Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

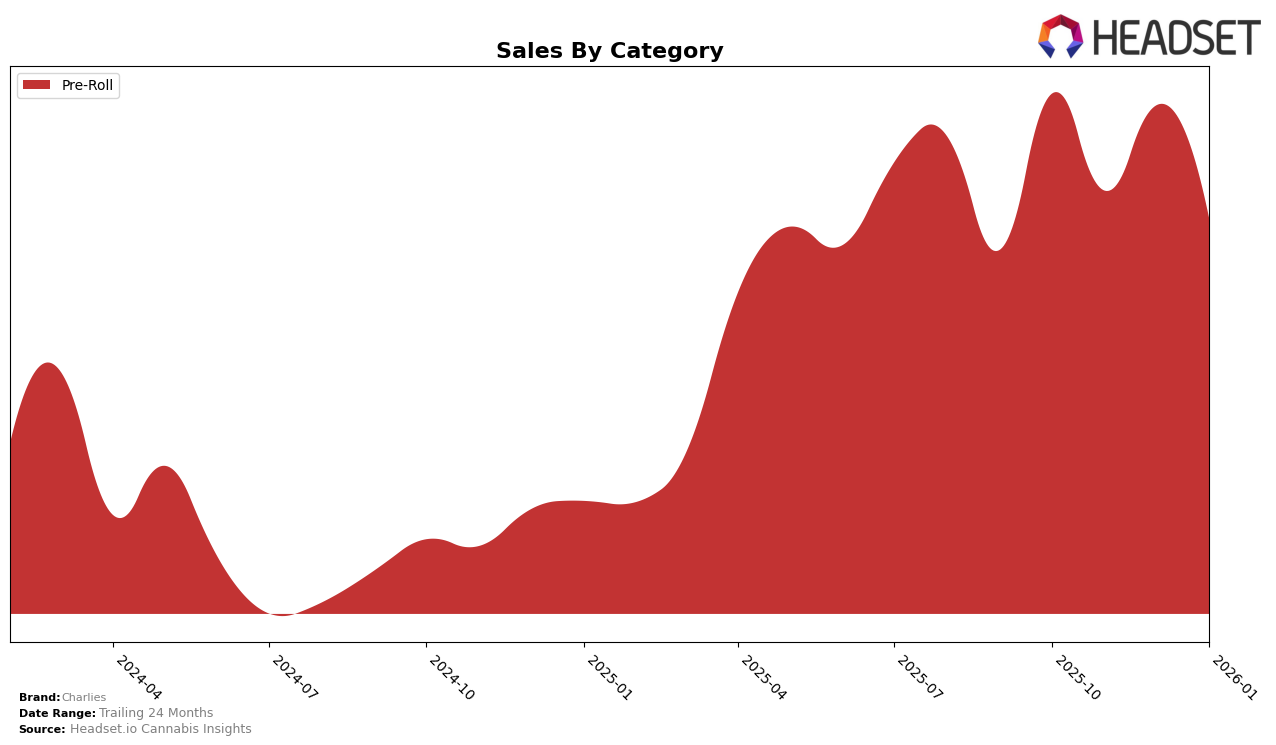

Charlies has shown a consistent presence in the Pre-Roll category in Arizona, maintaining a steady performance across the last few months. Despite a slight dip in rankings from 19th in October 2025 to 21st in both November 2025 and January 2026, the brand managed to reclaim the 19th position in December 2025. This fluctuation in ranks suggests a competitive market environment and highlights Charlies' ability to remain a contender within the top 30 brands in Arizona's Pre-Roll category. Notably, the sales figures reflect a similar trend, with a peak in October and December, indicating potential seasonality or promotional activities that could have influenced consumer purchasing behavior during these months.

While Charlies maintains a foothold in Arizona's Pre-Roll category, their absence in the top 30 rankings in other states or categories could suggest areas for growth or a more focused market strategy within Arizona. The lack of presence in other regions may indicate a strategic decision to concentrate resources and marketing efforts where they have established recognition and customer loyalty. However, this also presents an opportunity for the brand to explore expansion into new markets or diversify product offerings to capture a larger market share. As Charlies continues to navigate the competitive landscape, monitoring these rankings will provide insights into their strategic movements and potential growth trajectories.

Competitive Landscape

In the competitive landscape of the Arizona pre-roll category, Charlies has experienced fluctuations in its market position over the recent months, which could impact its strategic decisions moving forward. While Charlies maintained a relatively stable rank, oscillating between 19th and 21st place from October 2025 to January 2026, its sales figures showed a downward trend, indicating potential challenges in maintaining market share. Notably, Presidential consistently outperformed Charlies, ranking as high as 14th in November 2025, suggesting a stronger consumer preference or marketing strategy. Meanwhile, Fade Co. and 22Red were not consistently in the top 20, indicating less competitive pressure from these brands. However, Roaring 20s showed a positive trajectory, improving its rank to 20th by January 2026, which could pose a future threat to Charlies if this trend continues. These dynamics highlight the importance for Charlies to reassess its competitive strategies to enhance its market position and counteract declining sales.

Notable Products

In January 2026, Charlies' top-performing product was The Juice Pre-Roll 5-Pack (3g) in the Pre-Roll category, achieving the highest sales figure of 491 units. Following closely were Ghost OG Pre-Roll 5-Pack (3g) and Jealousy Pre-Roll 5-Pack (3g), ranked second and third, respectively. GG4 Pre-Roll 5-Pack (3g) secured the fourth position, while Biscotti Pre-Roll 5-Pack (3g) dropped to fifth from its previous third-place standing in December 2025. Notably, Biscotti Pre-Roll 5-Pack (3g) experienced a decline in sales from 503 units in December 2025 to 390 units in January 2026. Overall, the top products in January 2026 showcased a strong preference for pre-rolls, with minor shifts in rankings compared to December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.