Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

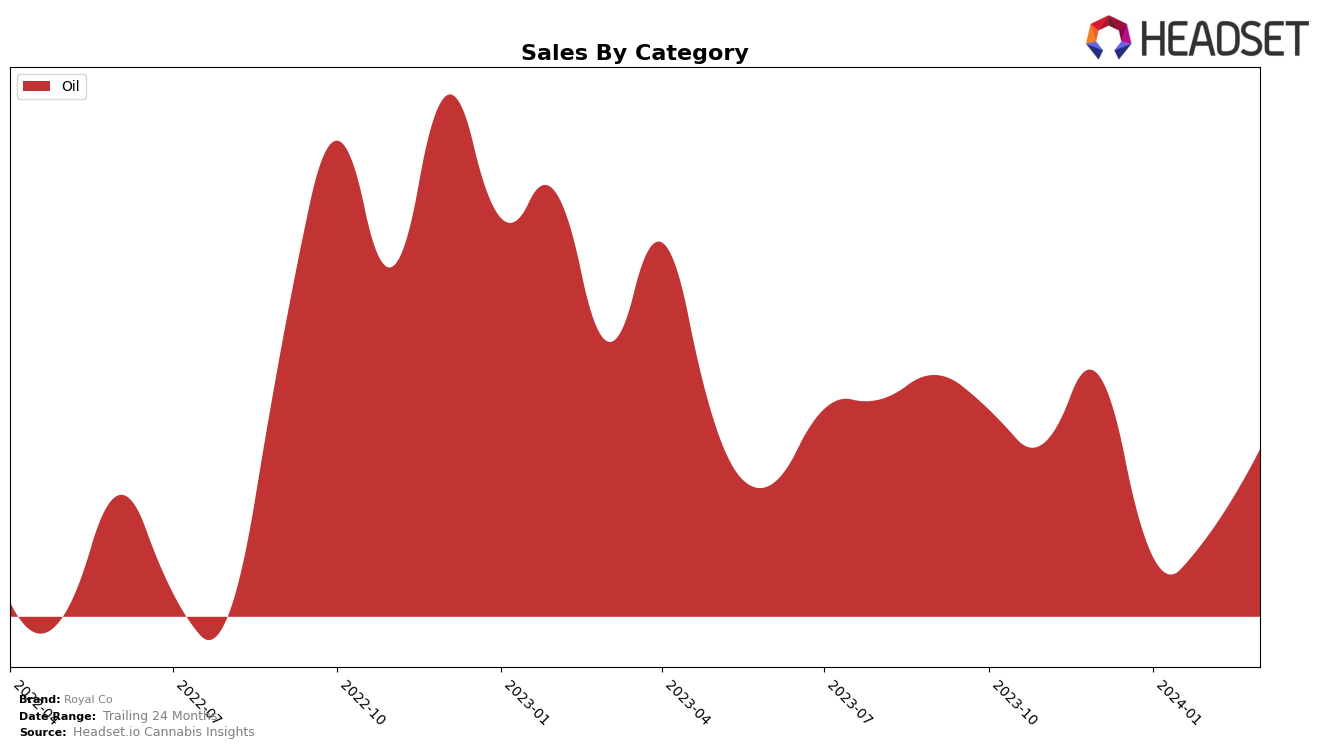

In the realm of cannabis oil, Royal Co has demonstrated a consistent performance within British Columbia, maintaining its position at 15th across the board from December 2023 to March 2024. This stability is noteworthy, especially when considering the fluctuating sales figures, which saw a dip in January 2024 to 2869.0, before rebounding significantly in March to 4847.0. Such resilience in sales and ranking amidst the competitive landscape of British Columbia's cannabis market underscores Royal Co's solid foothold. However, the absence of a month-over-month ranking improvement suggests a plateau in the brand's market penetration or possibly an equilibrium with its current consumer base.

Contrastingly, Royal Co's journey in the Saskatchewan market tells a different story. Here, the brand experienced a slight decline, slipping from the 19th position in December 2023 to the 21st in January 2024, after which it disappeared from the top 30 rankings altogether. The initial sales drop from 1265.0 in December to 530.0 in January, followed by a lack of sales data for February and March, may indicate a significant challenge in maintaining its market presence. This disappearance from the rankings could suggest several underlying issues such as distribution challenges, competitive pressures, or changing consumer preferences within Saskatchewan. The stark difference in performance between these two provinces highlights the geographical nuances of the cannabis market and the need for tailored strategies to navigate them effectively.

Competitive Landscape

In the competitive landscape of the oil category in British Columbia, Royal Co has maintained a consistent position at rank 15 from December 2023 through March 2024, showcasing stability in a fluctuating market. Despite this steadiness, Royal Co's sales have seen a rollercoaster, dipping in January before recovering in the following months, yet they remain significantly lower than some of their main competitors. Notably, Feather has consistently outperformed Royal Co, holding a higher rank (13-14) and achieving much higher sales throughout the period. Similarly, EarthWolf Farms has shown remarkable performance, especially in January and February, with sales that far exceed those of Royal Co, despite a slight rank fluctuation (12-13). On the other hand, XMG and Tweed, while also competitors, have not posed as significant a threat in terms of sales, with XMG experiencing a notable decline by March 2024. This analysis highlights the competitive pressure Royal Co faces, particularly from Feather and EarthWolf Farms, underscoring the need for strategic initiatives to enhance market position and sales performance in the face of stiff competition.

Notable Products

In Mar-2024, Royal Co's top-performing product was CBD Oil (30ml) from the Oil category, maintaining its number one position throughout the previous months with a notable sales figure of 319 units. There were no other products listed for comparison, indicating CBD Oil (30ml)'s consistent dominance in the lineup. This product's sales trajectory shows an increase in March from the previous month, suggesting a growing consumer interest or effective promotional strategies during this period. Without data on other products, it's clear that CBD Oil (30ml) stands out as Royal Co's flagship offering. The lack of competition within the dataset highlights the need for a broader product analysis to fully understand market dynamics.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.