Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

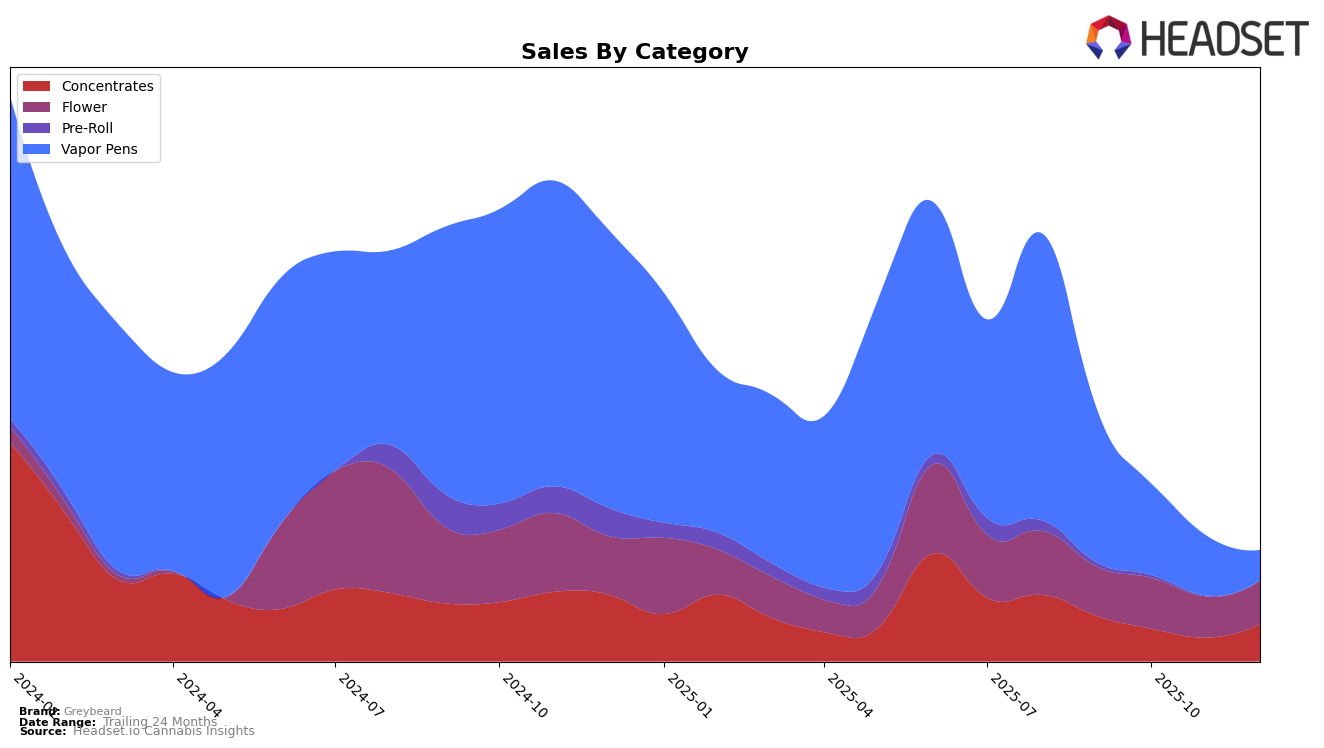

Greybeard has shown varied performance across different categories and regions, with notable movements in its rankings over recent months. In Alberta, the brand experienced a resurgence in the concentrates category, moving from outside the top 30 in November to rank 28th in December. This indicates a positive trend and potential growth in consumer interest. Conversely, in the vapor pens category, Greybeard's ranking has been on a decline, dropping from 44th in September to 75th by December, which could be a cause for concern regarding their market share in this segment. Meanwhile, in Saskatchewan, Greybeard's position in the concentrates category appears strong, maintaining an 11th place ranking in September, suggesting a solid foothold in this market.

In other regions, Greybeard's performance has been more mixed. For instance, in Ontario, the brand's presence in the vapor pens category seems to be weakening, with rankings slipping from 72nd in September to 91st in October. This decline might suggest increased competition or a shift in consumer preferences. On the other hand, in Saskatchewan, Greybeard's flower category rankings have shown a gradual decline from 44th in September to 51st by December, indicating a potential challenge in maintaining its position. Interestingly, in British Columbia, Greybeard's presence in the vapor pens category was notable in September with a 64th place ranking, but it seems to have fallen out of the top 30 in subsequent months, highlighting potential areas for strategic improvement.

Competitive Landscape

In the Alberta concentrates market, Greybeard experienced a notable fluctuation in its rankings and sales over the last few months of 2025. After being absent from the top 20 in November, Greybeard made a significant comeback in December, climbing to the 28th position. This resurgence is particularly impressive considering the competitive landscape, where brands like Pura Vida and Tremblant Cannabis saw a decline in their rankings, with Pura Vida dropping from 21st in September to 30th in December, and Tremblant Cannabis maintaining a relatively stable position around the 27th to 29th range. Additionally, La Boca showed a strong upward trend, moving from 41st in September to 26th in December, indicating a competitive push in the market. Greybeard's December sales of 24,739 CAD, although lower than some competitors, reflect a positive growth trajectory after a dip in October, suggesting a potential for further gains if the upward momentum continues.

Notable Products

In December 2025, Critical Diesel (3.5g) maintained its position as the top-performing product for Greybeard, despite a slight decline in sales to 1128 units. Country Lemon Live Resin Terp Slush (1g) climbed to the second spot with a notable sales figure of 507 units, showing a positive trend from its previous third-place ranking in November. Afghani Sunrise Pure Live Resin Cartridge (1g) slipped from second to third place as its sales continued to decrease over the months. Pink Sunset Live Resin Cartridge (1g) remained steady at fourth place, while Nuken Cured Resin Budder (1g) entered the rankings at fifth, indicating a new entry in the concentrates category. These shifts highlight a dynamic change in consumer preference towards concentrates and new product entries.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.