Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

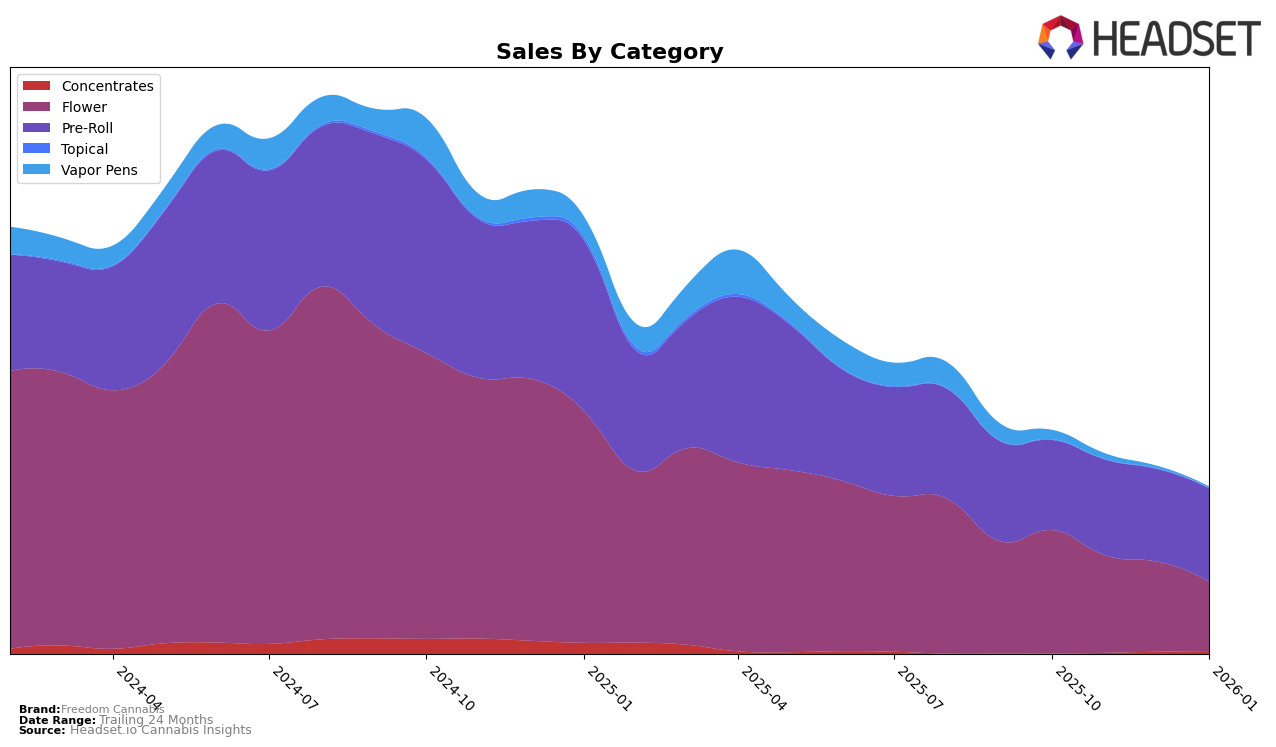

Freedom Cannabis has shown a varied performance across different product categories and regions, with notable movements in the rankings. In Alberta, their Flower category experienced a decline in rankings, moving from 24th in October 2025 to 41st by January 2026, which may indicate challenges in maintaining market presence or increasing competition. Conversely, their Pre-Roll category in Alberta showed improvement, climbing from 39th in October 2025 to 32nd in January 2026, suggesting a strengthening position in that segment. However, their Vapor Pens category did not make it into the top 30 in Alberta after October, highlighting a potential area for growth or increased competition.

In Saskatchewan, Freedom Cannabis's performance also varied across categories. The Flower category saw some fluctuations, with rankings moving from 40th in October 2025 to 38th in January 2026, indicating some stability despite the ups and downs. For Pre-Rolls, while they improved from 57th to 47th in November 2025, they didn't maintain a top 30 position thereafter. Interestingly, the Vapor Pens category in Saskatchewan entered the top 30 in November 2025, ranking 38th, but did not sustain this position in subsequent months, which might suggest a need to reassess their strategy in this category. This mixed performance across categories and regions presents both challenges and opportunities for Freedom Cannabis to refine their approach and capitalize on strengths.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, Freedom Cannabis has shown a notable upward trend in its ranking and sales performance. Starting from October 2025, Freedom Cannabis was ranked 39th, and by January 2026, it improved its position to 32nd. This positive trajectory is indicative of a strategic shift or increased market acceptance, as it surpassed competitors like Big Bag O' Buds, which fluctuated between 40th and 36th place during the same period. Meanwhile, Common Ground and Broken Coast maintained relatively stable positions, with Common Ground slightly ahead at 31st in January 2026. Despite being behind in sales compared to these brands, Freedom Cannabis's consistent improvement in rank suggests a growing consumer base and potential for further market penetration. This trend highlights the brand's resilience and adaptability in a competitive market, positioning it as a promising contender in Alberta's Pre-Roll sector.

Notable Products

In January 2026, the top-performing product from Freedom Cannabis was Lemon Hedz Pre-Roll 2-Pack (2g) in the Pre-Roll category, which climbed to the top rank with sales of 2,326 units. This product showed a significant rise from December 2025, where it was ranked fifth. Double Double Medium Pre-Roll 10-Pack (5g) slipped to the second position, maintaining strong sales figures across previous months. The Nomad Pre-Roll 3-Pack (1.5g) consistently held onto the third spot, showing stable performance. Reserve Sunset Pre-Roll 3-Pack (1.5g) remained in the fourth position, reflecting steady demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.