Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

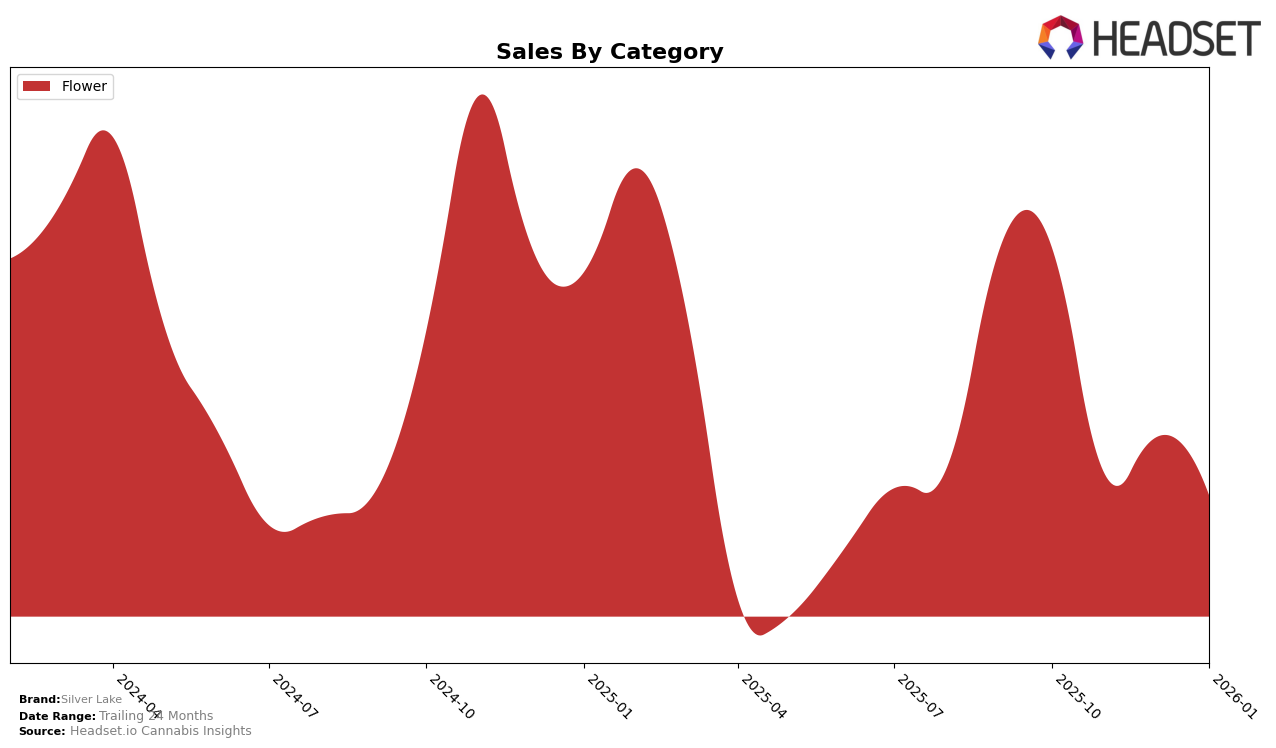

Silver Lake's performance in the Colorado market has shown some interesting trends over the past few months, particularly in the Flower category. The brand started strong in October 2025, securing the 5th position, but experienced a decline in subsequent months, falling to the 11th rank by January 2026. This downward movement in rankings could indicate increased competition or challenges in maintaining market share. Notably, their sales figures reflect this trend, with a significant drop from October's robust performance. This decline in ranking and sales suggests that Silver Lake may need to reassess its strategies to regain its standing in the Flower category.

Despite the challenges in Colorado, Silver Lake's absence from the top 30 in other states or provinces could be seen as a missed opportunity or a strategic focus on specific markets. The lack of presence in additional regions might suggest a concentrated effort to dominate in Colorado, though it also highlights the potential for expansion into new markets. The brand's performance in one state provides a valuable case study for understanding market dynamics and consumer preferences, offering insights into where Silver Lake might focus future efforts to enhance its market presence.

Competitive Landscape

In the competitive landscape of the Colorado flower market, Silver Lake experienced notable fluctuations in its ranking from October 2025 to January 2026. Starting at a strong position of 5th in October, Silver Lake's rank dropped to 9th in November and December, before slipping further to 11th in January. This decline in rank coincided with a decrease in sales, which saw a significant drop from October to November, followed by a slight recovery in December, and then another dip in January. Meanwhile, Equinox Gardens maintained a relatively stable presence, consistently ranking within the top 12, while The Original Jack Herer made a notable jump from 21st in December to 10th in January, suggesting a surge in popularity. Natty Rems also saw a significant rank drop in December but managed to recover slightly by January. These shifts highlight a competitive and dynamic market environment, where Silver Lake must strategize to regain its higher standing and counteract the upward momentum of its competitors.

Notable Products

In January 2026, Fruity Pebbles OG (Bulk) from Silver Lake maintained its top position in the Flower category, with notable sales of 11,671 units. Sundae Driver (Bulk) rose to second place after being ranked fifth in December 2025, showing a significant increase in its popularity. Modified Grapes (Bulk) experienced a slight drop in ranking, moving from second in December to third in January. Lemon Pound Cake (Bulk) entered the rankings for the first time, securing the fourth position. Pineapple Punch (Bulk), which was previously the top seller in October 2025, fell to fifth place, indicating a decline in demand over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.