Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

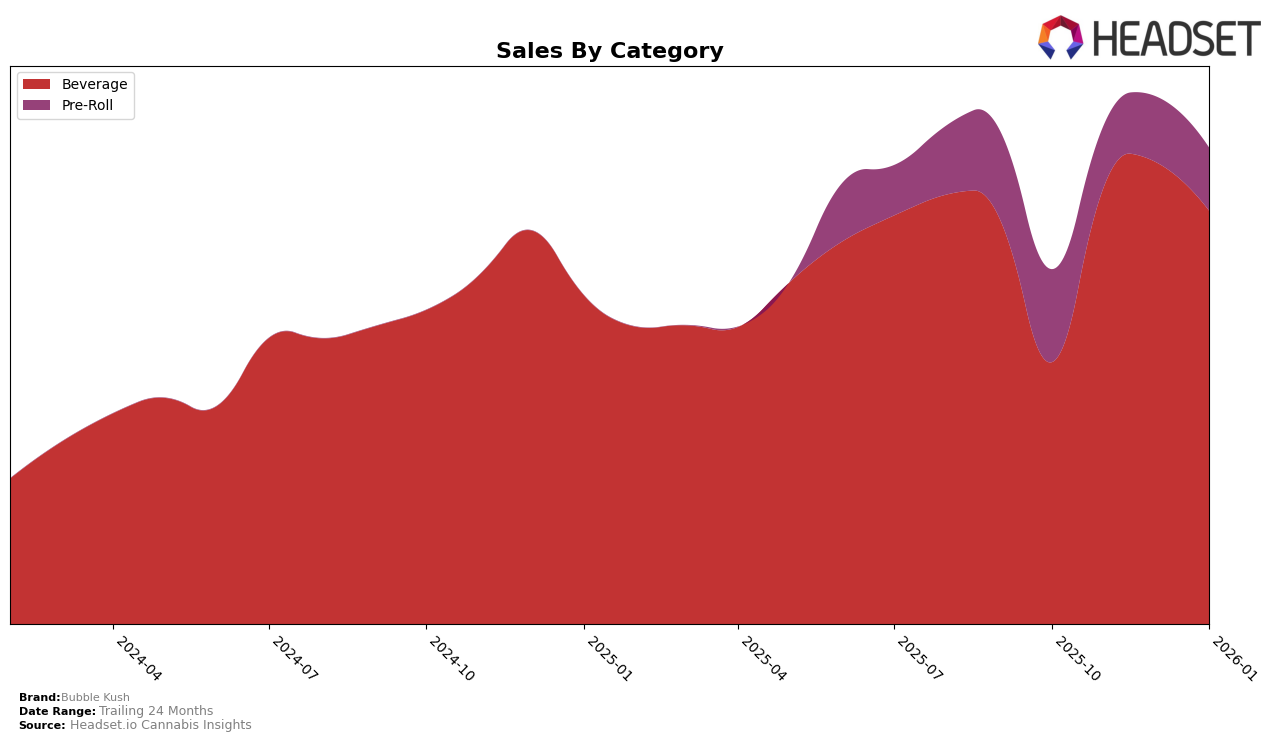

Bubble Kush has demonstrated a strong performance in the Beverage category across several Canadian provinces, with notable stability and improvement in rankings. In Alberta, the brand maintained a steady position at rank 5 from November 2025 to January 2026, indicating consistent market presence. Meanwhile, in British Columbia, Bubble Kush achieved a remarkable rise to the top position by November 2025 and sustained this lead through January 2026. This suggests a dominant market share and possibly a well-received product line in the province. However, despite these successes, the brand's rank in Ontario showed minimal movement, maintaining a rank of 9 for most of the period, only slightly improving to rank 8 by January 2026, which may indicate competitive challenges in this region.

Examining sales trends, Bubble Kush experienced varying degrees of sales performance across these provinces. In British Columbia, the brand saw a significant sales spike in November 2025, with sales figures reaching an impressive peak before slightly tapering off in the following months. This peak could be attributed to seasonal demand or successful marketing strategies. Alberta's sales figures remained relatively stable, reflecting the steady rank position, while Ontario showed a sales increase in December 2025, which did not significantly alter the brand's rank. The absence of Bubble Kush in the top 30 brands in other provinces or categories suggests potential areas for growth and expansion, as well as highlighting the competitive nature of the cannabis beverage market outside their current strongholds.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Bubble Kush has shown a steady presence, maintaining its rank at 9th place from October to December 2025, before improving slightly to 8th place in January 2026. This improvement is noteworthy considering the fluctuating performances of its competitors. For instance, Ray's Lemonade and Collective Project have consistently ranked higher, with both brands trading places between 5th and 7th positions over the same period. Meanwhile, Mary Jones maintained a steady 8th place ranking until January 2026, when it slipped to 9th, allowing Bubble Kush to move up. Despite these challenges, Bubble Kush's sales saw a significant increase in December 2025, which could indicate a growing consumer preference or successful marketing efforts. However, with TeaPot consistently trailing behind in 10th place, Bubble Kush remains in a competitive middle ground, suggesting potential for further growth if strategic adjustments are made.

Notable Products

In January 2026, Bubble Kush's top-performing product was the Root Beer Beverage (10mg THC, 355ml), maintaining its number one rank for four consecutive months with a sales figure of 43,530. The Orange Soda (10mg THC, 355ml) held steady at the second position, reflecting consistent consumer preference. Similarly, the Lemon Lime Soda (10mg THC, 355ml) and Tahiti Trip Soda (10mg THC, 355ml) retained their third and fourth ranks, respectively. The Wandz Fruitz - Dragonfruit Hibiscus Infused Pre-Roll 5-Pack (2.5g) remained in fifth place, showing stable performance across the months. Overall, the rankings for Bubble Kush's products in January 2026 remained unchanged from previous months, indicating a stable market trend for their top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.