Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

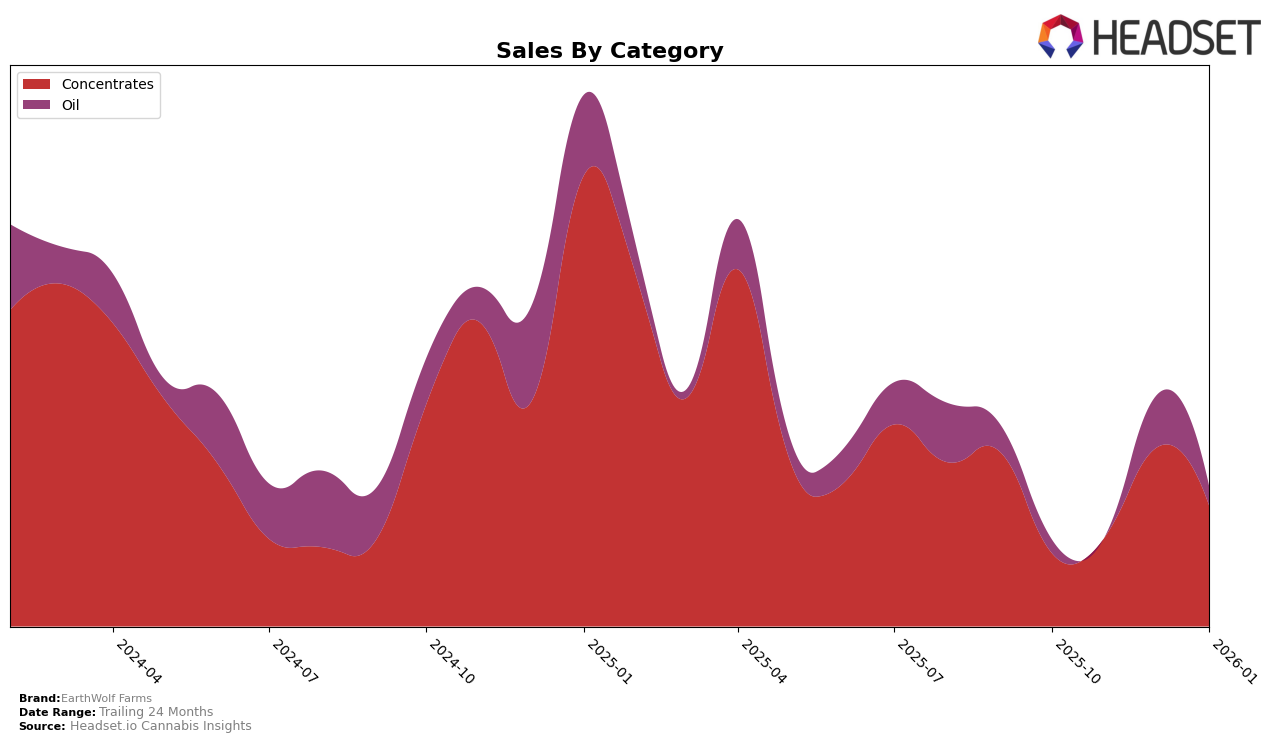

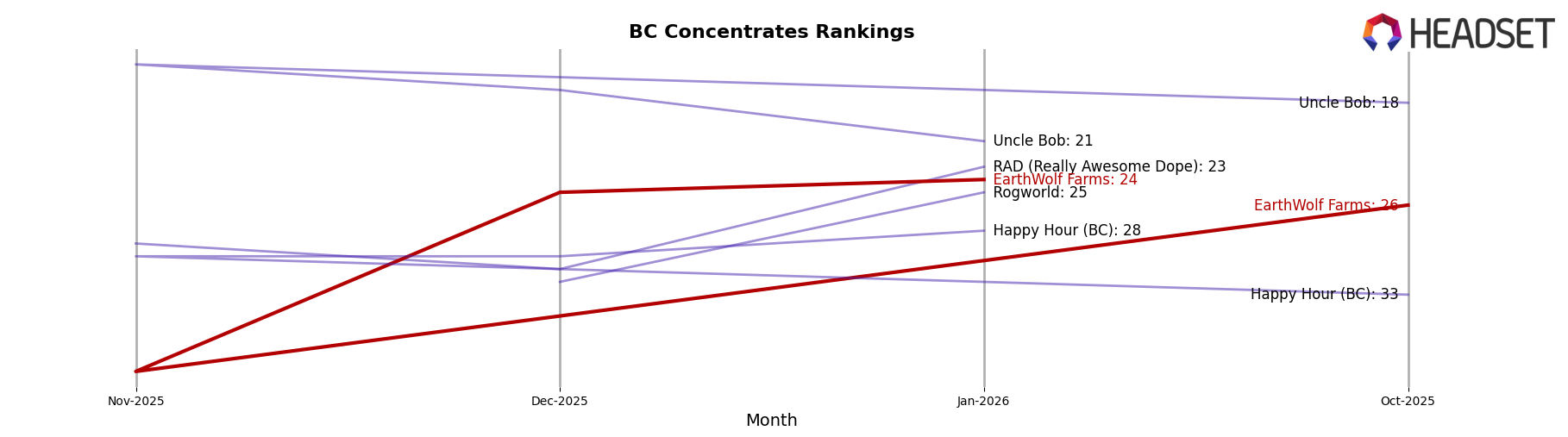

EarthWolf Farms has shown a dynamic performance in the Concentrates category within British Columbia. Notably, the brand experienced a significant leap from the 39th position in November 2025 to the 25th in December 2025, indicating a strong upward trend in consumer interest and market penetration. By January 2026, EarthWolf Farms continued its positive trajectory, securing the 24th spot, which suggests sustained growth and a strengthening presence in the market. This performance is particularly impressive given the competitive nature of the concentrates category, highlighting EarthWolf Farms' ability to capture and maintain consumer attention.

Despite the encouraging progress in British Columbia, it is worth noting that EarthWolf Farms did not appear in the top 30 rankings in other states or provinces for the concentrates category during the same period. This absence suggests potential challenges or opportunities for growth in regions outside of British Columbia. The brand's ability to maintain and improve its ranking in British Columbia could serve as a blueprint for expansion strategies in other markets, where it currently lacks a significant presence. As EarthWolf Farms continues to refine its market approach, monitoring its performance across different regions will be crucial for understanding its broader market impact and potential for future growth.

```Competitive Landscape

