Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

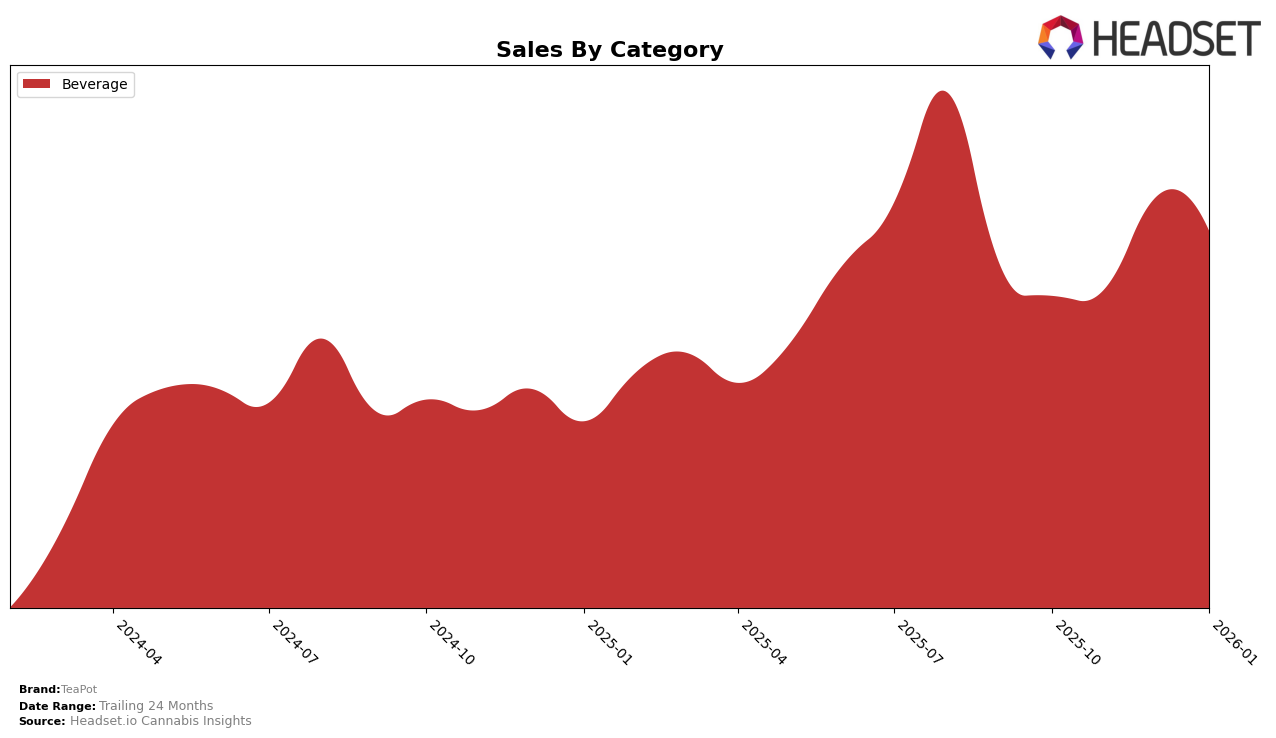

TeaPot has shown a consistent presence in the Beverage category across several Canadian provinces, but its performance varies by region. In British Columbia, TeaPot maintained a steady position within the top 10, ranking between 9th and 11th from October 2025 to January 2026. This stability is indicative of a solid market presence, although there was a slight decline in sales from November to January. Meanwhile, in Ontario, TeaPot consistently held the 10th position throughout the same period, suggesting a strong foothold in the market despite fluctuations in monthly sales figures. The consistent ranking in Ontario, coupled with a notable peak in sales in December, highlights the brand's resilience and potential for growth in this region.

In contrast, Saskatchewan presents a more dynamic scenario for TeaPot. Despite not being ranked in the top 30 during the months leading up to January 2026, TeaPot made a significant leap to 5th place in the Beverage category. This sudden rise suggests a successful strategic move or a positive shift in consumer preferences towards TeaPot products. The absence of rankings in the previous months could indicate challenges in market penetration, but the January ranking demonstrates potential for future growth and increased market share. These variations across provinces highlight the importance of tailored strategies that cater to regional market dynamics.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, TeaPot consistently maintained its position at rank 10 from October 2025 through January 2026. Despite its stable rank, TeaPot faces stiff competition from brands like Bubble Kush and Mary Jones, which have consistently ranked higher, with Bubble Kush improving its rank from 9 to 8 in January 2026 and Mary Jones only dropping to 9 in the same month. This indicates a robust competitive environment where TeaPot's sales, although significant, are outpaced by these competitors. Notably, Green Monke and Astro Lab remain lower in rank, suggesting that TeaPot is positioned well above some of its peers, yet it must strategize to close the gap with the leading brands to enhance its market share and sales trajectory.

Notable Products

In January 2026, the top-performing product from TeaPot was the Good Day - Peach Black Rosin Infused Tea (10mg THC, 12oz, 355ml), maintaining its number one rank with sales of 10,322 units. The Good Day - Rosin Infused Lemon Black Tea (10mg THC, 355ml) also held steady at the second spot, although its sales slightly decreased to 5,878 units. The Good Day - Lemon Black & Pedro's Sweet Sativa Iced Tea (5mg THC, 12oz) remained consistent in third place despite a noticeable drop in sales compared to December. The Good Evening - Blueberry Chamomile & Black Sugar Rose Ice Tea (5mg THC, 355ml) entered the rankings for the first time at fourth place, indicating a strong debut. Meanwhile, the Good Day - Mango Green Tea Iced Tea (5mg THC, 355ml) slipped from fourth to fifth place, reflecting a decline in its sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.