Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

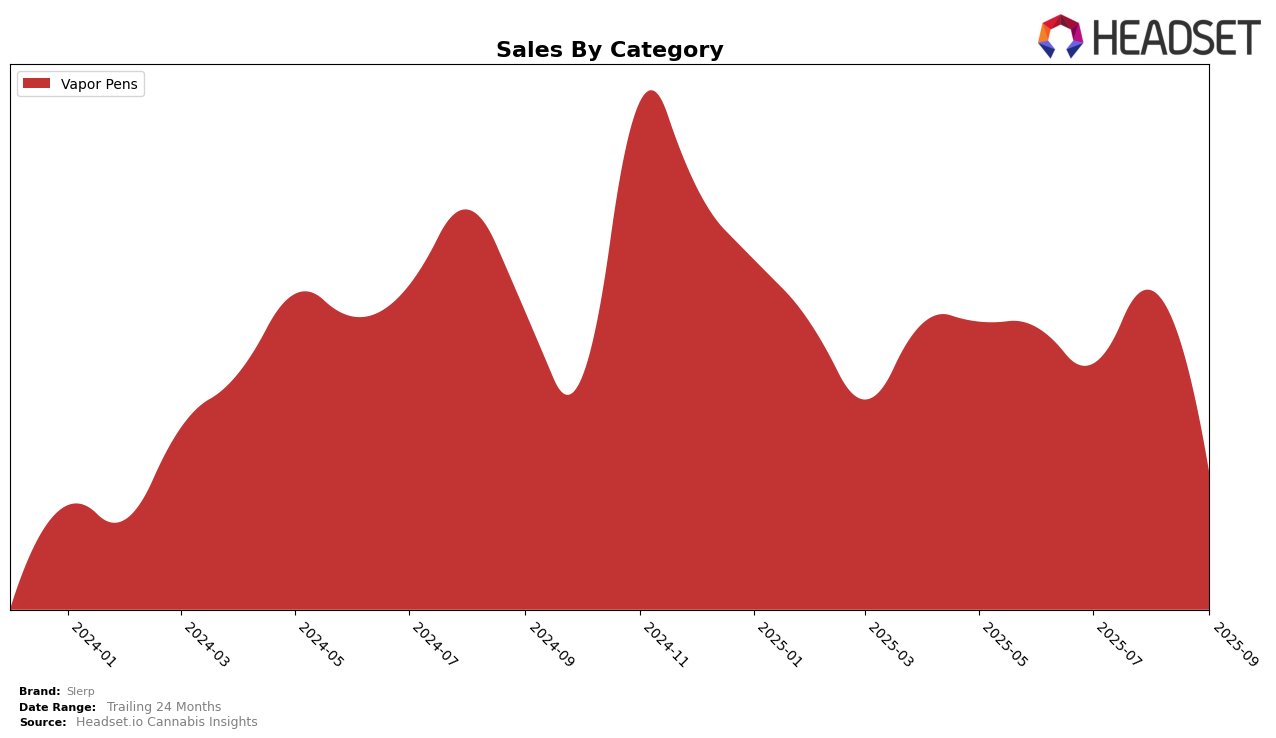

In the Vapor Pens category, Slerp has shown varied performance across different Canadian provinces. In Alberta, Slerp did not make it into the top 30 rankings for August 2025, indicating a challenging market position. However, the brand managed to regain its 69th position in September 2025, suggesting some recovery or stabilization. The sales figures reflect this volatility, with a noticeable drop from June to July, followed by a slight increase in September. This fluctuation might indicate a competitive landscape or shifting consumer preferences in Alberta's Vapor Pens market.

Conversely, in British Columbia, Slerp's performance in the Vapor Pens category has been more consistent, maintaining a presence within the top 30 brands throughout the observed months. The brand improved its ranking from 30th in June to 26th in August, before slipping back to 30th in September. Despite the drop in rank in September, the sales figures in August were notably higher, suggesting a peak in consumer demand or successful promotional efforts during that period. This consistent presence in British Columbia's rankings highlights a relatively stronger market position for Slerp compared to Alberta.

