Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

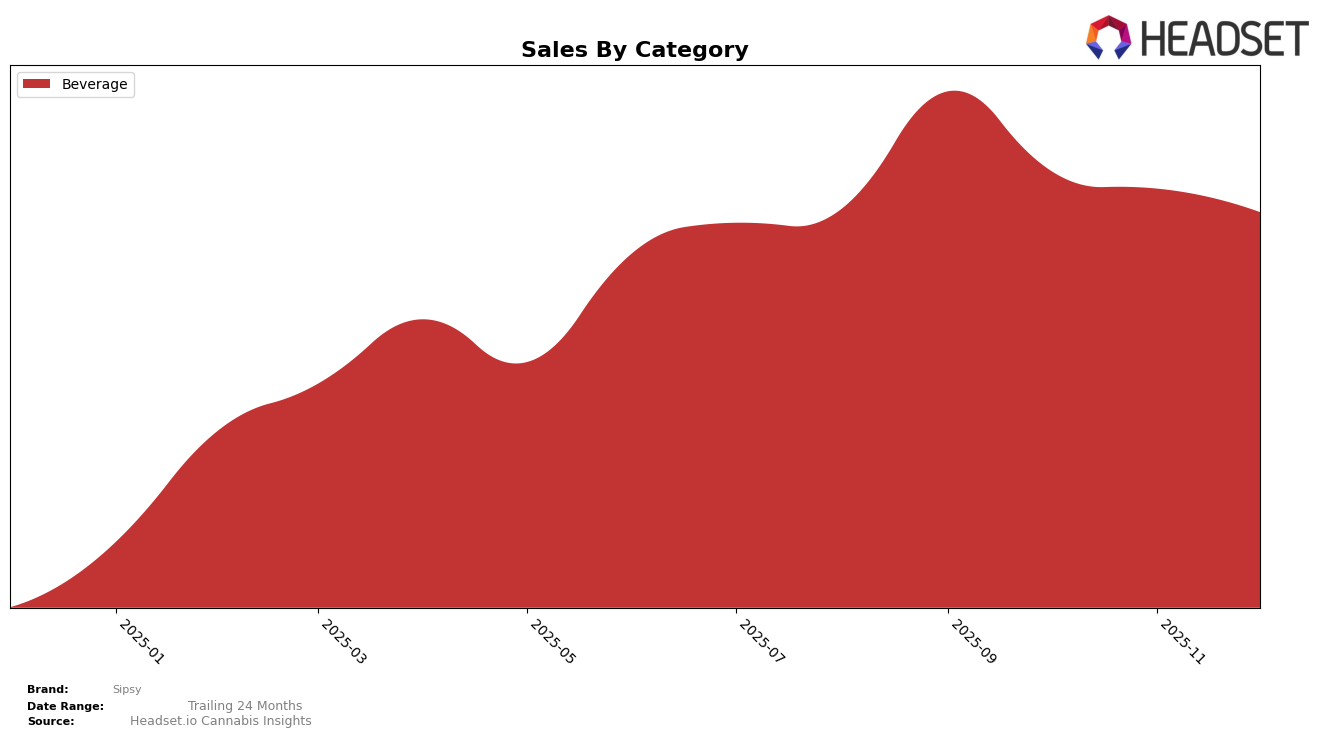

In the state of Washington, Sipsy has shown notable activity within the Beverage category. In September 2025, the brand achieved a ranking of 20th, with sales reaching $10,222. However, in the subsequent months of October, November, and December, Sipsy did not appear in the top 30 rankings. This absence indicates a decline in visibility and possibly sales performance within the category, suggesting a potential area for the brand to reassess its strategy or market presence in Washington.

The fluctuation in Sipsy's performance in Washington's Beverage category highlights the competitive nature of the cannabis market. While achieving a top 20 position in September 2025 is commendable, maintaining or improving this rank presents a challenge, as evidenced by the brand's absence from the top 30 in the following months. This data suggests that while Sipsy has the potential to capture market share, consistent performance requires ongoing efforts to adapt to market demands and consumer preferences. Understanding these dynamics can provide valuable insights for stakeholders looking to optimize their market strategies in the cannabis industry.

Competitive Landscape

In the competitive landscape of the beverage category in Washington, Sipsy faces significant challenges as it strives to maintain its market position. As of September 2025, Sipsy was ranked 20th, but it did not appear in the top 20 rankings for the subsequent months, indicating a potential decline in market presence. In contrast, Vice Soda consistently held the 18th position from September to November before dropping to 19th in December, suggesting a relatively stable performance with a slight fluctuation. Meanwhile, Swell Edibles maintained its 19th rank through November and slipped to 20th in December, showing a similar trend of minor rank adjustments. The sales figures for Vice Soda were notably higher than Sipsy's, indicating stronger market traction, while Swell Edibles also outperformed Sipsy in sales, albeit with a smaller margin. These insights suggest that Sipsy may need to strategize effectively to regain its competitive edge and improve its sales trajectory in the Washington beverage market.

Notable Products

In December 2025, Sipsy's top-performing product was Breeze Berry Shot (100mg THC, 3.38oz, 100ml) in the Beverage category, reclaiming the number one rank with sales of 305 units. Eternal Charm Apple Strawberry Blueberry Shot (100mg THC, 3.38oz, 100ml) and Rainbow Slush - Strawberry Cranberry-Lemon Shot (100mg THC, 3.38oz, 100ml) tied for second place, both showing a rank improvement from November where they previously ranked fifth and first, respectively. Smoke & Mirrors - Pineapple Mango-Habenero Shot (100mg THC, 3.38oz, 100ml) secured the third position, dropping from its previous top rank in October. Caramel Swirl Coffee Shot (100mg THC, 3.38oz, 100ml) entered the rankings in November and climbed to fourth place in December. Overall, the top products displayed dynamic shifts in rankings over the past months, with notable improvements for some and slight declines for others.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.