Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

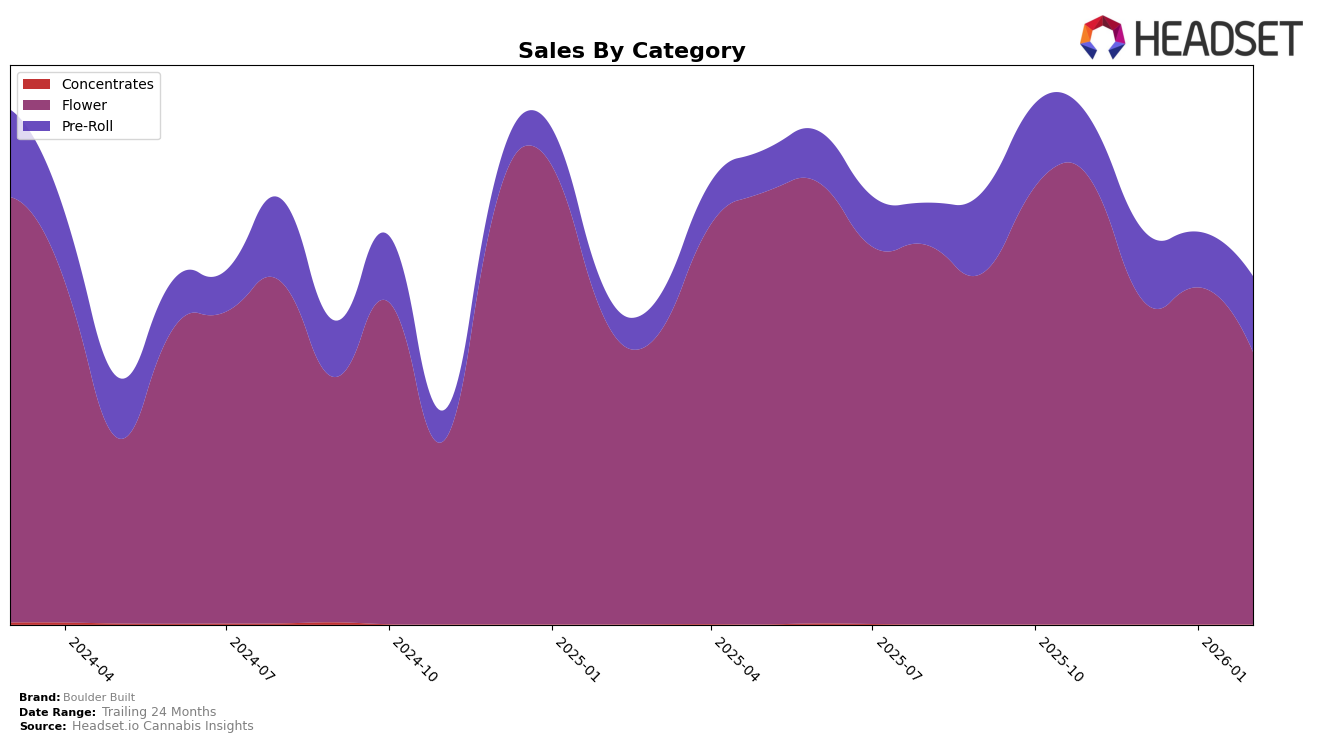

Boulder Built's performance in the Colorado market has shown some variability across different product categories. In the Flower category, Boulder Built experienced a decline in their rankings from November 2025 to February 2026, dropping from 14th to 26th. This downward trend indicates a potential challenge in maintaining their competitive edge within the Flower market. The sales figures also reflect this trend, with a notable decrease from November to February. Despite the drop, Boulder Built managed to remain within the top 30 brands, which suggests some level of resilience in a competitive landscape.

In contrast, Boulder Built's performance in the Pre-Roll category in Colorado has been more stable, with a slight improvement in rankings over the same period. Starting at 37th in November 2025, they advanced to 30th by February 2026, indicating a positive movement and potential growth in consumer interest or market share. The sales figures for Pre-Rolls also support this improvement, showing an upward trend from December to February. The ability to break into the top 30 in February is a positive sign, suggesting that Boulder Built might be gaining traction in this category.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Boulder Built has experienced notable fluctuations in its ranking and sales over recent months. Starting in November 2025, Boulder Built held a strong position at rank 14, but by December 2025, it dropped significantly to rank 27. This decline coincided with a decrease in sales, suggesting potential challenges in maintaining market share. However, Boulder Built showed resilience by improving its rank to 22 in January 2026, although it slipped again to rank 26 by February 2026. In contrast, competitors like The Health Center and Antero Sciences demonstrated more stable or improving trends, with The Health Center gradually climbing from rank 33 to 28 and Antero Sciences experiencing a peak at rank 16 in December 2025. Meanwhile, NOBO showed a dramatic improvement from rank 37 in December 2025 to 18 in January 2026, highlighting a potential threat to Boulder Built's market position. Additionally, Ardo made a significant leap from rank 66 in December 2025 to 24 by February 2026, indicating a rapid increase in competitiveness. These dynamics underscore the importance for Boulder Built to strategize effectively to regain and sustain its market position amidst these shifting competitor trends.

Notable Products

In February 2026, Boulder Built's top-performing product was GMO Crasher Bulk in the Flower category, which ascended to the number one rank with notable sales of 4301 units. Strawberries and Cream Bulk and Sudz Bulk, both in the Flower category, followed closely, securing the second and third positions respectively. Brass Billy Pre-Roll 1g took the fourth spot, marking a strong presence in the Pre-Roll category. Meanwhile, Sudz Pre-Roll 1g, which was ranked fifth in November 2025, maintained its fifth position in February 2026, demonstrating consistent performance. These rankings highlight a significant shift from January 2026, where GMO Crasher Bulk moved up from fifth to first, showcasing its growing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.