Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

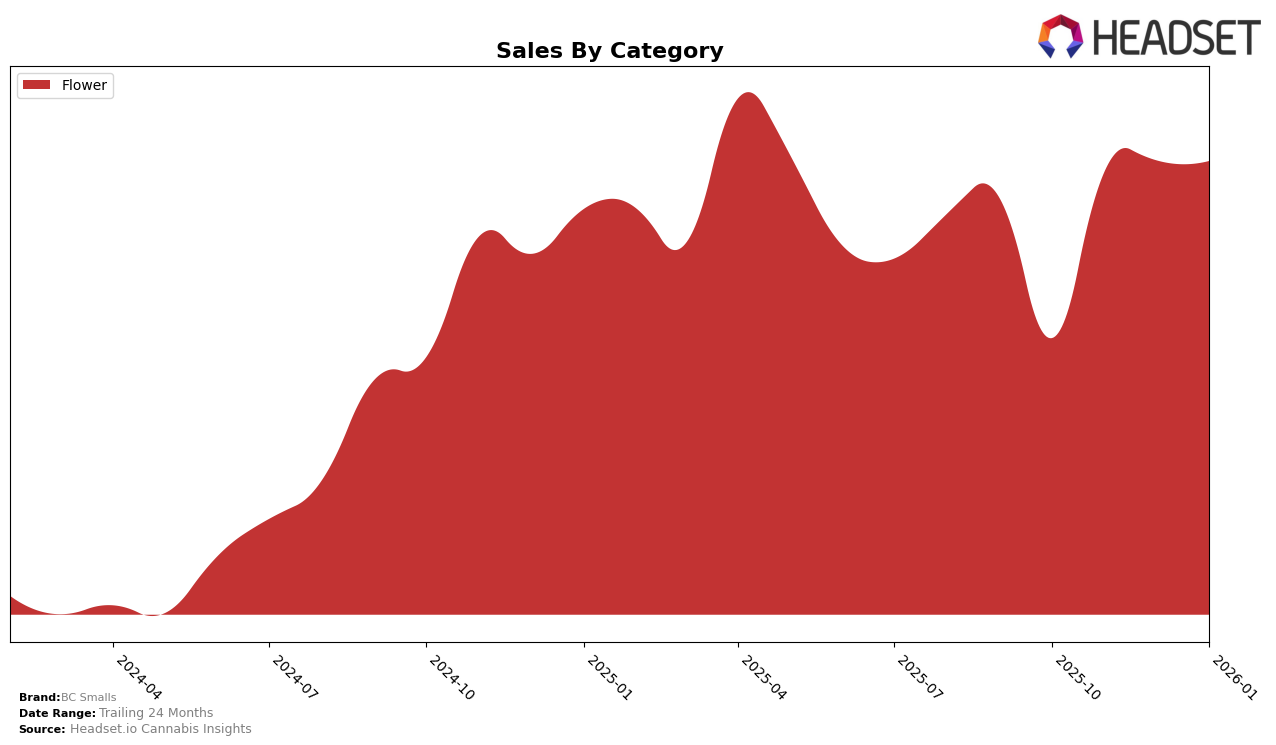

BC Smalls has shown notable performance in the Canadian cannabis market, particularly in the Flower category. In British Columbia, the brand demonstrated a strong presence with a consistent top 10 ranking, peaking at the 3rd position in January 2026. This upward trend indicates a robust market acceptance and possibly increasing consumer loyalty in the region. The brand's sales in British Columbia also reflect this positive trajectory, with a significant increase from October to November 2025, followed by sustained high sales figures in the subsequent months. Such performance suggests that BC Smalls is effectively capitalizing on consumer preferences and market dynamics in British Columbia.

In Ontario, BC Smalls experienced a more challenging market environment. The brand fluctuated around the 30th position in the Flower category rankings, managing to improve slightly to the 28th position by January 2026. This indicates some progress, albeit at a slower pace compared to its performance in British Columbia. The sales figures in Ontario show a slight decline from October to November 2025, but the brand managed to recover somewhat by December. This suggests that while BC Smalls is facing stiff competition in Ontario, there are still opportunities for growth if they can leverage their strengths and adapt to local market conditions.

