Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

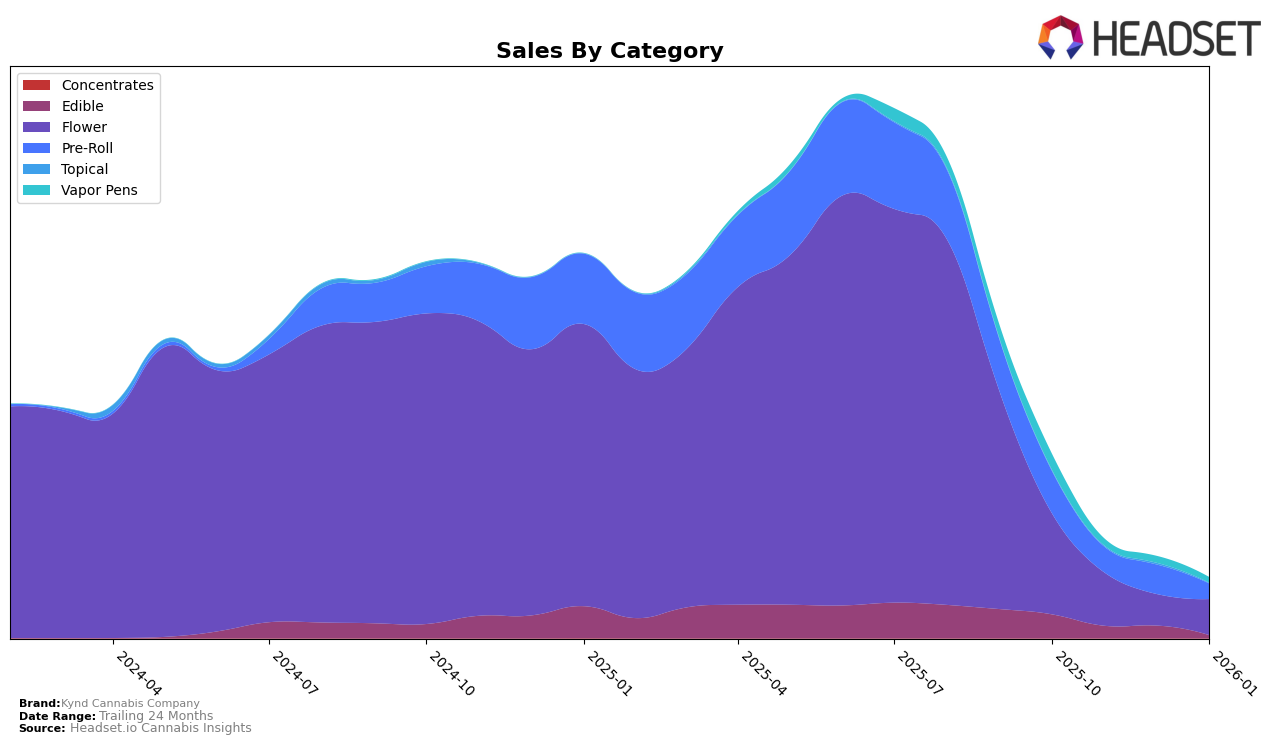

Kynd Cannabis Company has shown varied performance across different states and categories over recent months. In Massachusetts, the brand's ranking in the Edible category has declined significantly, dropping from 26th place in October 2025 to being out of the top 30 by January 2026. This decline is mirrored in their Flower category performance, where they fell from 41st to out of the top 60. However, their Pre-Roll category maintained a steady presence, albeit with a downward trend, ranking 64th in October and slipping to 98th by January. Such movements suggest a challenging market environment in Massachusetts, particularly in the Edible and Flower categories.

Meanwhile, in New Jersey, Kynd Cannabis Company has experienced mixed results. Notably, their Flower category saw a rebound, improving from 70th in November to 50th by January. Despite this positive movement, the Edible and Vapor Pens categories have not shown consistent improvement, with both categories failing to break into the top 30 by January. In Ohio, the Pre-Roll category has been a strong performer, consistently maintaining a top 25 position, although it did experience a slight dip from 21st to 24th. Overall, the brand's performance across these states highlights areas of opportunity and challenge, with some categories showing resilience while others struggle to maintain competitive market positions.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, Kynd Cannabis Company has experienced notable fluctuations in its ranking over the past few months. Starting from October 2025, Kynd Cannabis Company was ranked 47th, but saw a decline to 70th in November, before slightly recovering to 62nd in December, and then improving to 50th by January 2026. This indicates a volatile performance, potentially affecting consumer perception and sales momentum. In contrast, Heavyweight Heads showed a more stable and slightly improving trend, moving from 68th to 47th over the same period, which suggests a stronger market presence. Meanwhile, Hillview Farms maintained a relatively consistent performance, ranking around the mid-50s to high-40s, which could indicate a solid customer base and consistent sales. The fluctuating rankings of Kynd Cannabis Company compared to its competitors highlight the need for strategic marketing efforts to stabilize and improve its market position in New Jersey's Flower category.

Notable Products

In January 2026, the top-performing product for Kynd Cannabis Company was the Peanut Butter Pie Pre-Roll (1g), which ascended to the number one rank, selling 1,276 units. The Purple Mountain Majesty Pre-Roll (1g) followed closely, moving up to the second position from third place in December 2025. The Red Velvet Cheesecake Pre-Roll (1g) ranked third, although it experienced a decrease in sales compared to the previous month. Notably, the Boom Stix - Hybrid Blend Infused Pre-Roll (1g) and White Rtz Pre-Roll (1g) entered the top five for the first time, securing fourth and fifth positions, respectively. This shift in rankings highlights a dynamic change in consumer preferences within the Pre-Roll category for Kynd Cannabis Company.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.