Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

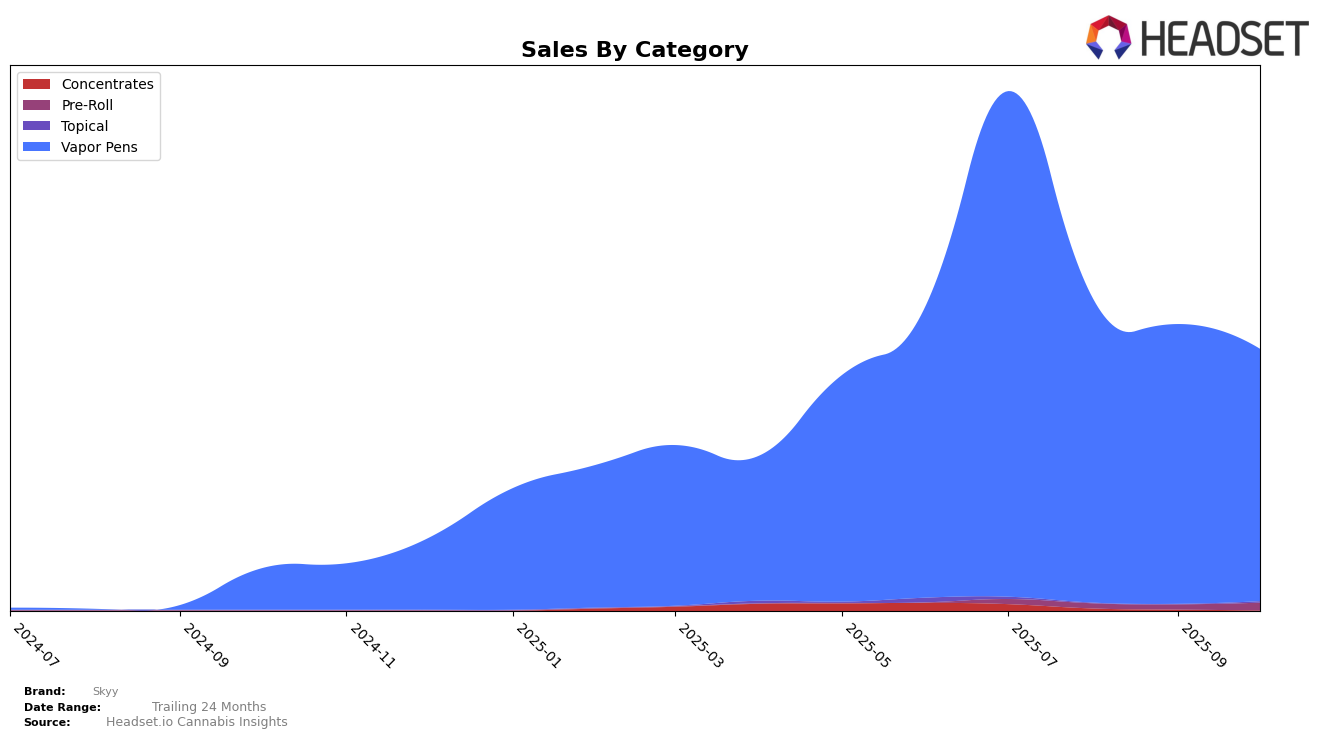

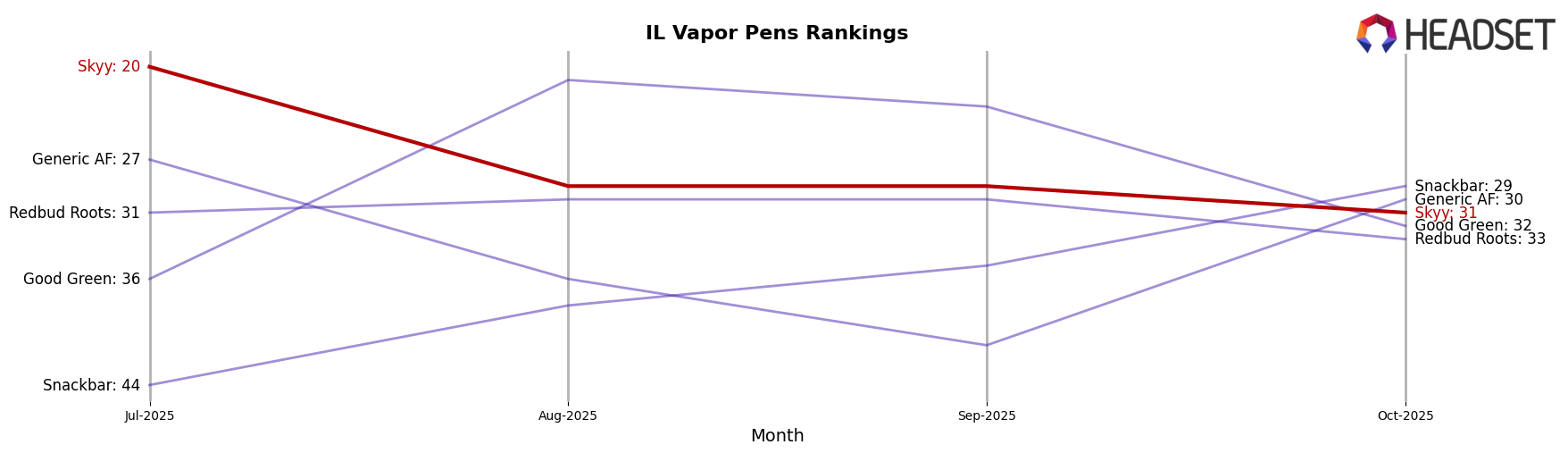

Skyy has experienced notable fluctuations in its performance across different categories and states over recent months. In the Vapor Pens category in Illinois, Skyy has seen a decline in its ranking, dropping from 20th in July 2025 to 31st by October 2025. This downward trend is significant as it indicates a potential loss of market share or increased competition within the state. The sales figures also reflect this movement, with a steady decrease from $615,085 in July to $306,719 by October. This suggests that the brand may need to reassess its strategy in Illinois to regain its footing in the Vapor Pens category.

Interestingly, Skyy's absence from the top 30 rankings in some states and categories can be seen as a negative indicator of its market penetration or brand recognition in those areas. This lack of presence in the top rankings could suggest that the brand is either not focusing its efforts in those markets or facing stiff competition that it has yet to overcome. While Skyy maintains a presence in Illinois, the brand's performance in other states remains a critical area for potential growth and improvement. Further analysis would be needed to understand the underlying factors affecting its performance and to identify opportunities for expansion or strategic adjustments in those regions.