Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

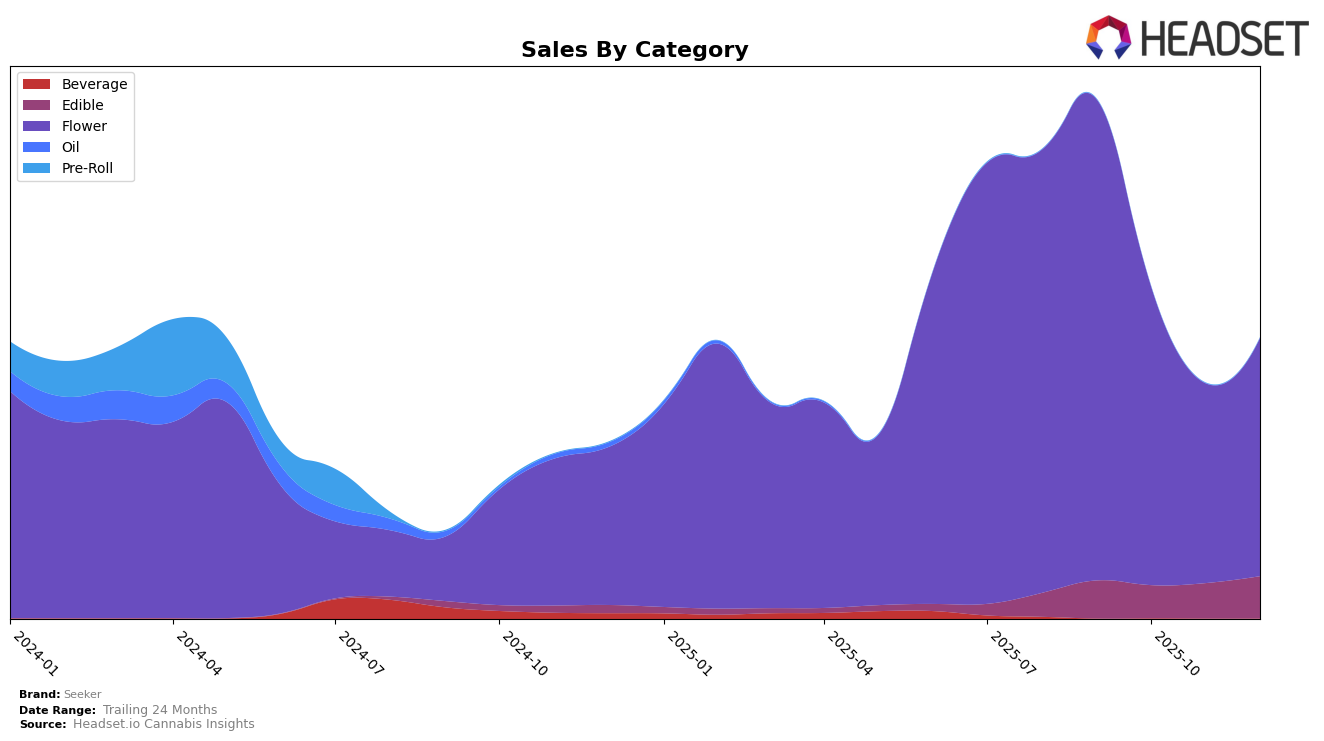

Seeker's performance across different categories and states has shown some variability, particularly in the Ohio market for the Flower category. Over the last few months of 2025, Seeker's ranking in Ohio has fluctuated, with a noticeable drop out of the top 30 in November, before climbing back to 40th place in December. This indicates a challenging period for the brand in Ohio, as it struggled to maintain a strong foothold in the competitive Flower category. Such fluctuations can be indicative of either increasing competition or internal challenges within the brand's strategy or distribution in the state.

In contrast, Seeker maintained a more stable presence in the Ontario market within the Edible category. Consistently ranking at 24th place, except for a slight dip to 25th in October, Seeker demonstrates a steadier performance in this region. This stability might reflect a more established consumer base or effective marketing strategies tailored to the Ontario market. The sales trend in Ontario also shows a positive trajectory, with an increase in sales from October to December, suggesting growing consumer interest or successful promotional efforts. These insights highlight the varying dynamics that Seeker faces across different regions and categories, offering a glimpse into their strategic positioning.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Seeker has experienced notable fluctuations in its ranking and sales performance over the last few months of 2025. Despite a challenging period, Seeker managed to improve its rank from 49th in November to 40th in December, indicating a potential recovery. However, its sales have seen a decline from September to November, before slightly rebounding in December. In comparison, Farmaceutical Rx (Frx) showcased a significant surge in November, climbing to 21st place, although it dropped to 39th in December. Meanwhile, Roll One / R.O. maintained a relatively stable position, hovering around the 38th rank in November and December, after a notable jump in October. HillFire also displayed a consistent performance, staying within the 36th to 41st range. These dynamics suggest that while Seeker faces stiff competition, particularly from brands like Farmaceutical Rx (Frx) and Roll One / R.O., there is room for strategic adjustments to regain market share and improve sales in the Ohio flower market.

Notable Products

In December 2025, the top-performing product for Seeker was Peach Soft Chew (100mg), maintaining its number one rank from November and achieving sales of 6594 units. Triple Berry Soft Chew (10mg) closely followed in second place, consistently holding this position from November, with a notable sales figure. Pineapple Express (2.83g) continued its steady performance, remaining in third place as it did in November. Jamaican Lamb's Bread (2.83g) showed significant improvement, moving up to fourth place from its fifth-place debut in November. Cookie Rain (2.83g) entered the rankings for the first time in December, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.