Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

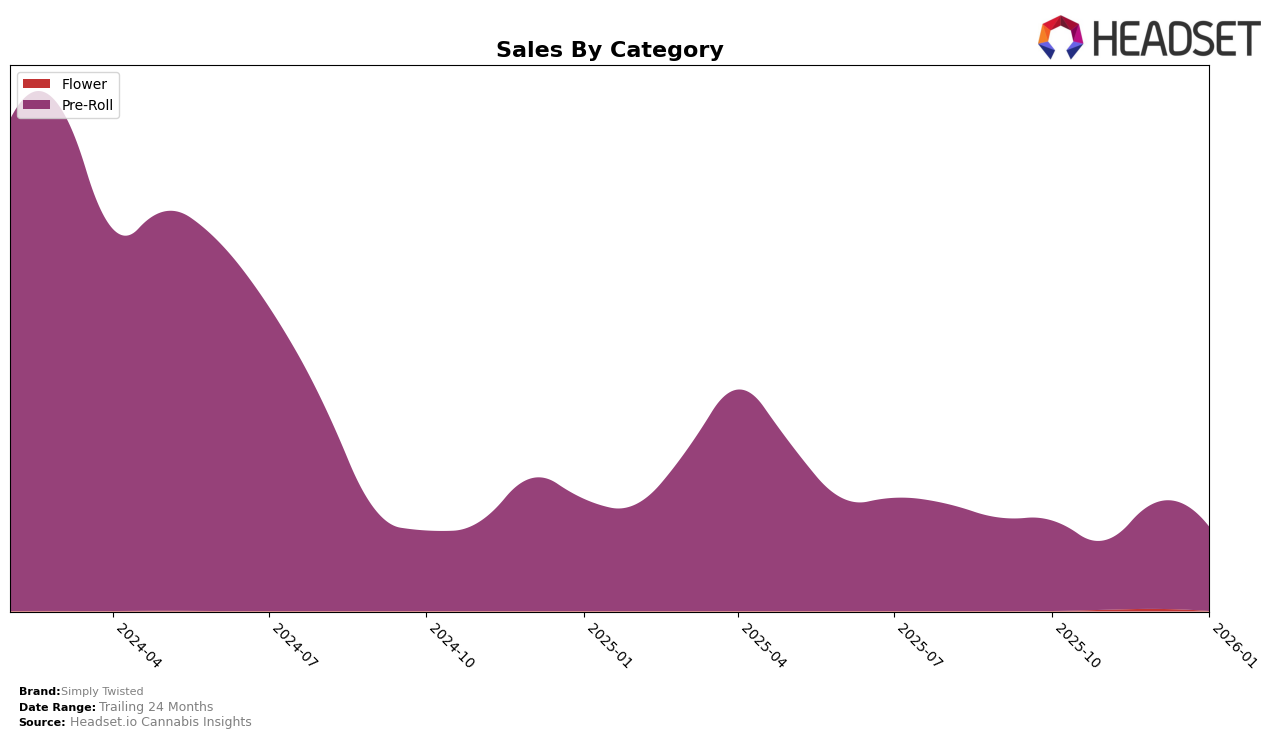

Simply Twisted has shown a fluctuating performance in the Arizona pre-roll category over the past few months. In October 2025, the brand held the 26th position, but it slipped to 30th in November. This decline was followed by a rebound to 26th place in December, only to fall again to 29th in January 2026. This pattern indicates some volatility in their market presence, with their rank oscillating around the lower end of the top 30. Notably, the brand managed to remain within the top 30 throughout this period, which is a positive sign of resilience despite the market's competitive nature.

The sales figures for Simply Twisted in Arizona also reflect this fluctuating trend. While they experienced a dip in sales in November 2025, there was a significant recovery in December, reaching one of their higher sales points in the observed period. However, January 2026 saw another decline. This variability in sales and rankings suggests that while Simply Twisted has a foothold in the Arizona pre-roll market, there are underlying challenges that affect their consistency in performance. The brand's ability to maintain its presence within the top 30, despite these fluctuations, underscores a potential for growth if they can stabilize their market strategy.

Competitive Landscape

In the competitive landscape of pre-rolls in Arizona, Simply Twisted has experienced fluctuating ranks over the past few months, indicating a dynamic market position. Notably, Simply Twisted's rank improved from 30th in November 2025 to 26th in December 2025, before slipping slightly to 29th in January 2026. This volatility contrasts with competitors like Halo Cannabis (formerly The Green Halo), which maintained a more stable ranking, consistently staying around the 27th to 30th positions. Meanwhile, Connected Cannabis Co. saw a significant drop from 20th in December 2025 to 30th in January 2026, suggesting potential challenges in maintaining their sales momentum. Despite these fluctuations, Simply Twisted's sales in December 2025 were notably higher than those of Caviar Gold, which consistently ranked lower, highlighting Simply Twisted's potential to capitalize on market opportunities and improve its competitive standing.

Notable Products

In January 2026, Simply Twisted's top-performing product was the Headband Pre-Roll 5-Pack with a sales figure of 993 units, securing the number one rank. Following closely was the Platinum Kush Pre-Roll 2-Pack, which ranked second. The Pineapple Express Pre-Roll 14-Pack showed improvement, climbing to third place from fifth in the previous month. Meanwhile, Sour Sunset Pre-Roll 5-Pack held steady at fourth place, while Mendo Breath Pre-Roll 14-Pack dropped from fourth to fifth. This shift in rankings highlights a dynamic change in consumer preferences within the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.