Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

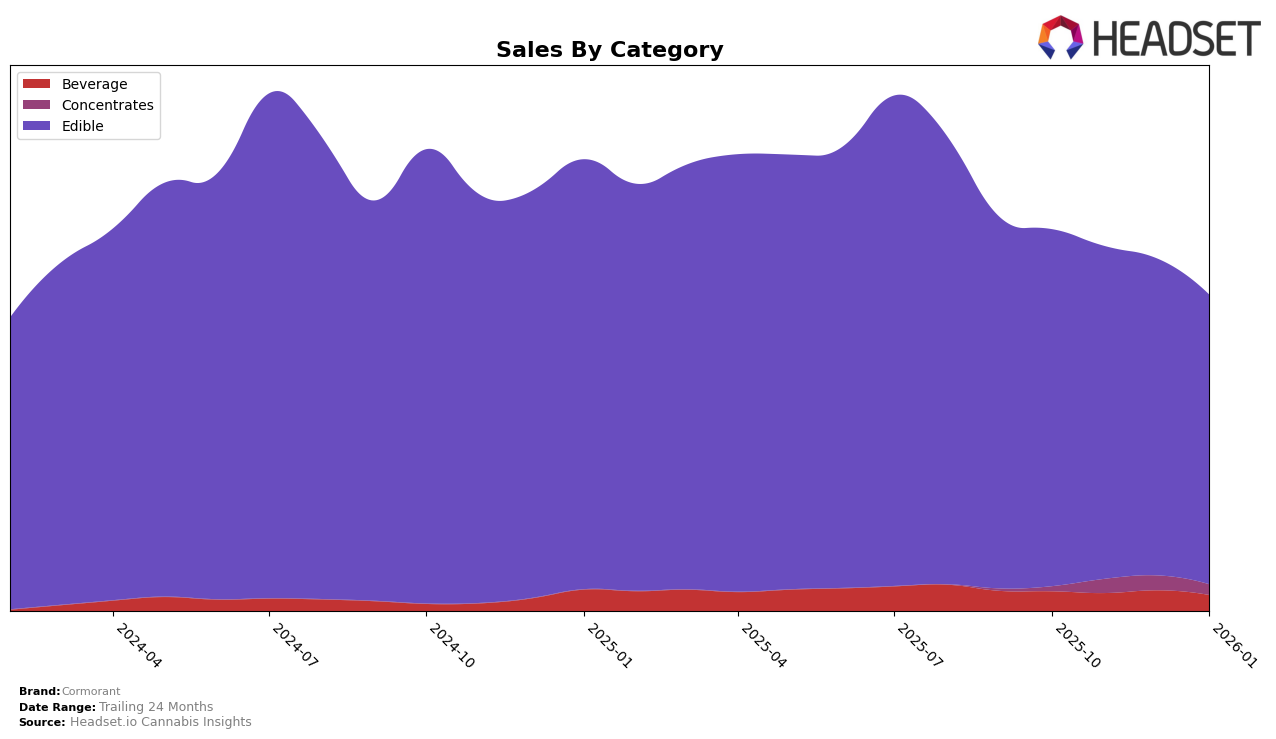

In the state of Washington, Cormorant has shown varied performance across different product categories. In the Beverage category, the brand experienced a slight decline in rank, starting at 18th in October 2025 and moving down to 21st by January 2026. This downward trend is mirrored by a decrease in sales over the same period, suggesting challenges in maintaining consumer interest or competitive pressures within the market. On the other hand, the Edible category paints a more stable picture for Cormorant. The brand maintained a consistent rank of 11th in October and November, slipping slightly to 12th in December and January. Despite the minor drop, the consistency near the top of the rankings indicates a strong foothold in this category, although sales figures suggest a gradual decline, which could be an area of concern moving forward.

It is noteworthy that Cormorant's presence did not extend to the top 30 brands in other states or categories, which could be seen as a limitation in their market reach. The absence from the top ranks in additional states or categories highlights potential growth opportunities that the brand has yet to capitalize on. This gap may offer a strategic avenue for Cormorant to explore, possibly by expanding their product offerings or enhancing their market strategies in regions where they are not currently visible. The dynamics in Washington suggest a brand with strong potential in edibles but facing competitive challenges in beverages, pointing to the need for targeted marketing efforts or product innovation to regain momentum and expand their footprint.

Competitive Landscape

In the competitive landscape of the edible category in Washington, Cormorant has experienced a slight decline in its market position from November 2025 to January 2026. Initially ranked 11th in October and November 2025, Cormorant slipped to 12th place by December 2025 and maintained that position into January 2026. This shift is notable as competitors like Mr. Moxey's improved their rank from 12th to 11th during the same period, suggesting a stronger market presence. Meanwhile, Drops consistently held the 10th position, indicating stable performance and possibly capturing some of the market share that Cormorant lost. Despite these challenges, Cormorant's sales figures show a downward trend, which could be a call to action for strategic adjustments to regain its competitive edge in the Washington edibles market.

Notable Products

In January 2026, Cormorant's top-performing product was the CBD/THC 1:1 Mango Sorbet (100mg CBD, 100mg THC, 4oz) in the Edible category, reclaiming its number one rank from October 2025 with a notable sales figure of 5486 units. The Tangerine Sorbet Frozen (100mg THC, 4oz) debuted in the rankings at the second position. The CBD/THC 1:1 Blueberry Sorbet (100mg CBD, 100mg THC, 4oz) also appeared for the first time, securing the third rank. Meanwhile, the Blueberry Sorbet (100mg THC, 4oz) dropped from the top spot in December 2025 to fourth place. Lastly, the Blackberry Lemonade Sorbet (100mg THC, 4oz) entered the rankings in fifth place, showcasing a dynamic shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.