Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

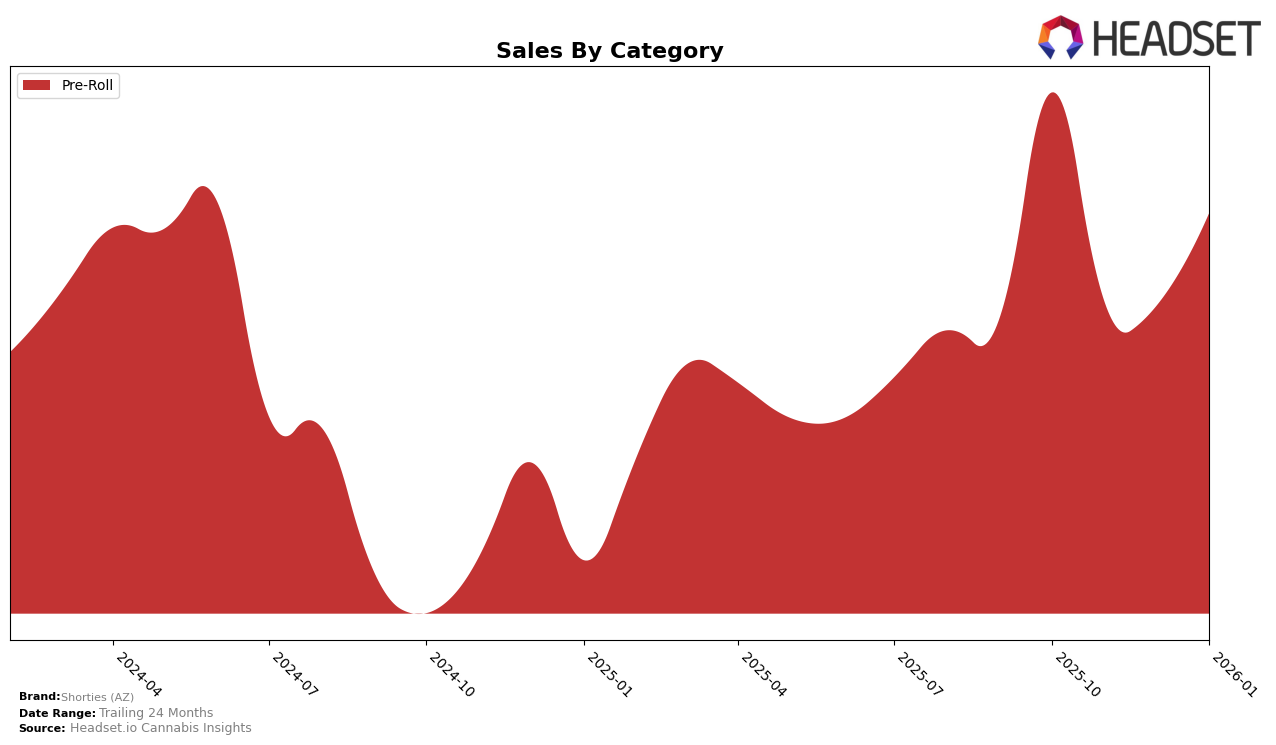

Shorties (AZ) has shown a consistent presence in the Pre-Roll category within the Arizona market, although with some fluctuations in their rankings. In October 2025, they held the 14th position, but by November and December 2025, they slipped to 17th place, maintaining that rank into January 2026. This indicates a slight downward trend in their market position towards the end of 2025, with a modest recovery to the 16th spot in January 2026. Despite these fluctuations, they have managed to remain within the top 20 brands, suggesting a stable, if not dominant, presence in the Pre-Roll category.

Sales figures for Shorties (AZ) reflect a peak in October 2025, with sales of $249,515, followed by a noticeable decline in November and December. However, there was a rebound in January 2026, with sales increasing to $207,433. This pattern of sales decline followed by recovery could suggest seasonal influences or changes in consumer preferences impacting the brand's performance. The absence of Shorties (AZ) from the top 30 in other states or categories highlights a focused market strategy primarily concentrated in Arizona, potentially limiting their broader market reach but allowing them to hone their offerings in this specific region.

Competitive Landscape

In the competitive landscape of the Arizona Pre-Roll category, Shorties (AZ) has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 14th in October, Shorties (AZ) saw a decline to 17th in November and December, before slightly recovering to 16th in January. This period of volatility is contrasted by the performance of competitors like Sluggers Hit, which maintained a stronger presence with a rank as high as 11th in December, and DTF - Downtown Flower, consistently ranking higher than Shorties (AZ) throughout this period. Despite these challenges, Shorties (AZ) showed resilience with a sales uptick in January, suggesting potential for recovery. Meanwhile, Sublime and WTF Extracts hovered around the lower ranks, indicating a competitive but fluctuating market environment. For Shorties (AZ), understanding these dynamics and leveraging advanced data insights could be key to regaining a stronger foothold in the Arizona Pre-Roll market.

Notable Products

In January 2026, the top-performing product for Shorties (AZ) was Pave Pre-Roll 10-Pack (3.5g), securing the number 1 rank with notable sales of 920 units. Following closely, P Wing Infused Pre-Roll 10-Pack (5g) climbed to the 2nd position, improving from its previous rank of 3 in November 2025. Grape Ox Pre-Roll 10-Pack (3.5g) held a strong presence at number 3, maintaining a consistent top 5 ranking across the months. Zero Gravity Infused Pre-Roll 10-Pack (5g) debuted at the 4th spot, while Cherry Kerosene Infused Pre-Roll 10-Pack (5g) rounded out the top 5. These rankings highlight a competitive landscape among the pre-roll category, with notable shifts in product popularity from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.