Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

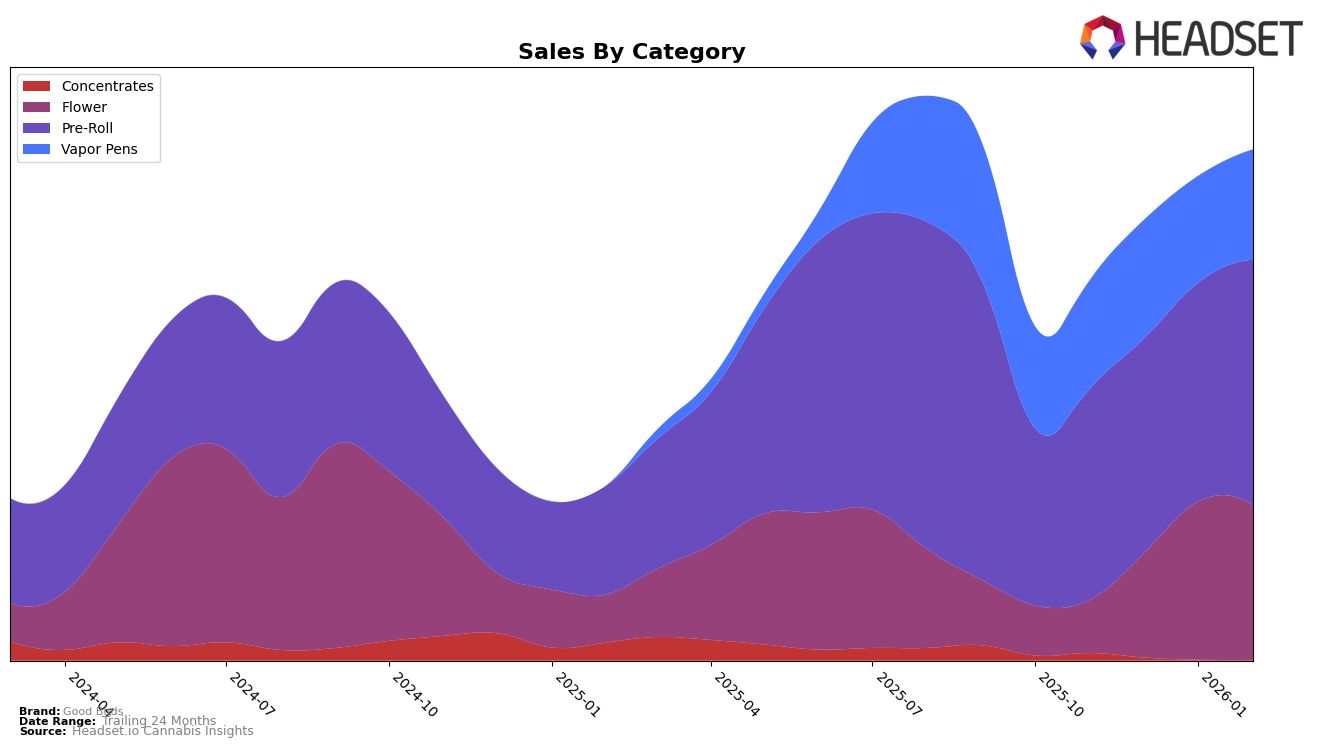

Good Buds has shown notable movement in the Alberta market across various categories. In the Flower category, the brand experienced a significant climb, moving from a rank of 54 in November 2025 to breaking into the top 30 by January 2026. This upward trend, however, saw a slight dip in February 2026, settling at rank 33. In the Pre-Roll category, Good Buds maintained a consistent presence within the top 30, peaking at rank 19 in February 2026. On the other hand, their performance in the Vapor Pens category saw a steady position at rank 32 from December 2025 through February 2026, indicating a stable, albeit less dominant, presence in this segment.

In British Columbia, Good Buds has demonstrated a strong performance, particularly in the Flower category. The brand made an impressive leap from rank 87 in November 2025 to 29 by February 2026, showcasing a robust upward trajectory. In the Pre-Roll segment, Good Buds improved its standing from rank 43 in November 2025 to 28 by February 2026. However, in the Vapor Pens category, the rankings fluctuated, with the brand peaking at rank 23 in February 2026 after a dip to 31 in January. These movements highlight Good Buds' dynamic presence and adaptability across different product categories in British Columbia.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, Good Buds has shown a promising upward trajectory in its rankings, moving from 24th place in November 2025 to 19th by February 2026. This positive trend is indicative of a steady increase in consumer preference and market penetration. Notably, Bold, a close competitor, also improved its position from 22nd to 18th during the same period, maintaining a slight edge over Good Buds. Meanwhile, Big Bag O' Buds made a significant leap from 46th to 17th, showcasing a remarkable surge in popularity. Despite these competitive pressures, Good Buds has managed to increase its sales consistently, reflecting a robust brand presence. As Simply Bare and PIFF also vie for market share, Good Buds' ability to climb the ranks suggests a strong potential for continued growth in Alberta's Pre-Roll market.

Notable Products

In February 2026, the top-performing product from Good Buds was the Mango Cake Pre-Roll 2-Pack (1g), maintaining its number one rank from the previous three months, with sales reaching 9120 units. The BC Organic - Gluerangutan Pre-Roll (1g) climbed back to the second position after slipping to third in January 2026. The Gluerangutan Pre-Roll 7-Pack (3.5g) held steady at third place, showing consistent performance with a slight increase in sales from January. The Mango Cake Pre-Roll 7-Pack (3.5g) remained in fourth place, indicating stable consumer demand. Notably, the newly introduced Timewarp Pre-Roll (1g) debuted at fifth place, suggesting promising potential in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.