pre-Roll category, climbing from 22nd place in November 2025 to 10th by January 2026. This upward movement reflects an increasing consumer interest in their pre-roll offerings. Conversely, in the Flower category, they hovered around the 18th position, indicating a stable yet less dominant position compared to their success in Concentrates. The Vapor Pens category saw some fluctuation, with rankings ranging from 23rd to 32nd, suggesting variability in consumer preferences or market competition in this segment.

Competitive Landscape

In the competitive landscape of the Colorado flower market, Good Chemistry Nurseries consistently held the second rank from October 2025 to January 2026, indicating a stable position amidst fluctuating sales figures. Despite a notable sales peak in December 2025, Good Chemistry Nurseries remained unable to surpass Seed & Strain Cannabis Co., which maintained the top rank throughout the period. Meanwhile, Green Dot Labs and Triple Seven (777) alternated between the third and fourth positions, with Green Dot Labs showing a slight edge in sales over Triple Seven. This competitive environment underscores the challenge for Good Chemistry Nurseries to increase its market share and potentially overtake the leading brand, Seed & Strain Cannabis Co., which not only sustained its rank but also demonstrated a significant sales surge in January 2026.

Notable Products

In January 2026, Grape Glacier Pre-Roll (1g) emerged as the top-performing product for Good Chemistry Nurseries, leading the sales with a notable figure of 7,824. Sour Chillz (3.5g) followed closely in second place, showing an impressive rise from its fourth place in November 2025 and third in December 2025. The Ménage (3.5g) secured the third position, making its debut in the rankings. The Menage Live Rosin (1g) and Moose & Lobsta (3.5g) rounded out the top five, occupying fourth and fifth places respectively. This shift indicates a strong preference for both pre-rolls and flower categories among consumers in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.