Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

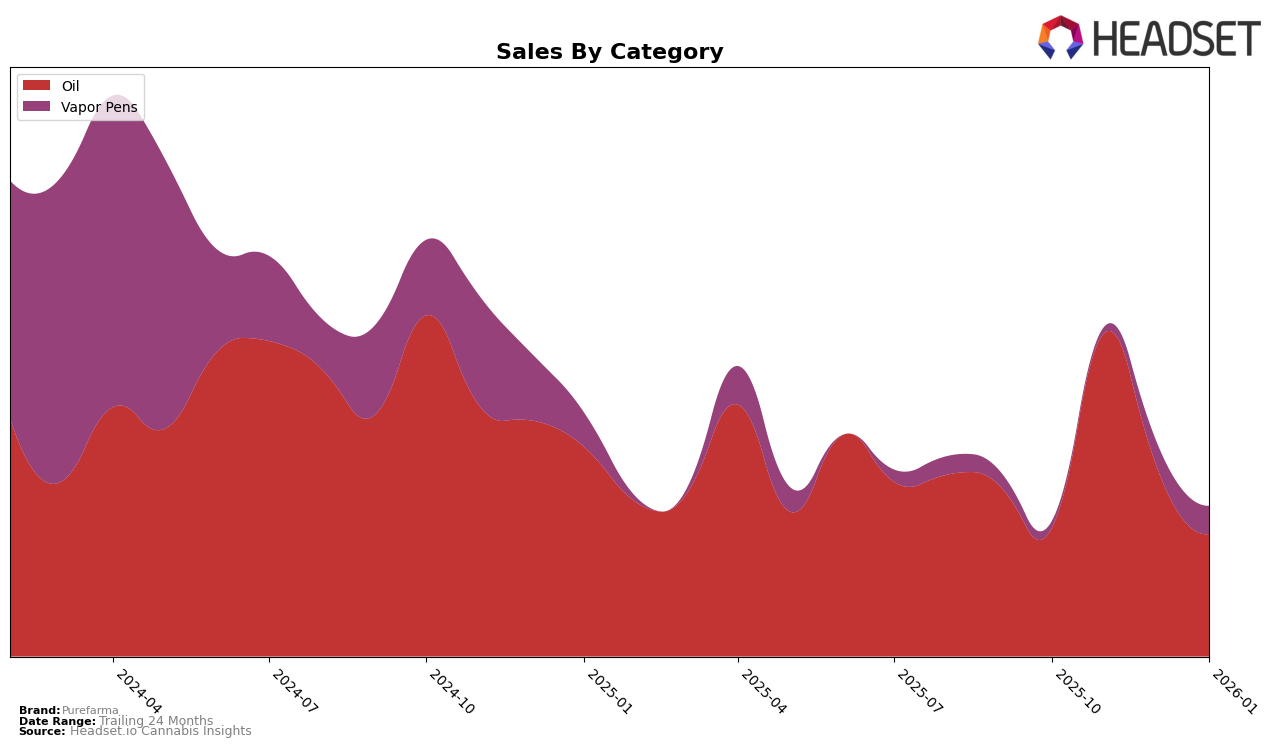

Purefarma has shown a consistent presence in the oil category within British Columbia. Over the months from October 2025 to January 2026, the brand maintained a stable ranking, oscillating slightly between the 6th and 7th positions. This stability indicates a strong foothold in the market, although a slight dip in sales from November to January suggests potential challenges or seasonal fluctuations. The significant jump in sales in November highlights a peak period, which could be attributed to strategic marketing efforts or increased consumer demand during that time.

Interestingly, Purefarma's absence from the top 30 rankings in other states or provinces suggests a concentrated market strategy or limited distribution beyond British Columbia. This could be seen as a missed opportunity for expansion, especially if the brand aims for broader recognition and market share. The consistent ranking within British Columbia, however, underscores a loyal customer base and successful brand positioning in the oil category, which could serve as a foundation for future growth in other regions.

Competitive Landscape

In the competitive landscape of the oil category in British Columbia, Purefarma has shown a consistent presence in the rankings, maintaining a position between 6th and 7th place from October 2025 to January 2026. This stability is noteworthy, especially considering the fluctuations seen in other brands. For instance, Frank experienced a significant rise from 7th to 4th place in December 2025, indicating a potential shift in consumer preference or marketing effectiveness. Meanwhile, MediPharm Labs held a strong position in the top 5, though it saw a slight decline to 6th place by January 2026. Emprise Canada and DayDay were not in the top 20 in October 2025, but Emprise Canada entered the rankings in November, suggesting a late-year push or product launch. Despite these shifts, Purefarma's consistent ranking suggests a loyal customer base, though the brand may need to innovate or increase marketing efforts to climb higher in the rankings and boost sales, which have shown a downward trend from November 2025 to January 2026.

Notable Products

In January 2026, Purefarma's top-performing product was CBD Hemplixir 30 Oil (30ml), maintaining its position as the number one ranked product for four consecutive months despite a sales dip to 803 units. The CBD Earth Full Spectrum Cartridge (1g) consistently held the second rank, with sales increasing to 325 units in January. Hemplixir 100 CBD Oil (30ml) showed notable improvement, climbing from fourth in December to third in January. Meanwhile, CBD Earth Full Spectrum Disposable (1g) dropped to fourth place, marking a decline from its previous third position. Overall, Purefarma's product rankings remained relatively stable with minor shifts, indicating strong consumer preference consistency.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.