Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

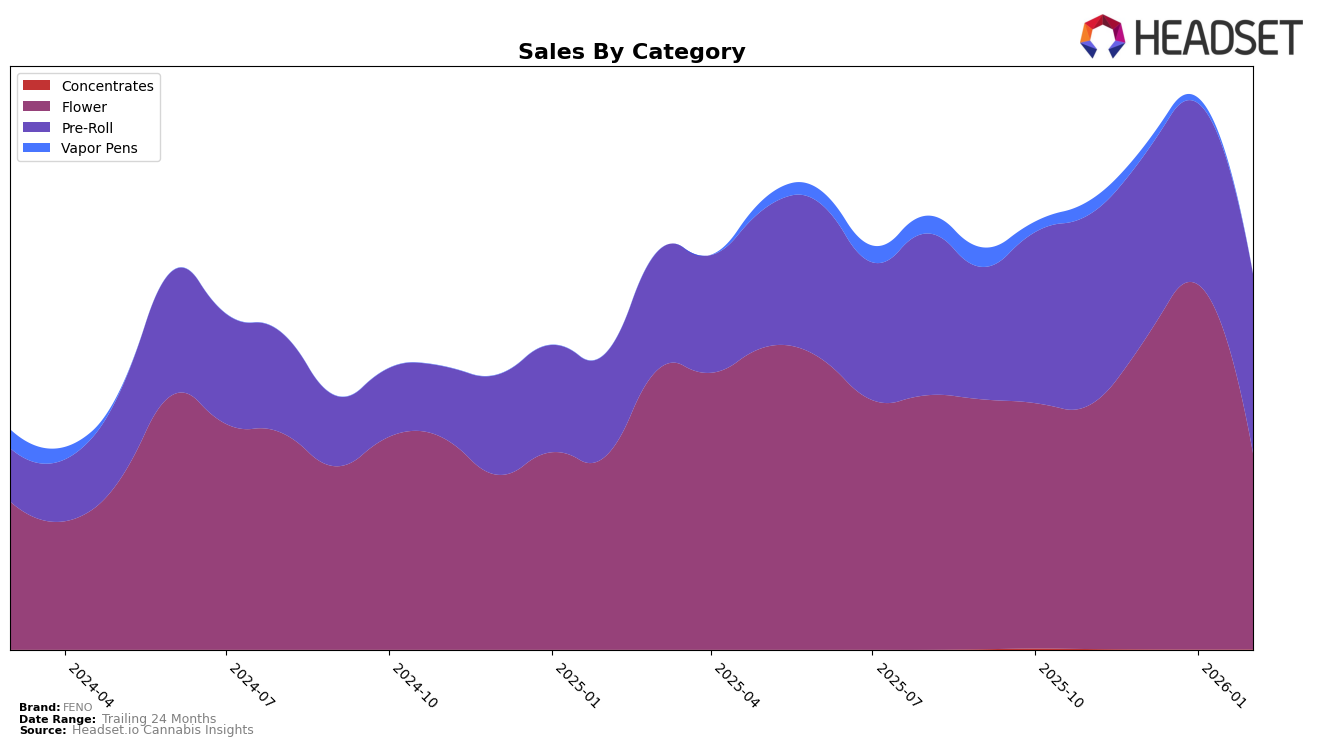

FENO's performance in the Arizona market showcases some intriguing fluctuations across different product categories. In the Flower category, FENO saw a notable rise from 24th place in November 2025 to 16th place by January 2026, indicating a strong upward trend. However, this momentum did not sustain into February, where they slipped back to 25th. This suggests a potential volatility in customer preferences or competitive pressures within the Flower segment. Meanwhile, in the Pre-Roll category, FENO maintained a more stable position, hovering around the 10th to 12th ranks over the same period, which could imply a more consistent customer base or product offering in this category. Interestingly, FENO's absence from the top 30 in the Vapor Pens category after November could signal challenges or a strategic shift away from this product line.

Despite the challenges in some areas, FENO's sales figures reveal a noteworthy achievement in the Flower category, where they saw a peak in January 2026, with sales reaching over $550,000. This peak aligns with their highest ranking in the Flower category, suggesting a correlation between their market position and sales performance. However, the subsequent drop in February sales to approximately $294,000 indicates potential market saturation or increased competition. While the Pre-Roll category did not experience the same level of ranking volatility, the steady sales figures hint at a loyal customer base. The absence from the Vapor Pens top 30 ranking post-November might reflect a strategic decision to focus resources on more profitable or stable categories. These insights into FENO's performance provide a glimpse into their strategic positioning and potential areas for growth or reevaluation.

Competitive Landscape

In the competitive landscape of the Arizona flower category, FENO has experienced notable fluctuations in its ranking and sales performance over recent months. Starting from November 2025, FENO was ranked 24th, but it climbed to 16th by January 2026, marking a significant improvement. However, by February 2026, FENO's rank slipped to 25th, indicating a potential challenge in maintaining its upward trajectory. In contrast, Riggs Family Farms maintained a relatively stable presence, albeit with a slight dip from 17th to 23rd in February. Meanwhile, TRIP showed a consistent improvement, moving from 28th to 24th, suggesting a growing market presence. Earthgrow also experienced a decline, dropping from 19th to 26th. Despite these fluctuations, FENO's sales peaked in January 2026, reflecting a strong demand that month. These dynamics highlight the competitive pressures and opportunities within the Arizona flower market, emphasizing the need for strategic positioning to capitalize on growth opportunities.

Notable Products

In February 2026, Culiacancito Pre-Roll 5-Pack (3.5g) maintained its top position as the best-selling product for FENO, with sales reaching 2473 units. Jenny Kush Pre-Roll 5-Pack (3.5g) climbed to the second rank, improving from the third position in January. Grape Gas Pre-Roll 5-Pack (3.5g) secured the third spot, showing a notable presence after not being ranked in January. Cap Junky Pre-Roll 5-Pack (3.5g) and Guava De Fresa Pre-Roll 5-Pack (3.5g) both held the fourth position, with Cap Junky maintaining its ranking from previous months. Overall, FENO's pre-roll category showed dynamic shifts in rankings, with Jenny Kush and Grape Gas making significant gains.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.