Competitive Landscape

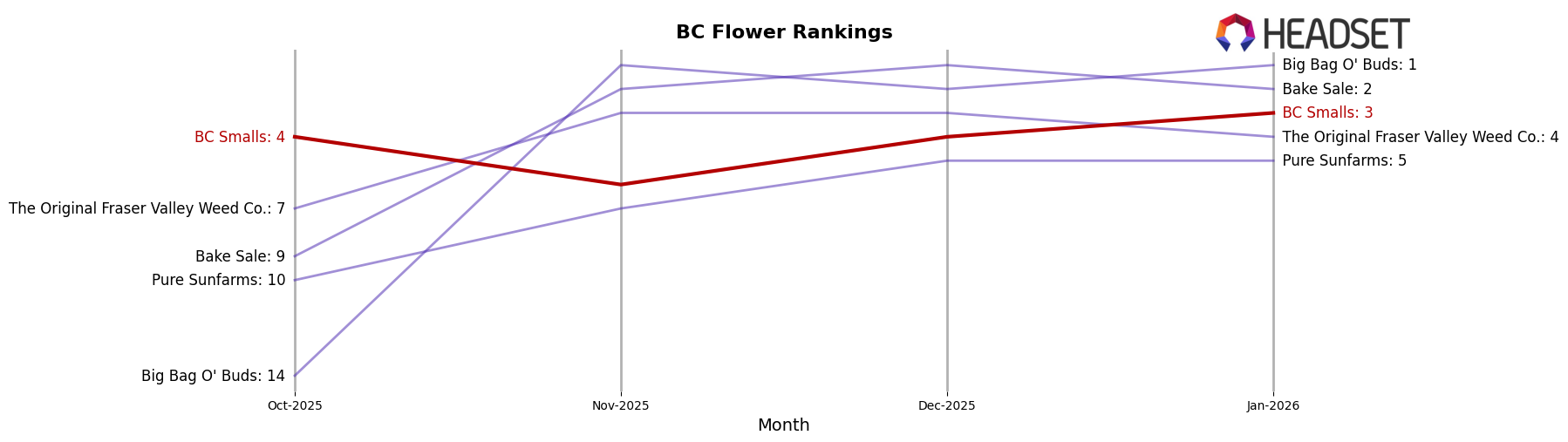

In the competitive landscape of the flower category in British Columbia, BC Smalls has experienced notable fluctuations in rank over the past few months, indicating a dynamic market environment. Despite a strong start in October 2025, ranking 4th, BC Smalls saw a dip to 6th place in November, before rebounding to 4th in December and climbing to 3rd in January 2026. This upward trend suggests a positive reception of their products, although they face stiff competition from brands like Big Bag O' Buds, which consistently held top positions, ranking 1st in November and January. Additionally, Bake Sale emerged as a formidable competitor, achieving the top rank in December. Meanwhile, Pure Sunfarms and The Original Fraser Valley Weed Co. also demonstrated strong performances, maintaining positions within the top 5. The competitive pressure from these brands underscores the importance for BC Smalls to continue innovating and differentiating their offerings to capture and sustain consumer interest in this rapidly evolving market.

Notable Products

In January 2026, BC Smalls' top-performing product was Galactic OG Smalls (3.5g) in the Flower category, maintaining its first-place ranking from the previous two months with sales of 8,482 units. Hippie Cripwalk Smalls (3.5g) followed closely in second place, having consistently ranked in the top three since October 2025. Sleeping Tiger Smalls (3.5g) showed a strong performance, rising to third place from fourth in December 2025. Zelectrolytes Smalls (3.5g) entered the rankings in January 2026 at fourth position, marking its debut in the top five. White Widow Smalls (3.5g) experienced a decline, dropping to fifth place from its previous second and third positions in November and December 2025, respectively.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.