Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

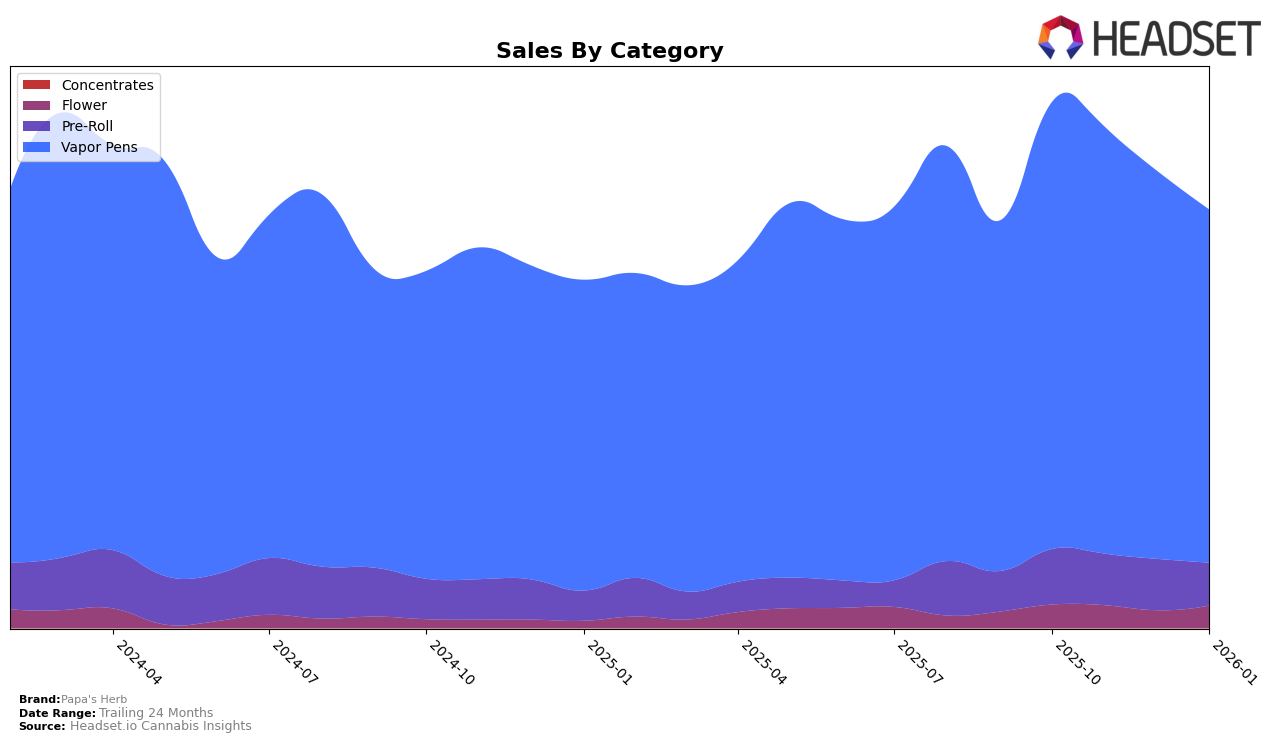

Papa's Herb has shown a mixed performance across various states and categories, with some notable movements. In Alberta, the brand's Pre-Roll category remained outside the top 30, ranking around 65th to 67th over the months, but saw a slight improvement to 62nd in January 2026. However, the Vapor Pens category experienced a downward trend, dropping from 13th to 23rd, indicating a potential area of concern for maintaining competitive positioning. Meanwhile, in California, Papa's Herb's Vapor Pens consistently held a strong position, improving from 17th to 15th, suggesting a solid foothold in this category despite fluctuations in sales figures.

In contrast, Arizona and New Jersey presented challenges for Papa's Herb in the Vapor Pens category. The brand's ranking in Arizona fluctuated, dropping out of the top 30 by January 2026, while in New Jersey, a dramatic fall from 22nd to 52nd in December 2025 highlighted volatility. On a more positive note, the entry into the top 30 for Vapor Pens in Saskatchewan at 21st in January 2026 marks a significant achievement, suggesting potential for growth in new markets. The Flower category in Ontario saw a decline in rankings, but the Vapor Pens category remained stable, indicating a need for strategic focus to bolster performance across different product lines.

Competitive Landscape

In the competitive landscape of vapor pens in California, Papa's Herb has shown a steady improvement in rank from October 2025 to January 2026, moving from 17th to 15th position. This upward trend is notable, especially when compared to competitors like Bloom, which has consistently maintained a higher rank, moving from 16th to 13th over the same period. Meanwhile, Clsics experienced fluctuations but remained ahead of Papa's Herb, despite a dip in January 2026. Dabwoods Premium Cannabis saw a decline, dropping from 13th to 16th, which could indicate an opportunity for Papa's Herb to capture market share. Additionally, UP!, which was not in the top 20 until January 2026, suggests a competitive dynamic where new entrants are emerging. Overall, Papa's Herb's consistent sales performance and gradual rank improvement highlight its potential to climb further in the competitive California vapor pen market.

Notable Products

In January 2026, the Blueberry Zlushie Liquid Diamonds Disposable (1g) emerged as the top-performing product for Papa's Herb, maintaining its rank from November 2025 and returning to the first position from a second-place finish in December 2025. Meanwhile, the Fruit Punch Liquid Diamonds Disposable (0.95g) dropped to the second rank, after leading in December, with notable sales of 4006 units. The Blueberry Zlushie Distillate Cartridge (1g) consistently held the third position, marking a return to the rankings after not appearing in December. The Blueberry Zlushie and Fruit Punch Infused Pre-Roll 2-Pack (1g) maintained a steady fourth rank across the months, while the White Peach & Apple Apricot Tsunami Infused Pre-Roll 2-Pack (1g) debuted at fifth place in January 2026. These shifts highlight the competitive nature of the vapor pens category within the brand's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.