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Skyy has experienced notable fluctuations in its ranking and sales over the past few months. Starting from a strong position at rank 20 in July 2025, Skyy saw a decline to rank 31 by October 2025. This downward trend in rank is mirrored by a decrease in sales, indicating potential challenges in maintaining market share. Meanwhile, competitors like Snackbar have shown a contrasting upward trajectory, improving their rank from 44 in July to 29 in October, along with a significant increase in sales. Similarly, Good Green experienced a fluctuating rank, peaking at 21 in August before dropping to 32 in October, yet their sales remained relatively robust. These dynamics suggest that while Skyy remains a significant player, it faces increasing competition from brands like Snackbar and Good Green, which are gaining traction in the Illinois vapor pen market.

Notable Products

In October 2025, Purple Urkle Distillate Disposable (1g) emerged as the top-performing product for Skyy, holding the number one rank with sales of 494 units. Shirley Temple Distillate Cartridge (1g) climbed to the second position from its previous fourth rank in July 2025, reflecting a notable improvement in its market performance. Mango Burst Distillate Disposable (1g) secured the third spot, maintaining a strong presence in the Vapor Pens category. Strawberry Fields Distillate Cartridge (1g) and Blueberry Dreams Distillate Cartridge (1g) rounded out the top five, ranking fourth and fifth, respectively, both of which were newly ranked in October. This shift in rankings highlights the dynamic nature of consumer preferences within Skyy's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.