Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

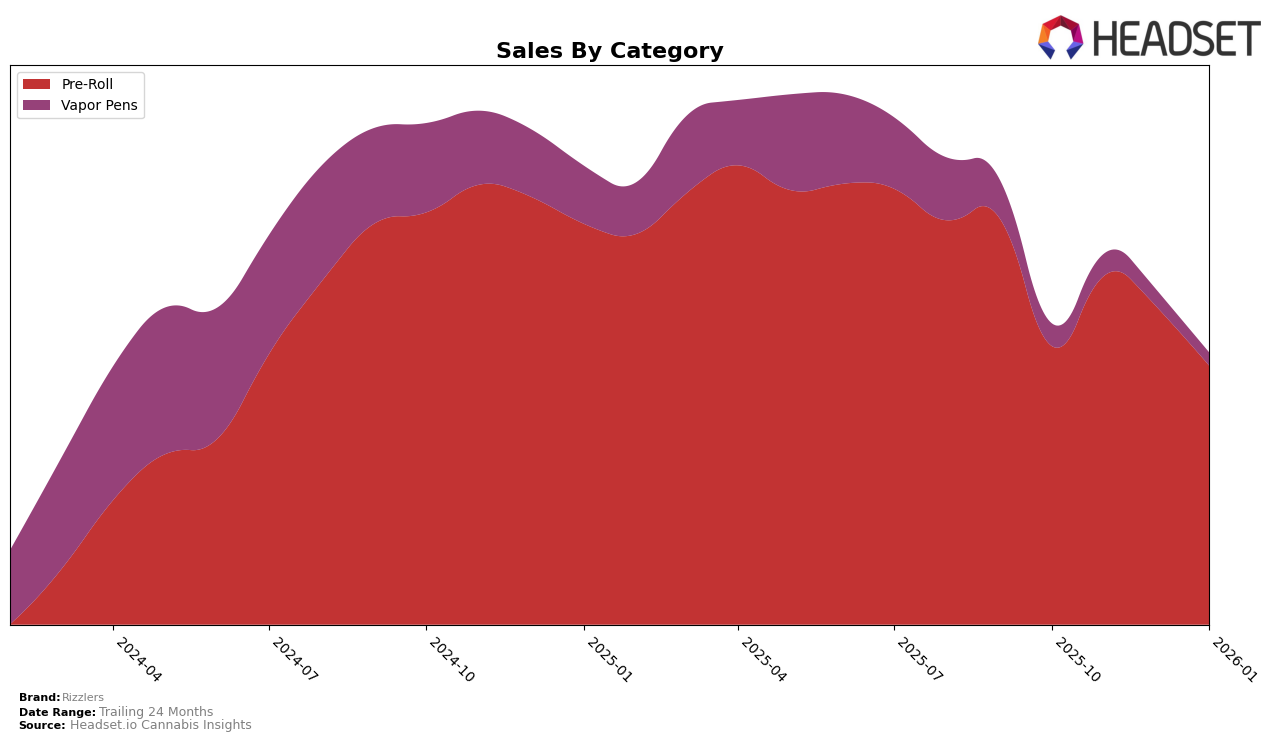

Rizzlers has shown varying performance across different categories and provinces, with some notable trends in their rankings. In the Alberta market, Rizzlers' Pre-Roll category has experienced a decline, dropping from the 27th position in October 2025 to 37th by January 2026, indicating a downward trend in popularity or sales performance. On the other hand, their Vapor Pens category in Alberta has seen fluctuations, with a notable absence from the top 30 in November 2025, which could be a point of concern for the brand. Meanwhile, in British Columbia, Rizzlers' Pre-Roll category has shown a positive trajectory, moving up from 43rd in October 2025 to 24th by January 2026, suggesting a growing consumer base or effective market strategies.

In Ontario, Rizzlers' Pre-Roll category maintained relatively stable rankings, hovering in the mid-20s before slipping to 31st in January 2026, which might indicate increased competition or changing consumer preferences. However, their Vapor Pens category did not make it into the top 30 after October 2025, which could highlight a gap in market penetration or product appeal in this category. In Saskatchewan, Rizzlers' Pre-Roll category showed a gradual decline from 24th to 30th position over the same period, which could suggest challenges in maintaining market share. These trends across provinces and categories provide insight into Rizzlers' market dynamics, highlighting areas of strength and potential opportunities for growth or improvement.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Rizzlers experienced a dynamic shift in rankings from October 2025 to January 2026. Initially ranked at 28th in October, Rizzlers improved to 25th in November, demonstrating a positive trajectory. However, by January 2026, Rizzlers dropped to 31st, indicating a potential challenge in maintaining its upward momentum. This fluctuation in rank is contrasted by competitors like Simply Bare, which consistently improved its position from 32nd to 29th, and CountrySide Cannabis, which advanced from 35th to 30th. Meanwhile, Nugz (Canada) made a significant leap from 56th to 35th, showcasing a robust growth trajectory. Despite Rizzlers' initial sales strength, the decline in rank suggests increased competition and the need for strategic adjustments to regain its competitive edge in the Ontario Pre-Roll market.

Notable Products

In January 2026, the top-performing product from Rizzlers was the Twisters- Tropicoco & Watermelon Razzler Infused Pre-Roll 2-Pack (1g), which maintained its top rank from December with sales of 6808. This product had previously fluctuated between the 1st and 3rd positions over the preceding months. The Twisters - Blud Orange & Berry Drip Infused Pre-Roll 2-Pack (1g) followed closely, slipping to the second position after being the top product in December. The Twisters - Grape Galaxy Infused Pre-Roll 6-Pack (3g) consistently held the third spot since December. Meanwhile, the Watermelon Razzler Distillate Infused Pre-Roll 6-Pack (3g) dropped to fourth place, continuing a downward trend from its peak in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.