Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

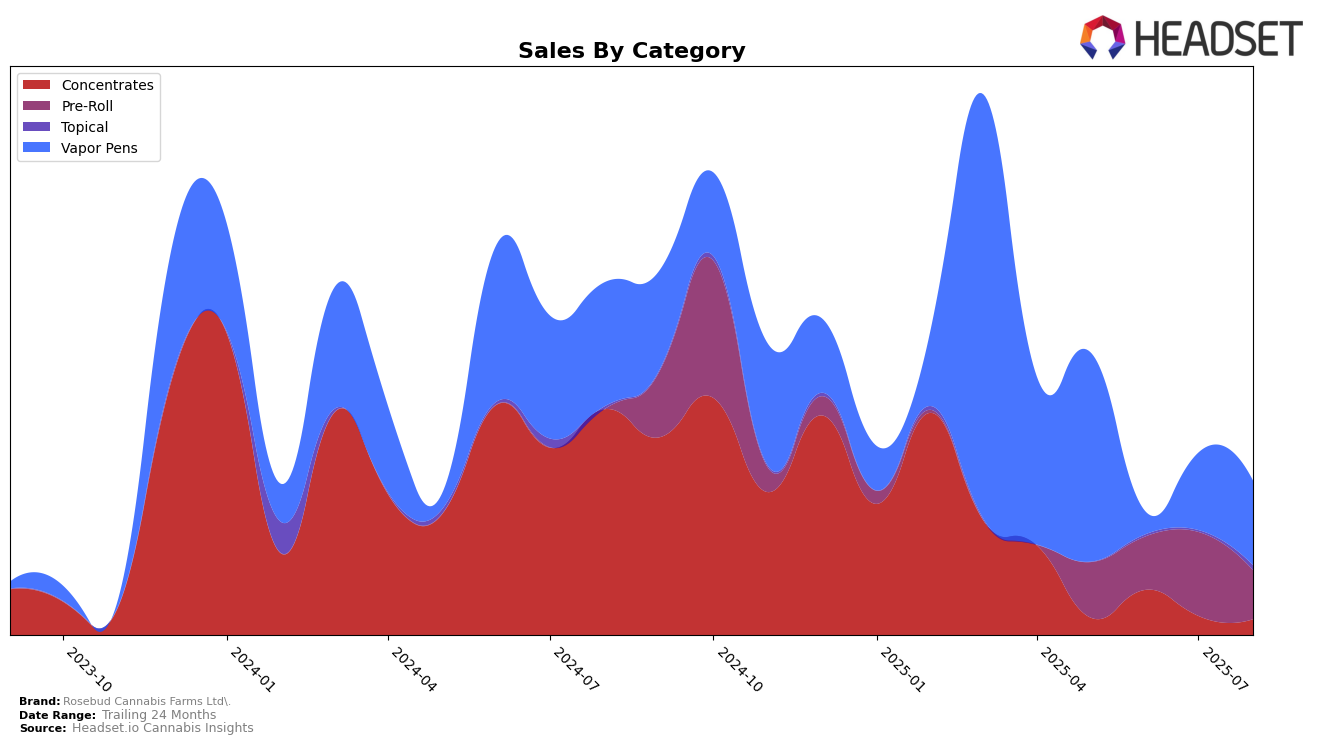

Rosebud Cannabis Farms Ltd. has shown varying performance across different categories and regions, with notable trends in the vapor pens category in British Columbia. In May 2025, the brand was ranked 47th in this category, showcasing a decent presence. However, by June 2025, it was not in the top 30 brands, indicating a potential decline or increased competition. The brand's rank further slipped to 55th in July and 56th in August, suggesting a consistent downward trend in this particular category. This movement highlights the challenges Rosebud Cannabis Farms Ltd. faces in maintaining its competitive edge in the vapor pens sector within this province.

Despite these challenges in British Columbia, Rosebud Cannabis Farms Ltd. continues to generate sales, albeit with some fluctuations. From May to August 2025, there was a noticeable decline in sales figures, with May starting at 28,083 and August closing at 11,234, which might reflect the impact of its declining rankings. This trend could be indicative of shifting consumer preferences or increased market competition, factors that the brand might need to address to regain its standing. Observing these dynamics can provide insights into the strategic adjustments Rosebud Cannabis Farms Ltd. might consider to improve its market position in the future.

Competitive Landscape

In the competitive landscape of vapor pens in British Columbia, Rosebud Cannabis Farms Ltd. has experienced notable fluctuations in its market position from May to August 2025. Starting in May at rank 47, Rosebud Cannabis Farms Ltd. saw a decline to rank 55 by July, and further to 56 in August. This downward trend in rank coincides with a decrease in sales, indicating potential challenges in maintaining market share. In contrast, Back Forty / Back 40 Cannabis consistently outperformed Rosebud, maintaining a strong presence with ranks of 10 and 12 in May and July, respectively, highlighting its dominance in the market. Meanwhile, brands like Greybeard and Purefarma also showed varying ranks, with Greybeard slipping from 45 to 54 and Purefarma reappearing at rank 57 in August. These dynamics suggest that Rosebud Cannabis Farms Ltd. faces stiff competition from established brands, necessitating strategic adjustments to regain its competitive edge in the vapor pen category.

Notable Products

In August 2025, the top-performing product for Rosebud Cannabis Farms Ltd. was the BC Garlic Guava Papaya Hash Infused Pre-Roll 2-Pack (2g) in the Pre-Roll category. This product achieved the number one rank, maintaining its top position from July, with a notable sales figure of 216 units. The BC Guava Gas Live Rosin Cartridge (1g) in the Vapor Pens category closely followed, holding steady at the second rank, consistent with its performance in July. The BC Guava Gas Live Rosin Infused Pre-Roll 3-Pack (1.5g) remained in third place, showing a consistent trend from the previous month. Rounding out the top five, the Lavender & Lemongrass Scented Salve (150mg THC, 37.5g) in the Topical category re-entered the rankings at fifth place, showing a positive shift from its absence in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.