Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

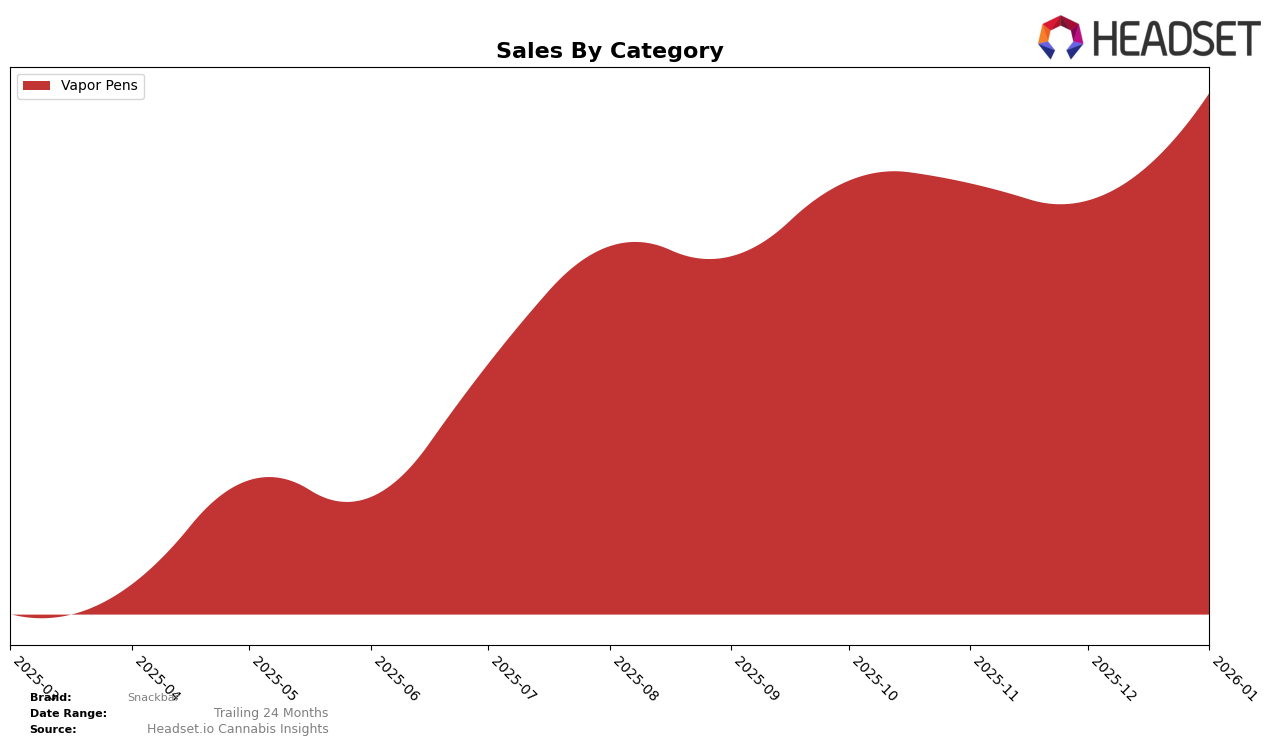

Snackbar's performance in the Vapor Pens category in Illinois shows a notable upward trend. While the brand was not in the top 30 rankings for October and November 2025, it made a significant leap to 28th position by January 2026. This improvement indicates a positive reception and increasing market penetration in the state. Despite a slight decline in sales from October to December 2025, with sales figures dropping from $232,622 to $222,614, the brand's January 2026 sales surged to $276,994, suggesting successful marketing strategies or product launches that resonated with consumers.

It is important to note that Snackbar's journey through the rankings in Illinois highlights both challenges and opportunities in the competitive Vapor Pens category. The absence from the top 30 in the initial months could have been a concern, but the subsequent climb suggests that the brand has effectively addressed market demands or leveraged consumer trends. This movement also hints at potential areas of growth and the importance of maintaining momentum to sustain its position in the rankings. Further analysis could uncover the specific strategies contributing to this growth, offering insights into how Snackbar is navigating the competitive landscape in Illinois.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Snackbar has demonstrated a notable upward trajectory in its rankings, moving from 35th place in October 2025 to 28th place by January 2026. This improvement in rank is accompanied by a significant increase in sales, particularly evident in January 2026. In contrast, Nuvata has consistently ranked higher than Snackbar but has experienced a slight decline in sales over the same period. Meanwhile, Good Green has also improved its rank, surpassing Snackbar, but with more fluctuating sales figures. Alchemy (Ieso) started strong but saw a drop in rank and sales by January 2026, while Good Vibes showed a consistent rise in both rank and sales, closely trailing Snackbar. These dynamics suggest that while Snackbar is gaining momentum, it faces strong competition from brands like Good Green and Good Vibes, which are also on an upward trend in the Illinois vapor pen market.

Notable Products

In January 2026, Snackbar's top-performing product was Grape Crush Distillate Disposable (1g) in the Vapor Pens category, securing the first rank with sales of 2152 units. This product showed a significant improvement from its second position in December 2025. Lemon Yuzu Distillate Disposable (1g) maintained its strong performance, moving up to the second rank from third, with Magic Mango Distillate Disposable (1g) dropping to third place despite consistent sales figures. Watermelon Lychee Distillate Disposable (1g) held steady at the fourth rank, showing gradual sales growth over the months. The shift in rankings highlights a competitive dynamic among the top products, with each vying for the leading position in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.