Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

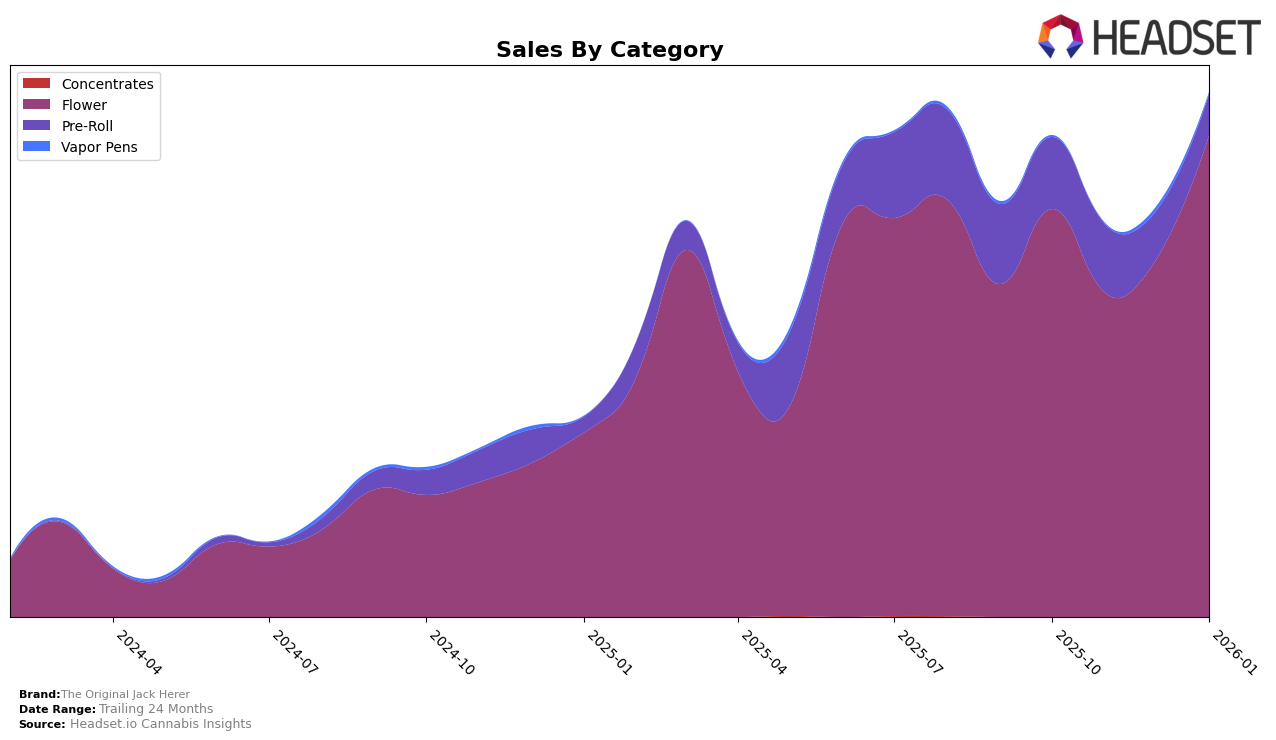

The Original Jack Herer has shown a notable performance in the Flower category in Colorado over the past few months. After starting at rank 16 in October 2025, the brand experienced a dip, moving to rank 21 in both November and December. However, a significant upward movement was observed in January 2026, where it climbed to rank 10, indicating a strong recovery and possibly increased consumer demand or successful marketing strategies. This positive shift is accompanied by an impressive increase in sales from $380,748 in December to $538,801 in January, suggesting a robust growth trajectory in this category.

In contrast, the Pre-Roll category in Colorado tells a different story for The Original Jack Herer. The brand struggled to maintain a consistent presence in the top 30, with rankings such as 49 in October and 48 in January, indicating challenges in capturing market share in this segment. Despite a brief improvement to rank 34 in November, the brand did not sustain this momentum, which is reflected in fluctuating sales figures, dropping from $62,011 in November to $29,185 in January. This inconsistency suggests potential areas for improvement or reevaluation of strategies within the Pre-Roll category.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, The Original Jack Herer has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranking at 16th place in October 2025, the brand dropped out of the top 20 in November and December, only to make a significant comeback to 10th place by January 2026. This resurgence is particularly impressive given the competitive pressure from brands like Equinox Gardens, which maintained a relatively stable rank, and Silver Lake, which saw a slight decline from 5th to 11th place over the same period. Meanwhile, Natty Rems experienced a more volatile trajectory, dropping from 7th to 20th place before recovering to 12th. The Original Jack Herer's ability to climb back into the top 10 suggests a successful strategic adjustment or market response, positioning it favorably against competitors like 14er Boulder, which also showed a positive trend, moving from 11th to 8th place. This dynamic environment highlights the importance of agility and market adaptability for The Original Jack Herer to sustain and improve its competitive edge in Colorado's Flower market.

Notable Products

In January 2026, the top-performing product for The Original Jack Herer was Jack Herer (3.5g) from the Flower category, maintaining its first-place ranking with a notable sales figure of 17,224. Jack Herer Pre-Roll (1g) held steady in second place, despite a decrease in sales compared to previous months. Master Jack (3.5g) from the Flower category climbed to third place, marking its first appearance in the top rankings since November 2025. Emperor's Cut Pre-Roll (1g) entered the rankings in fourth place, showing a resurgence after not being ranked in the prior months. Candied Peaches (3.5g) from the Flower category completed the top five, slipping slightly from its previous third-place position in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.