In the competitive landscape of the British Columbia concentrates market, EarthWolf Farms has experienced notable fluctuations in its rank and sales over recent months. Starting in October 2025, EarthWolf Farms held the 26th position, but saw a dip to 39th in November, before rebounding to 25th in December and slightly improving to 24th by January 2026. This volatility highlights the competitive pressure from brands like Uncle Bob, which consistently outperformed EarthWolf Farms, maintaining a stronger presence with ranks ranging from 15th to 21st. Meanwhile, RAD (Really Awesome Dope) and Happy Hour (BC) showed varied performance, with RAD not even making the top 20 in October and January, and Happy Hour consistently trailing behind EarthWolf Farms. The entry of Rogworld into the rankings in December and January further intensified the competition. Despite these challenges, EarthWolf Farms' sales saw a significant increase in December, suggesting potential for growth if they can stabilize their market position.

Notable Products

In January 2026, Afghan Hash (2g) led the sales for EarthWolf Farms, reclaiming the top position in the Concentrates category with sales of 142 units. Zen Oil (30ml) followed closely, maintaining a strong presence with a second-place finish, despite a drop from its December peak. White Gold Live Rosin (1g) secured the third spot, showing a slight decline from its previous top rank in November. Pineapple Garlic Live Rosin (1g) entered the top five for the first time, landing in fourth place. Venom OG Live Rosin (1g) rounded out the top five, experiencing a consistent decline from its second-place position in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.