Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

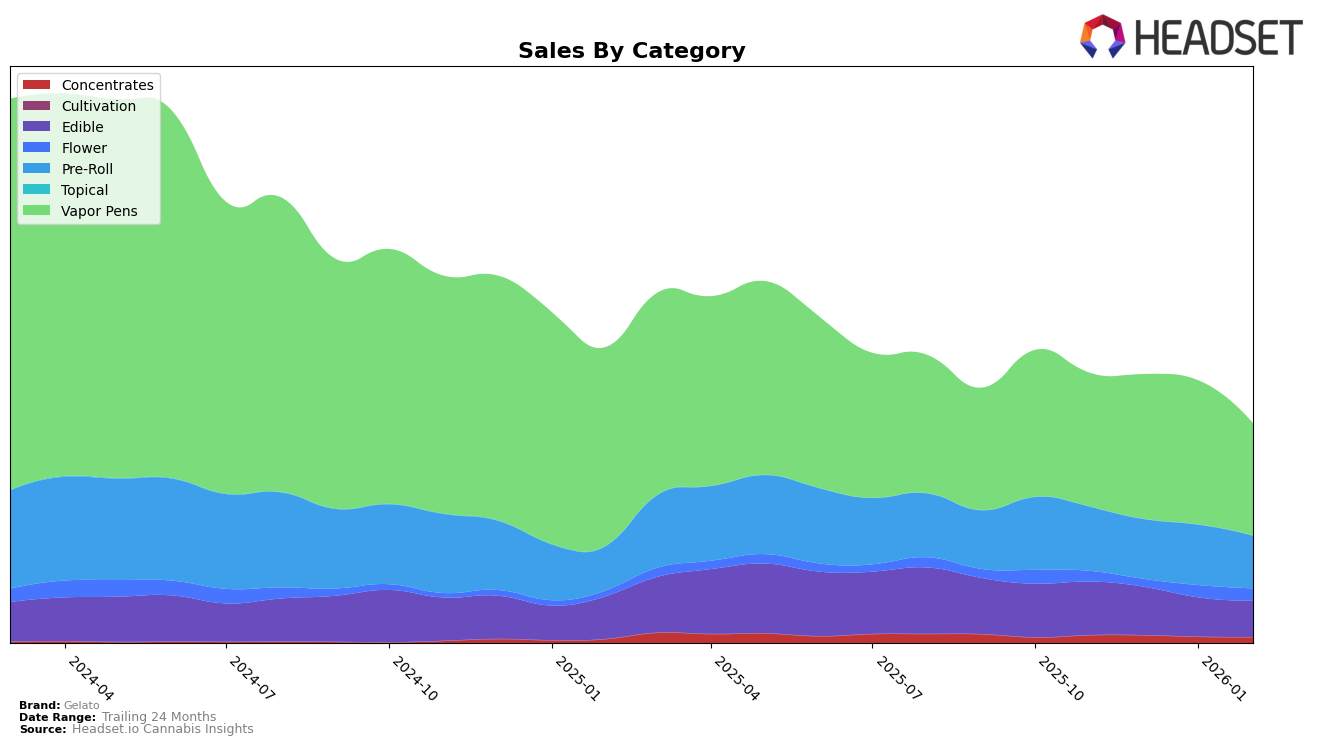

In California, Gelato has shown varied performance across different cannabis categories. In the Edible category, Gelato has been on the cusp of breaking into the top 30, moving from rank 34 in November 2025 to 31 by February 2026, indicating a positive trend despite not yet reaching the top tier. However, their performance in the Vapor Pens category has been less consistent, with rankings fluctuating between 20 and 17, ultimately settling back at 20 in February 2026. This suggests a potential challenge in maintaining a steady upward trajectory in this category. Meanwhile, Gelato's Pre-Roll category has maintained a stable position at rank 22 throughout the months, reflecting a consistent presence in the market.

In Michigan, Gelato's performance has been mixed across categories. Notably, in the Edible category, the brand experienced a decline in rank from 17 in November 2025 to 21 by February 2026, indicating some challenges in maintaining its earlier momentum. Despite this, Gelato's Vapor Pens category showed a promising improvement, climbing from rank 57 in November to 42 in January 2026, before experiencing a slight dip to 48 in February. The Concentrates category, however, did not see Gelato breaking into the top 30, with ranks slipping from 55 in November to 60 by February, highlighting a potential area for growth. Overall, while there are areas of concern, there are also positive movements that could signal potential opportunities for the brand in the future.

Competitive Landscape

In the competitive landscape of Vapor Pens in California, Gelato has experienced fluctuating rankings over recent months, indicating a dynamic market position. Notably, Gelato's rank improved from 21st in December 2025 to 17th in January 2026, before dropping back to 20th in February 2026. This volatility contrasts with ABX / AbsoluteXtracts, which maintained a steady presence around the 18th position, and Micro Bar, which also showed a stable ranking near 19th. Meanwhile, Buddies and Flavorade have been climbing the ranks, with Buddies moving from 30th in November 2025 to 22nd by February 2026, and Flavorade peaking at 17th in December 2025 before slipping to 21st in February 2026. These shifts suggest that while Gelato remains a competitive player, it faces strong upward momentum from Buddies and consistent performance from ABX / AbsoluteXtracts and Micro Bar, highlighting the need for strategic marketing efforts to maintain and improve its market position.

Notable Products

In February 2026, Gelato's top-performing product was Headband Pre-Roll (1g) in the Pre-Roll category, which climbed to the first position from second in January, with notable sales of 5,324 units. MAC Pre-Roll (1g) made a strong debut at the second position, while Northern Lights Pre-Roll (1g) secured the third spot, showing a consistent performance from its fourth position in December 2025. Skywalker OG Pre-Roll (1g) maintained its rank at fourth, despite not being ranked in the previous months, indicating a resurgence in popularity. Citrus Punch Pre-Roll (1g) experienced a decline, dropping from the top spot in December to fifth place, suggesting a shift in consumer preference within the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.