Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

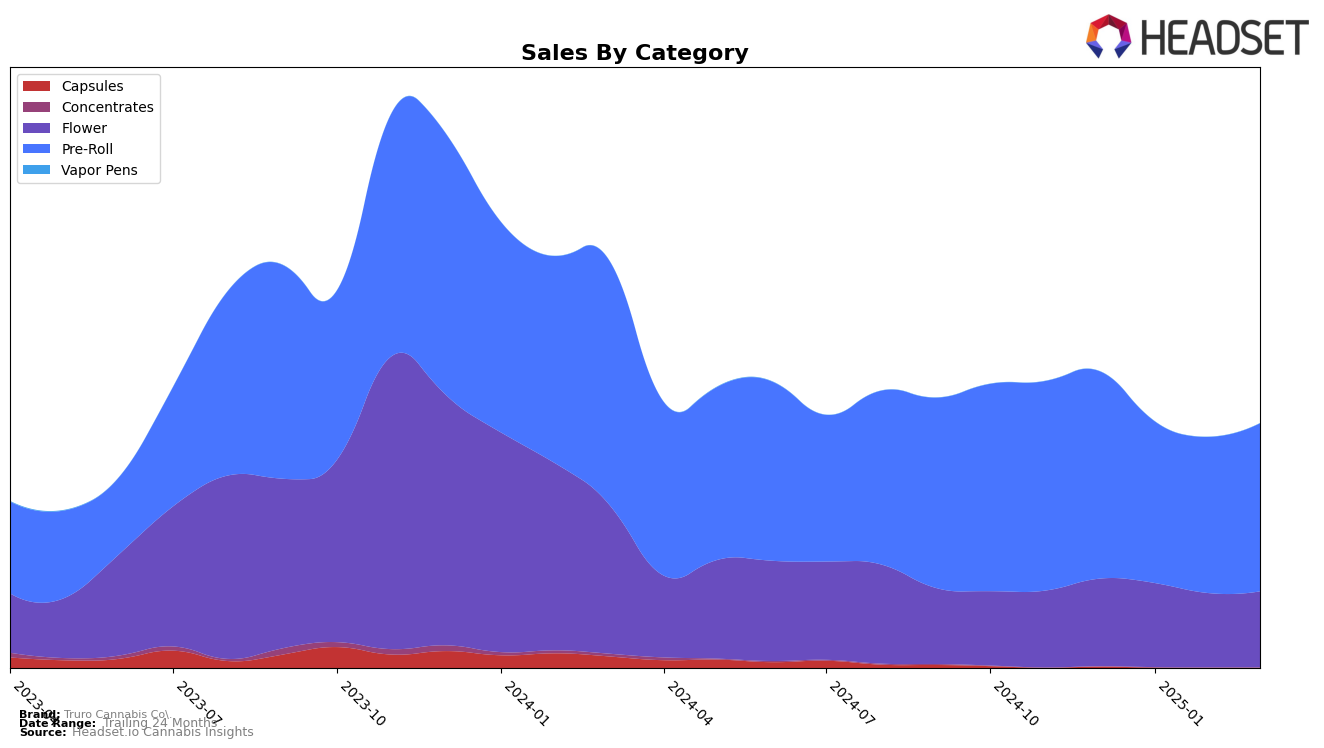

Truro Cannabis Co. has shown varied performance across different categories and provinces, reflecting a dynamic presence in the Canadian cannabis market. In Alberta, the brand's Flower category did not make it into the top 30 rankings from December 2024 to March 2025, indicating a challenging market position in this category. However, the Pre-Roll category in Alberta presents a contrasting picture, where Truro Cannabis Co. improved its ranking from 77th in December 2024 to 60th by March 2025. This positive movement suggests a growing consumer preference or successful strategic adjustments in the Pre-Roll segment.

In Ontario, Truro Cannabis Co. has maintained a more stable presence. The brand's Flower category experienced some fluctuations, peaking at the 70th position in February 2025, although it slipped back to 78th by March 2025. Meanwhile, the Pre-Roll category has shown remarkable consistency, holding steady around the 40th position throughout the months from December 2024 to March 2025. This stability in Ontario's Pre-Roll rankings could indicate a strong and loyal customer base or effective marketing strategies in place for this specific category.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Truro Cannabis Co. has maintained a relatively stable position, ranking 41st in both December 2024 and March 2025, with a slight improvement to 40th in January and February 2025. This consistency in rank, despite fluctuations in sales, suggests a steady market presence. Meanwhile, competitors like DEBUNK have shown a notable improvement, climbing from 42nd to 39th place by March 2025, indicating a potential threat to Truro's position. Additionally, GREAZY has experienced a decline, dropping from 34th to 40th, which could present an opportunity for Truro to capture some of their market share. Other competitors such as Pistol and Paris and Versus have also shown variability in their rankings, with Versus improving to 42nd in March 2025. These dynamics highlight the competitive pressures and opportunities within the Ontario Pre-Roll market, emphasizing the need for strategic positioning by Truro Cannabis Co. to enhance its market share and rank.

Notable Products

For March 2025, Caps Junky Pre-Roll (0.5g) continues to dominate as the top-performing product from Truro Cannabis Co., maintaining its number one rank consistently over the past four months with a notable sales figure of 14,358. Tres Dawg x I 95 Pre-Roll (0.5g) saw a rise in popularity, climbing from the third position in February to second place in March, indicating a strong growth in consumer preference. Donair Kush Pre-Roll (0.5g), while dropping to third place, remains a consistent favorite among customers. Jealousy x Apples & Bananas Pre-Roll (0.5g) entered the rankings for the first time in March, securing the fourth spot and showcasing potential for future growth. Titanimal Bubble Hash and Kief Infused Pre-Roll (0.5g) rounds out the top five, though it has seen a gradual decline in its ranking since December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.