Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

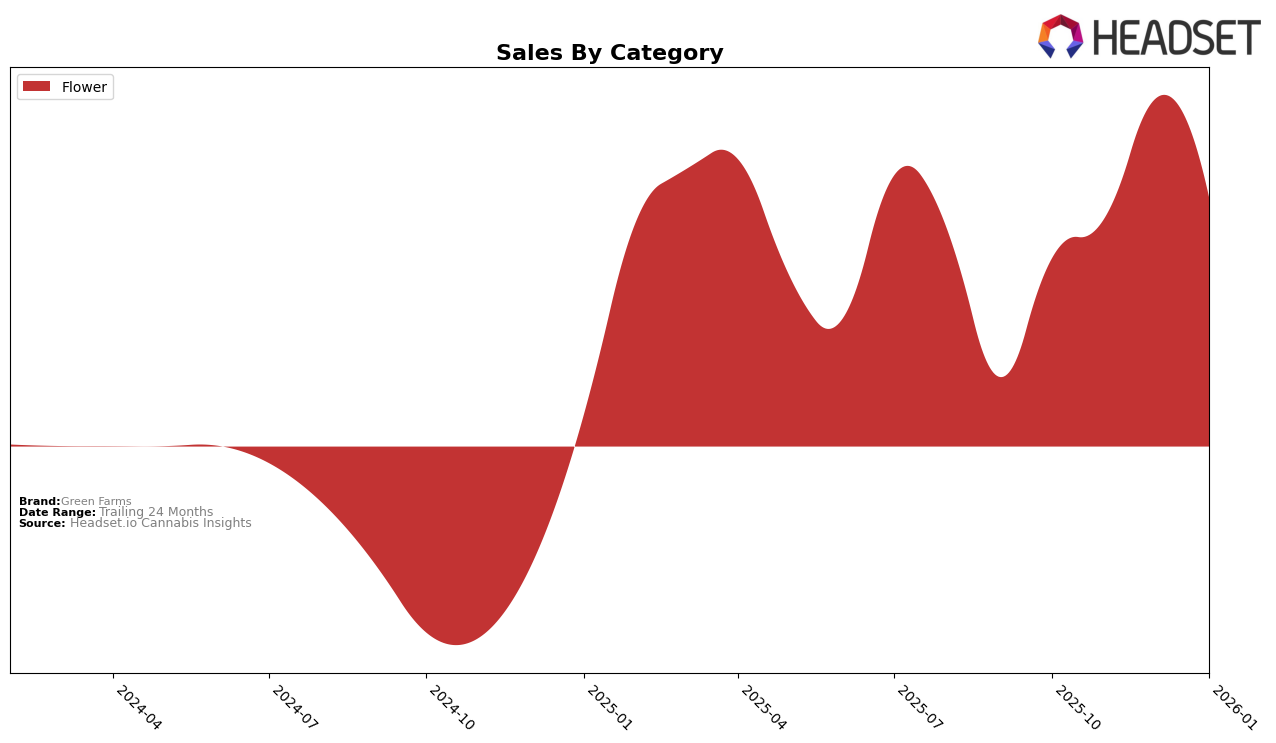

Green Farms has shown a notable performance in the Colorado market, particularly within the Flower category. The brand's ranking has experienced significant fluctuations over the past few months, beginning at 29th place in October 2025 and climbing to 13th place by December 2025. This upward movement suggests an increasing consumer preference for their products during this period. However, by January 2026, the brand's rank slightly dipped to 19th, indicating some volatility in their market position. Despite this, the substantial rise in sales from October to December highlights a strong growth trend that may be worth exploring further.

It's important to note that Green Farms was consistently within the top 30 brands in Colorado's Flower category throughout the observed months, reflecting a solid presence in this competitive market. The absence of rankings for other states or categories suggests that Green Farms either did not make it into the top 30 in those areas or is primarily focused on their performance in Colorado. This could imply a strategic concentration on specific markets or categories, which could be beneficial if managed effectively. Observing how their strategy evolves and whether they expand their presence in other states or categories could provide deeper insights into their growth trajectory.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Green Farms has shown a notable upward trajectory in rank and sales over the past few months. Starting from a rank of 29 in October 2025, Green Farms climbed to 13 by December 2025, before settling at 19 in January 2026. This improvement is significant, especially when compared to competitors like Bonsai Cultivation, which saw a decline from rank 13 in October to 20 in January, and NOBO, whose rank fluctuated but ended at 18 in January. Meanwhile, Boulder Built experienced a drop to 21 in January after peaking at 14 in November. The consistent rise in Green Farms' sales, particularly in December, suggests a growing consumer preference, positioning it as a formidable player in the market. This trend highlights Green Farms' potential for continued growth and market share expansion in the coming months.

Notable Products

In January 2026, the top-performing product from Green Farms was Black Cherry Cheesecake Fritter (3.5g) in the Flower category, maintaining its number one rank from December 2025 with sales of 2,552 units. Trinity (3.5g) climbed back to the second position after slipping to third in December, showing consistent demand. Dulce de Uva (3.5g) improved its rank, moving up from fourth to third place, despite a slight decrease in sales. Wedding Pie (3.5g) experienced a notable drop, falling from second in December to fourth, indicating a significant decrease in popularity. Fall 97 (3.5g) entered the top five for the first time, securing the fifth position, which suggests a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.