Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

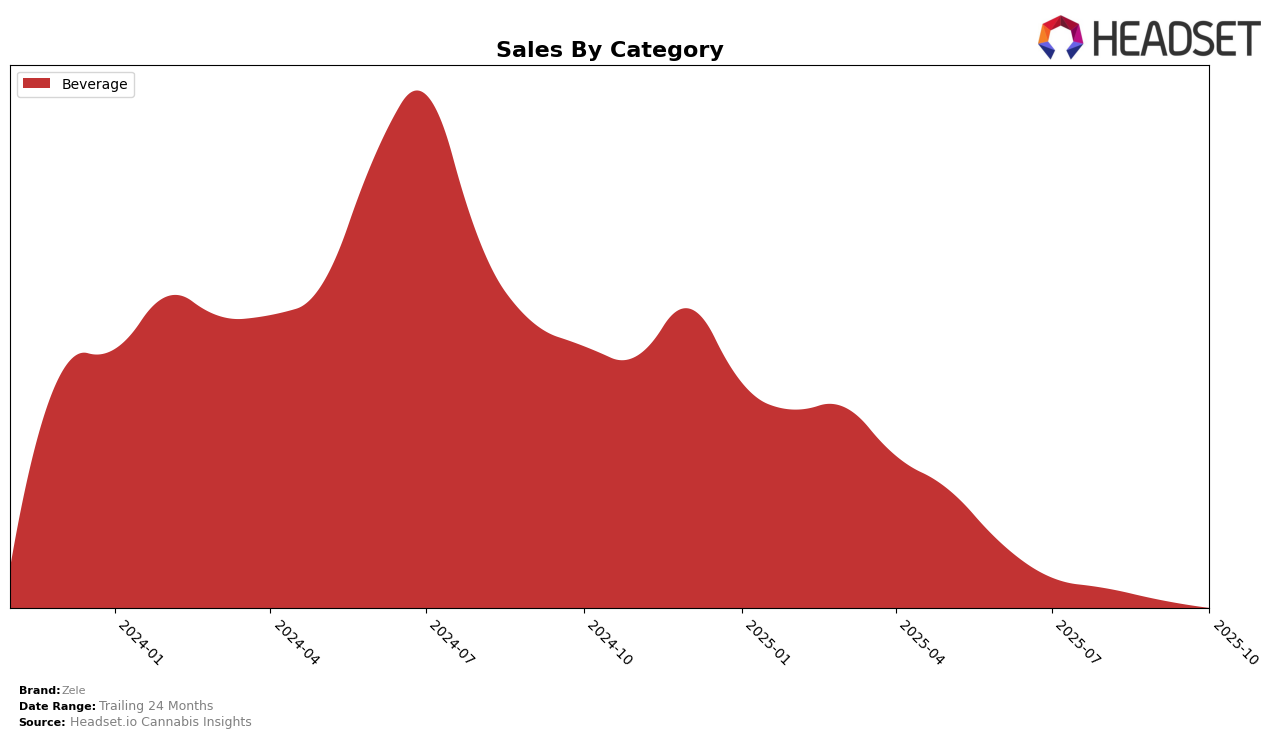

In the province of Alberta, Zele's performance in the Beverage category has experienced some fluctuations. Starting at a rank of 15 in July 2025, Zele saw a decline to rank 19 by August, with sales dropping from 16,033 CAD to 10,124 CAD during the same period. The absence of rankings for September and October indicates that Zele did not place in the top 30 brands in Alberta's Beverage category during those months, which could be a concern for their market presence and competitive positioning.

Examining Zele's overall category performance, the data suggests a need for strategic adjustments to regain momentum. The downward trend in Alberta highlights potential challenges in maintaining brand visibility and consumer interest. While specific sales figures for September and October are not provided, the lack of top 30 rankings suggests a significant opportunity for Zele to reassess its marketing strategies or product offerings to enhance its standings in the competitive landscape of the Beverage category.

Competitive Landscape

In the competitive landscape of the beverage category in Alberta, Zele has experienced notable fluctuations in its market position over recent months. In July 2025, Zele held a strong position at rank 15, but by August 2025, it had slipped to rank 19, and it did not appear in the top 20 for September and October. This decline in rank coincides with a significant drop in sales from August onwards. Meanwhile, Ace Valley maintained a relatively stable presence, consistently ranking around 15th to 17th place, despite a noticeable sales dip in October. HYTN, which appeared in the rankings in July at 18th, did not maintain a top 20 position in subsequent months. These dynamics suggest that while Zele initially competed closely with Ace Valley, its declining sales and absence from recent rankings indicate a need for strategic adjustments to regain its competitive edge in the Alberta beverage market.

Notable Products

In October 2025, the top-performing product from Zele was Lemon Lime Soda with 10mg THC, 355ml, which maintained its number one rank for the fourth consecutive month, despite a decrease in sales to 380 units. Orange Soda with 10mg THC, 355ml, held steady at the second position, although its sales figures continued to decline. LO Peach Haze Soda with 10mg THC, 355ml, reappeared in the rankings at third place after being unranked in the previous months. Black Cherry Craft Soda with 10mg THC, 355ml, consistently ranked fourth, with a slight decrease in sales from September to October. Notably, Sarsaparilla Craft Soda with 10mg THC, 355ml, entered the rankings at fifth place, indicating a new interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.