Competitive Landscape

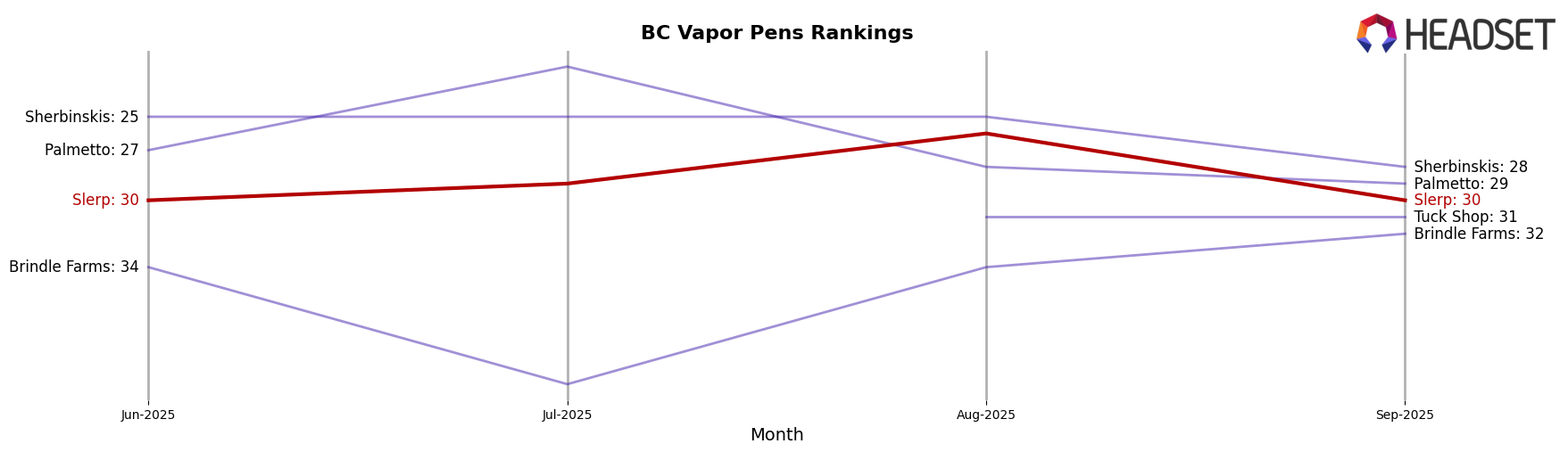

In the competitive landscape of vapor pens in British Columbia, Slerp has experienced fluctuating rankings over the past few months, indicating a dynamic market presence. In June 2025, Slerp was ranked 30th, and although it improved to 26th in August, it slipped back to 30th by September. This volatility in rank is mirrored by its sales performance, which peaked in August but saw a significant drop in September. Competitors such as Sherbinskis and Palmetto have maintained a relatively stable presence, with Sherbinskis consistently holding a position around 25th, while Palmetto's rank varied but remained competitive. Notably, Tuck Shop entered the rankings in August and maintained a position close to Slerp, suggesting emerging competition. These dynamics highlight the need for Slerp to strategize effectively to stabilize and improve its market position amid strong competition.

Notable Products

In September 2025, Slerp's top-performing product was the Quad Berry Liquid Diamond Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking from August, with notable sales of 1,625 units. The Baked Blueberry Liquid Diamond Cartridge (1g) held steady at second place, despite a decrease in sales to 396 units. The Vanilla Cherry Liquid Diamond Cartridge (1g) remained in third place, showing a significant drop in sales to 37 units from its peak in June. The Sour Watermelon Cured Resin Cartridge (1g) improved its ranking to fourth place, consistent with its steady sales figures. The Raspberry Peach Cured Resin Cartridge (1g) did not rank in September, indicating a potential discontinuation or sell-out situation.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.